How to Relocate for a New Job with No Money

So you are considering relocating for a new job? Starting a new job can be exciting. Starting one in a brand new place is even more exciting. What happens, though, if you need to relocate for a new job when you have no money? It can be a stressful thought, especially if you know that this job can change your life if you can just get to it. You do not want to lose the opportunity, so how do you make it happen? There are a few different moves you can make.

Talk to Your New Boss

Often, companies that want you to relocate for a new job will provide assistance with the move. It may not be for the entire amount, and it may come in the form of a loan that you have to repay over time, but it will get you moved. As that is the ultimate goal, having their assistance would be a great solution to the problem. Assuming that there is no relocation assistance, the rest of this information should help.

Assess

Any time that something is changing, needs to change, or anything similar, you must first assess your situation by answering the following questions:

Is This New Job Worth the Move?

This is an important one. As fun and exciting as new places can be, no one really likes the actual moving part. Packing up belongings, lugging them on to a moving truck, unloading them, unpacking them, putting them away- and all of this while you are trying to complete your daily activities and learn a new place. It is stressful. It is tiring. So before you decide to relocate for a new job, make sure it will be worth all of your trouble.

How Long Do I Have to Get There?

Sometimes, they need you to move right away. Other times, you get a notice in advance. The amount of time you have before you need to be at the new job will help you make a plan and set it in motion. If you have months or a year, you have time to do this in a well thought out way, so take a breath. If you need to be there in a week, well, take a breath anyway. There is no problem solving when you are hyperventilating and your mind is running away like a train. Trust me- I know that from experience. Call me crazy or too hopeful or naïve, but I believe that there is a solution to every problem- you just have to find it.

What Is My Full Financial State?

You may not have any money, but that does not mean that you are in complete financial ruin. Do you have any assets that you can cash in, such as investments? Do any friends or family owe you money that you can get back? Do you have any valuable items you could sell, like a car or even some electronics you do not use or need? Is there any money stashed away anywhere? You need a full view of what you have available to you.

How Much Do I Need to Move?

You really, really need a good understanding of how much money you need to move- without having to eat nothing but Ramen noodles for the first month. The amount it will cost to move includes a lot of things, some of which you may not have to have. Just in case, though, check into the following costs:

- Physical moving expenses, such as a rental truck, boxes, the gas it will cost to drive the truck, shipping fees if you choose to send your stuff separately, and similar items. It is a good idea to even include money you will need to stop on the way to eat or things that you will replace when you get to your new home instead of taking them. Whatever it will take to physically get yourself and your items to the new place should be here.

- How much it will cost to move into your new place. This includes deposits, first month’s rent, utility connection fees, cable and Internet fees- if you choose to get those- and so on. Perhaps you do not know exactly where you will move yet, but you should be able to easily get an average idea of rent through an Internet search or even through the city’s Facebook page. You can also generally call the utility companies for an idea of deposit amounts.

- Anything you will need to buy once you get there. Maybe you decided to make it easy and not pack your furniture up. When you get there, you will need some items, so factor those costs in, as well.

- Basically, anything you can think of that will cost you money to make this move and set up when you get there.

Ready…Set…Start Your Planning

You have answered the basic questions, so you should have a pretty good grip on your current reality. Now, it is time to start planning. Depending on the amount of time you have before you need to move, you may or may not be able to do all of these things. The more time you have, the more you can try, but with some quick work, some can be fit in to even the shortest time frames.

First, You Need Some Motivation

If you really want to make this move, you probably feel extremely motivated at the moment. That can change quickly, though, when the work and the extreme doubt set in, so you need some external motivation. I have always found goal charts to be extremely effective, regardless of age. You might also make a vision board that reminds you of why you are working so hard. Anytime you start to feel your hope falter, take a look at your vision board, or whatever other external motivator you choose.

Dare I Say That You…Need…a…Budget

You should have a monthly budget, anyway, but you definitely need a budget for relocating for a new job. Divide the amount you need by the number of months you have to get it. That amount is what you need to come up with each month to ease your burden. Now, take a look at your budget. How much of the needed monthly amount can you squeeze into your regular budget? Commit that amount, and come up with a plan for the rest with the below tips. Taking into account all the expenses you will have to cover, among which a moving budget, for instance.

Listen to a Piece of Wisdom

You should come to terms with something right now. If you have lived in your current residence for more than about a week, you likely have a lot more stuff now than you did when you moved in. The speed with which stuff accumulates is astounding, so you will inevitably look around as you start to pack and say, “Where did all of this junk come from?” That is just the nature of having a home.

The point I am trying to make here is that you will undoubtedly find things that you do not want to take with you, things that you cannot imagine any human being would possibly want, and some stuff you do not even remember where it came from. Do yourself a favor: get rid of it now. Start going through your home this very minute and ask yourself, “Do I really want to pack this? Do I really want to start my new life with this?” You will probably find yourself getting rid of more than you imagined you would.

Now, have a yard sale. By doing this, you are completing three things for yourself:

- Making some extra money to go toward your moving

- Minimizing what you will need to pack

- Saving yourself some time. Think about having a yard sale once a week or once a month until you are ready to move

Change Your Current Living Situation

Do you rent or own right now? If you own your own place, consider selling it and putting it on the market now. If you sell it quickly enough, you will have the money from your sale to go towards your move. If you sell it prior to your moving date, you might be able to rent a hotel room or stay with a friend, which brings me to the next point.

If you currently rent, is it possible to move in with a friend until your move. Maybe pay them a little to help with the bill and, at the same time, save yourself some money. The money you save from paying your regular rent can be put into your moving fund.

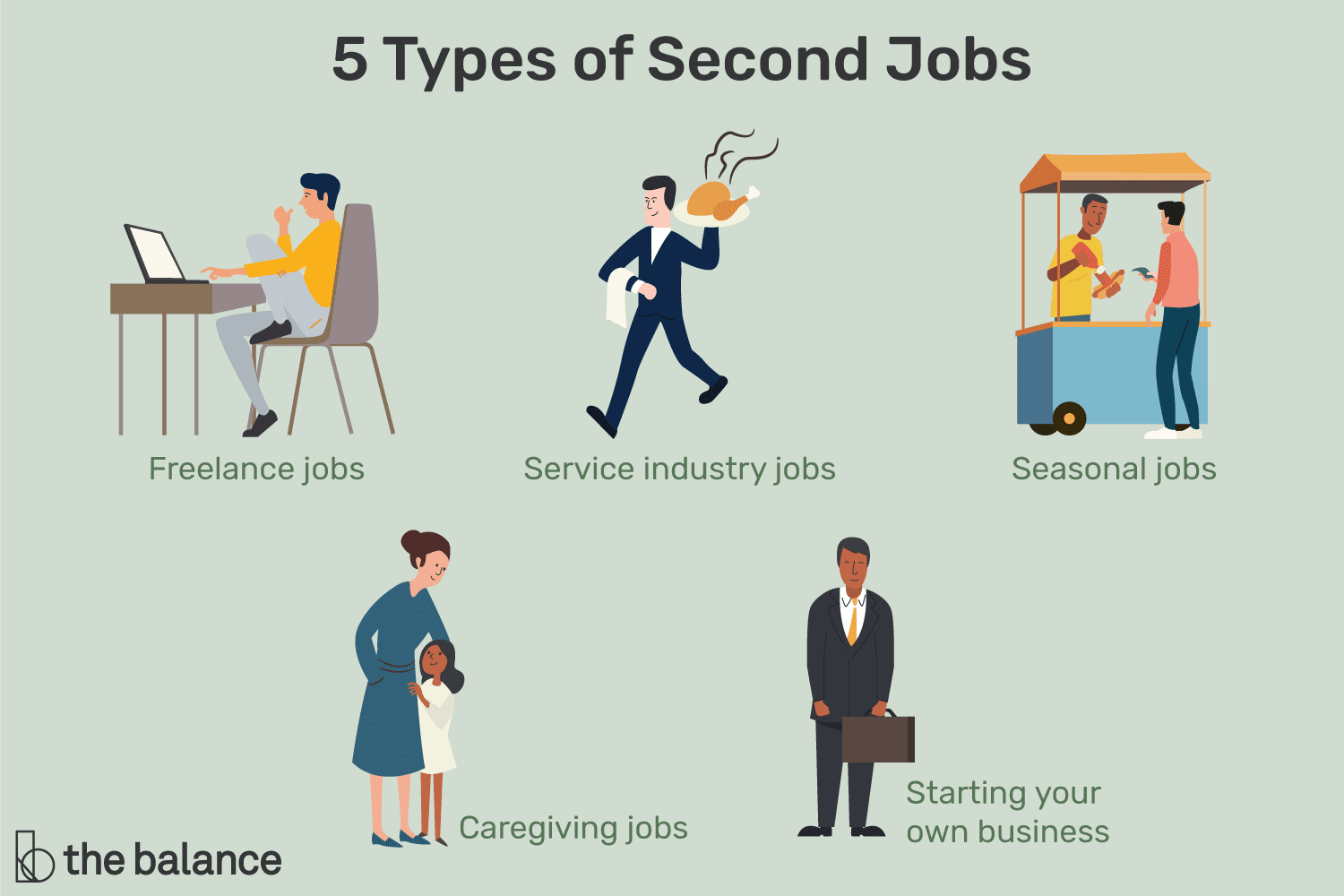

Pick up a Second Job or a Side Hustle

Yes, this is one of my answers for everything finance related, but really, it can make a difference. Let me throw some numbers at you to help drive my point home. Let’s say you work at a part time job for just 10 hours per week at minimum wage. That’s $72.50 per week (at the current wage). That comes to $290 or $3,480 per year. That is a pretty decent amount to add to your “Relocating for a New Job” fund for just 10 hours a week.

An excellent side job is waiting tables. Obviously, it depends on how busy the restaurant is but I have worked at quite a few including chain restaurants, such as Applebee’s and Chili’s, some small town restaurants, and then some in between. I can say for certainty that if you need money to move, waiting tables can get you there, without a doubt. I have raised four children, bought a home, and much more through these jobs.

Let me clarify, though, if you are a crabby pants, waiting table is not a good idea for you. If you cannot put your problems to the side, put a smile on your face, and make your customers feel valuable, forget that I mentioned serving. Try something else instead because you will not make the money you need. There are other part time jobs and side hustles that would be better suited so that you can reach your goal of relocating for a new job.

Cut Your Moving Costs

Do not wait until the last week to do this, if you can help it. As soon as you know that you will be relocating for a new job, you should start researching and planning how to save on this move. For instance, if you will be using a moving company, call around to check rates. Get at least three price quotes before deciding. Another thing is that travel costs different amounts on different days of the week or months of the year. The same is true for vacation rentals. If you will be flying, taking a train, or a bus, find out when the cheapest times to travel will be.

I said it above and I will say it again….get rid of anything you do not want or need. The less you have to pack and transport, the less relocating for a new job will cost. And, coincidentally, you will save on headache medicine from taking some of the stress off.

Speaking of packing, do you have a few friends who will come help you pack for a glass of wine or a couple of beers? Or maybe you can trade off help packing with you helping clean out there attack or garage. Give your buds a call and see what they say.

Family Help

If you have some really supportive family members, maybe they will throw in $50 or $100 to help you out with relocating for a new job (maybe more if you are lucky). Or, see if they will give you cash as your birthday or Christmas gift early. The worst they can say is “No” and leave you in the same position you started off in.

If All Else Fails

If you have done all of the planning, cost cutting, deal making, side hustling, begging and trying to negotiate, you can do and there is still not enough, it’s ok. There is still always the option of getting a loan for help relocating for a new job. As you are starting fresh with a new job and, probably, a new life, going into debt should be a last resort. However, if you need a loan to get there, the option is available. There are a few things you need to know first, though.

There are a variety of loan types and lenders available, but they are not all created equally.

When you are relocating for new a job, the last thing you want is to put yourself in a bad financial position. Though you may not have a choice about going into debt, it does not necessarily mean you have to get into the worst debt. What I mean is that there are certain types of loans you should avoid at all costs. The two main ones are:

- Payday loans, and

- Title loans

Because of the astronomical interest rates involved. You are looking at average interest of around 25%. That may fluctuate some depending on the lender but not enough to justify getting yourself into that much debt. Don’t forget that you will have to handle those debts later if!

Other Short Term Loans

There are other short term loan lenders that might approve a loan with no collateral. Unfortunately, like payday loans and title loans, the interest is usually pretty high and, as the name suggests, they are short term loans. Having to worry about repaying a loan before you even get settled into your new job is not going to be very fun, so if you can avoid these, do.

A personal installment loan seems like the best way to me as they have lower interest rates and better repayment terms. The interest is generally fixed and calculated into the cost of the loan. Every payment you make is split between the principle and the interest. On the down side, you generally need pretty good credit or collateral for a personal installment loan. If that is you, go for this type of loan first since it will give you some room to breathe.

For the most part, there are loans for anyone and everyone, provided you have income to repay a loan. I will assume that if you are relocating for a new job that you have an income. There are even bad credit loans for people who cannot get approved for more traditional loans. These do come with higher interest rates and stricter terms, however, since those with bad credit are more of a risk. But now you know that Relocation Loans for people with bad credit do exist!

Beware of Where You Apply for Loans

There are as many places to apply for a loan as there are loan types, and finding one can be quite overwhelming. The easiest thing to do is shop for loans online. There you can compare multiple lenders at once. On top of that, there are trusted platforms that only connect you with reputable lenders. Finding a trusted platform, such as Loanry, to connect with lenders is a wise move as your information is much safer.

After You Sign the Dotted Line

Once you have received your loan, you need to very quickly make a plan to repay it. If you are able to get a personal installment loan, you already have a payment schedule. You just need to plug it into your budget. For other loan types, you want to pay those off as quickly as possible to prevent paying more in fees than you borrow. Slice your budget sideways, forward, and backward until you find a way to pay it off.

Final Thoughts

Relocating for a new job can be an incredible journey for you, and your family if you have one. You can get the funds you need to move if you are persistent. Set your mind on your goal and push until you have reached it. Then, enjoy your new job and new life because you worked hard to get there.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.