A Study of the 7 Best Online Payment Services

It’s becoming more and more convenient and practical to send and receive money by simply pulling out your phone (or opening your laptop). Whether you’re ordering something online, sending cash to your kid at college, and so on… The best online payment services offer convenience and limited fees or obligations.

If you’re a small business owner working your table at special events or offering mobile services to customers, the right online payment service can make your job easier and keep things moving so you can serve more customers. You don’t make money while you’re waiting on payments to clear or trying to run plastic through a machine. You make money when one happy customer wraps up easily and the next happy customer steps up!

This year, of course, we have to factor in the whole Covid-19 nightmare and how it’s impacting retail, restaurants, and our general patience with being around other people in public – or not being around them, period. Easy, quick payment methods that don’t involve touching each other, or the ability to safely pay online, with or without a credit card, are more in demand than ever before.

New Payment Services

Historically, figuring out how to process payments has been one of the biggest headaches of any new endeavor. Entrepreneurs were limited by the need to take cash, risk taking personal checks, or hauling around one of those old metal credit card swiping machines. You basically had to establish your own financial infrastructure just to get started – and that’s assuming your local bank or credit union was even interested in helping you figure it all out. Even with your own website, figuring out payment options could be daunting.

How many times have you, as a customer, tried to purchase something from a lesser-known online company and finally given up and just gone to Amazon or some other name brand? Yeah, exactly.

Besides, if we’re being honest, it’s about more than making things convenient. The best online payment services for small business owners make impulse purchases as painless as possible and let customers stay “in the flow.” You’ve probably done it yourself. If it takes seven steps to order something, that’s seven opportunities to think the better of it and change your mind. If it’s just a click or two, on the other hand…

(Oh well, it’s on the way now. I’m sure I’ll love it. If not, one less thing to buy for the next holiday or special occasion.)

More and More Online Payment Services

Little surprise, then, that the number and variety of online payment services has exploded in recent years. It’s great having so many options, but honestly, it can be a bit overwhelming. Where should you even begin? We’re going to spotlight seven of the best online payment services currently setting the bar for everyone else. Some specifically target convenience for small businesses, while others are more popular with individual users. Chances are good, however, that one of them is just right for you.

First, however, let’s make sure we’re familiar with a few of the terms you’re likely to hear thrown around.

Let’s Talk Online Payment Terms

As with so many things, especially when something is relatively new to many users, you’ll find many terms used interchangeably – whatever their actual definitions. Our goal here isn’t to pass a vocabulary quiz. We just want to be able to keep up with the conversation or understand the FAQ. No pressure.

Payment Provider, Payment Processing, and Payment Gateway

Q: What is a payment provider?

A: The payment provider is the company you choose to handle your electronic transactions – especially credit and debit cards. The primary service most small businesses are looking for is payment processing.

Your payment provider generally provides you the equipment, software, or other system for validating customers’ card information and communicating with the appropriate financial institution to make sure they have enough credit or a high enough balance to make the purchase. It’s the provider’s responsibility to detect fraud and to protect both you and your customer from shenanigans.

Q: What is a Payment Gateway?

A: A major part of making this happen is a reliable and efficient payment gateway. The gateway is how information is able to pass securely and quickly from your customer’s card to the processing institution and back to you. The term can refer to the equipment, the process, or the technology itself.

Q: What is a Payment processing?

A: Payment Processing is a service. It requires expertise and sophisticated technology to do properly. Presumably, you’d like them to be communicative and efficient as well. That means it’s usually not free. You charge for your expertise, goods, and services, and so do quality payment processors. It shouldn’t make the process unprofitable, of course – just make sure you pay attention to all percentages, fees, and potential additional charges.

Payment Services / Payment Systems

Some payment providers offer various services or service packages. These options are generally referred to as payment services or payment systems.

The most familiar example of this for most newcomers is PayPal. You can use PayPal to send or receive money for a minor fee – that’s one payment service. If you’re a merchant, you can use PayPal Here to accept a variety of payment types, from credit cards to Apple Pay or Google Pay. That’s another payment service (or payment system). If you want to accept online orders, PayPal’s PayFlow lets you do that securely, making it a third payment system. Each of these are offered by the same payment provider – PayPal.

ACH Transfers

ACH stands for “automated clearing house.” Honestly, though, it’s probably best to just put that out your mind as soon as possible. (I can’t help but think of either big box discount stores or Ed McMahon handing fictional families giant cardboard checks when I hear the full term.) Instead, let’s focus on what it means in practice.

Q: What are ACH Transfers?

A: ACH transfers are simply how money is moved between different accounts and different banks electronically. If you get paid via direct deposit, you’ve used ACH transfers. If you pay bills online, you’ve used it as well. Some businesses use ACH transfers to pay their suppliers or make deposits into employees’ retirement accounts. For our purposes, it’s just money moving through wires.

Merchant account

If you’re selling goods or services using an online payment service, you’re required to set up a merchant account distinct from your existing business bank account – although it can be through the same institution, if they offer such things. Funds from any online transactions are deposited into your merchant account, and eventually into the business account of your choosing.

Merchant accounts come with their own fees, often based on your business’s history and credit rating. They may be offered through your payment provider, your existing financial institution, or a third party.

Seven of the Best Online Payment Services

For most of us, there are two basic reasons to use any FinTech.

- We use FinTech to save money

- We use Fintech to increase convenience

If your focus is on finding ways to save money, the first step is to figure out where your money is going already. Consider starting with this list of some of the best apps for tracking spending. Let’s not ever forget the power of paying as we go rather than incurring new debt. And don’t get me started on how few Americans have a proper emergency fund!

If you’ve already got your budget game in gear, or if you need to be able to take payments as easily as you make them, it’s time to focus on convenience and flexibility.

Here are seven online payment services that make one or both of those convenient and practical every day.

1. Adyen

1. Adyen

Accept payments everywhere

Adyen offers a full suite of payment processing for almost any sort of business, large or small. Its one of the most versatile options for accepting payments online or in person, in almost any form, and – as they remind potential clients regularly – from almost anywhere in the world.

One element setting Adyen apart from many other payment processors is their data analysis. As you use Adyen to do business, it compiles insights and data about your customer interactions and offers what they call “data-rich insights to learn customer behavior.” Don’t worry about your eyes crossing or your brain melting. You can select which factors you’d like to see displayed, and Adyen will create graphs or charts to help you visualize the direction things are going. More importantly, you’ll be better able to decide how to shape where things go moving forward.

Adyen offers a healthy variety of payment systems and services and their security record is solid. The flip side of this is that sorting through the options and figuring out pricing can be a bit bewildering. I’m a big fan of reading the small print and knowing what you’re getting, but depending on the size and needs of your business, there may be a small leap of faith involved with Adyen. That said, they’re used by major players like Microsoft, eBay, Spotify, Uber, and McDonald’s to manage payments and online transactions. None are businesses known for throwing away money unnecessarily.

Popularity isn’t everything, but it does suggest Adyen is doing something right.

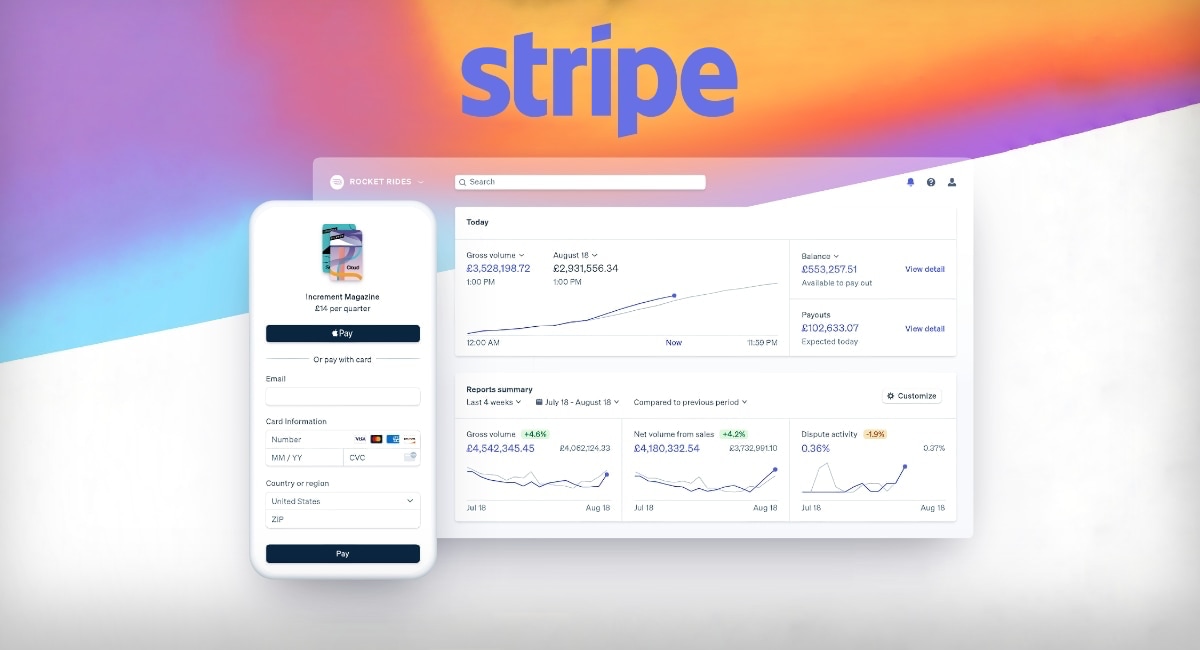

2. Stripe

2. Stripe

Payments infrastructure for the internet

Stripe is a payment processor and gateway in one, and a major player despite not being a household name. Stripe’s primary claim to fame is their easy integration with your website or online store. You can also redirect customers to pay you through Stripe before returning them to your site. From the user end, it’s considered one of the most customer-friendly and easy-to-use ways to shop securely online.

Stripe offers affordable flexibility for specific types of online businesses. If you offer subscriptions of any sort – periodicals, monthly services, memberships, etc. – Stripe can manage these for you. Once you’ve set up your parameters you can also set up your goals, it will allow customers to subscribe.

They can also alter their memberships, cancel or suspend services, or contact you with questions or concerns. You can check subscription reports as often or as rarely as you like.

Stripe is also handy for Business-to-Business (B2B) or freelancing ACH transfers. It allows you to invoice clients and generates its own virtual account numbers. That way you can keep the transaction as secure as possible. It will also allow you to set up your own crowdfunding platforms and deftly manages major currencies from around the world. Stripe is used by Unicef, Habitat for Humanity, Lyft, DoorDash, Zoom, and even Amazon.

Here’s the Potential Catch

Part of what makes Stripe so flexible is that it’s not ready-to-use, “out-of-the-box” software. Instead, it’s an API (Application Programming Interface) – or, a collection of APIs, if you prefer. That means it takes a little time and attention to pull together the elements you wish to use. It also requires a basic understanding of the API process. If you’ve ever blogged using, say… Drupal instead of WordPress, it’s the same basic idea. The power to and personalization to fit your exact needs means one size does not fit all. Whether that’s a pro or a con depends on you.

3. PayPal

3. Paypal

With ways to shop, pay and chip-in,we’re here for you.

Let’s talk about something a bit more familiar from the user side of things. Most of us know PayPal as a convenient way to send or receive money with friends and family. Some also use it to make purchases online. Its familiarity is one of its greatest strengths – almost everyone recognizes PayPal. Its other strength is that anyone can use it if they choose with minimal setup and no specialized knowledge of how it actually works. While there’s a fee for most transactions, there’s nothing to download and no setup charges. It’s arguably the easiest and least expensive way to send money almost anywhere in the world quickly and securely.

For individuals, PayPal offers their own credit or debit cards, prepaid cards, and several other options to simplify your life. – particularly around, say, the holidays. Like any new credit, it’s important not to confuse easy terms with “free money.” (It doesn’t work like that.) If you’re needing a little flexibility without wanting to commit to an actual credit card, however, PayPal has a 4-payment option that may prove a nice compromise.

They’re also reaching out more and more to businesses, offering the usual point-of-purchase and online options, as well as some shipping and invoicing support and dispute resolution. It’s nothing particularly fancy, but some would argue that’s the strength of it – any business, large or small, can pick and choose the elements they need and begin using them with a minimal learning curve.

4. Google Pay

4. Google Pay

Money made Simple

Since we’re talking household names, we might as well address arguably the biggest name in all things internet – the GOOGLE. Google is the “Big Brother” we all feel like we should be more concerned about but just keeps making life easy and happy so we figure… whatever, bra – search me, scan me, take me… I’m yours.

Google Pay is the latest incarnation of Android Pay and Google Wallet. As the names suggest, its primary claim to fame is the ease of making payments in person as easily as you do online. Google Pay stores your credit cards, debit cards, or other accounts and accesses them through its app on your phone. So, when you’re checking out at your local store, you don’t even have to pull out your wallet. Indeed, you just open the app on your phone and run it over the scanner.

Assuming, of course, the store accepts Google Pay. And that you don’t have an iPhone. Those, um… those can be biggies, actually.

While it’s certainly a popular payment method, Google Pay isn’t quite as universal as the name would lead you to expect. Still, if a business accepts cardless payments of any sort, it probably accepts Google Pay as well. Many websites, of course, take it as well. If you’re new to the world of cardless payments, you probably aren’t in the habit of looking for the signs. – they’re usually right next to those little Visa and Discover stickers you hardly notice anymore.

The biggest advantage to Google Pay is how easy it is to set up and use. It’s not trying to be all things to all users, so it does a few straightforward things simply and securely. But let’s be honest – how many things have seemed both simply and secure recently? Yeah, exactly. Me neither. Sometimes simpler is better.

5. Square

5. Square

Accept payments. Everywhere

Square is the touchless payment method most of us heard of first. Usually this is because we were buying something at an antiques show or farmer’s market and when we pulled out the plastic, the vendor stuck a weird little plug into their iPhone and swiped our card before having us sign with our finger. Today that’s strangely normal, but not that many years ago, it was some hipster-ish wackiness – at least for my generation.

Square offers small businesses easy payment services. But they also provide basic inventory management, invoicing, and a healthy assortment of income and inventory reports. It’s customizable but sticks with familiar, universally accessible applications and in-house add-ons.

6. Samsung Pay

6. Samsung Pay

More than a wallet

I’ve included this one because it’s not on most of the latest-coolest-wildest lists, despite being widely accepted and ridiculously easy to use. Like some of the other popular user-focused services, it’s tied to a traditional card or cards of your choice.

Almost 1 out of every 3 cell phones currently in use in the United States is made by Samsung. (If you have a Galaxy something-or-other, that’s them.) Samsung Pay is easy to download and allows you to make contactless payment just like Apple Pay or Google Pay. Unlike those options, however, it works with pretty much any payment terminal that doesn’t require you to physically insert your card into a slot and leave it there while it thinks. Anything where you swipe or just kinda wave your phone around awkwardly, however, is a win.

Samsung Pay is gradually increasing its offerings, but it’s not PayPal and definitely not a merchant-focused service. It’s more of an organizer than innovator. However if what you need is an easier way to keep track of your payment methods and account info, this might be the FinTech for you.

7. Apple Pay

7. Apple Pay

Cashless made effortless.

For reasons I can’t entirely explain, let alone justify, I’ve never been an Apple guy. Nevertheless, there’s no denying the impact the Apple brand has had on, well… everything. Naturally, that includes offering one of the best online payment services on the market.

Apple Pay isn’t quite as universally accepted as Samsung Pay, but you’d probably be surprised how many places take it. It offers fancier interaction options – fingerprints, facial recognition, blood or urine samples, etc. (OK, I made that last bit up – but the other stuff is pretty impressive.) As further security, Apple uses a method they call “tokenization” to prevent your actual credit card information from being sent. Instead, they essentially.

Unlike some of its competitors, Apple allows person-to-person payment. This makes it much easier to divvy up the check at dinner or send your kids money. They’ve recently introduced their own credit card as well, putting them into direct competition with PayPal.

Well, sort of. Apple has always been a company founded on a sense of community and insider status. No matter how large they’ve grown and how powerful they’ve become, you can still divide so much of the personal technology world into “Apple” and “Not Apple.” Apply Pay is in some ways no different. At the same time, their very intentional compatibility with many devices has made them not only one of the best online payment services in the world, but one of the most widely used.

Conclusion

As with so many things, your options these days are so extensive as to be a bit overwhelming at times. Don’t be afraid to do a little more research, but once you’ve put in as much time as you can spare, it’s OK to take a deep breath and make the best call you can – then don’t look back.

Whether you’re a small business looking for the best online payment services because you need more flexible ways to accept payments, or an individual just trying to keep better track of your spending and keep both your accounts and your immune system safe while you do it, there are great options out there.

If you’re still just trying to figure out how it all works, or need some free financial advice before you can make a plan, we’ve got plenty to offer at no obligation.

Blaine Koehn is a former small business manager, long-time educator, and seasoned consultant. He’s worked in both the public and private sectors while riding the ups-and-downs of self-employment and independent contracting for nearly two decades. His self-published resources have been utilized by thousands of educators as he’s shared his experiences and ideas in workshops across the Midwest. Blaine writes about money management and decision-making for those new to the world of finance or anyone simply sorting through their fiscal options in complicated times.