Parenting Money Tips For Low Income Families

I think we can all agree that parenting is hard. I think we can also agree that having enough money to pay for everything is also hard. When you combine parenting with spending money wisely, it is really difficult. It is possible, but you must make smart choices along the way. The best way to know which choices are smart ones is to have a good understanding of the best way to use your money. These are not things that just come naturally to many people. Most of us have to learn the right way to spend and save money. You can start here by reading this article on smart parenting money tips.

Budgeting Is Important

One of the top parenting money tips you can receive is the importance of budgeting. I know that is often a scary statement because it causes a feeling of control. And, yes in some ways, it is control, but it puts you in control. I encourage you to change your thinking about budgets. Shift your focus from feeling like a budget puts you in a place where you are forced to be without the items you want to it puts you in a place where you understand how much money you have to spend.

Budgeting really is an opportunity for you to gain a better understanding of how much money you have coming in each month. You can also understand how much money you are spending each month and where. When you have children, it is easy to spend money and really have no idea where it is going. You tend to have to spend money in different places when you have children. Because of this, it is important to understand what you must spend money on and where you can save.

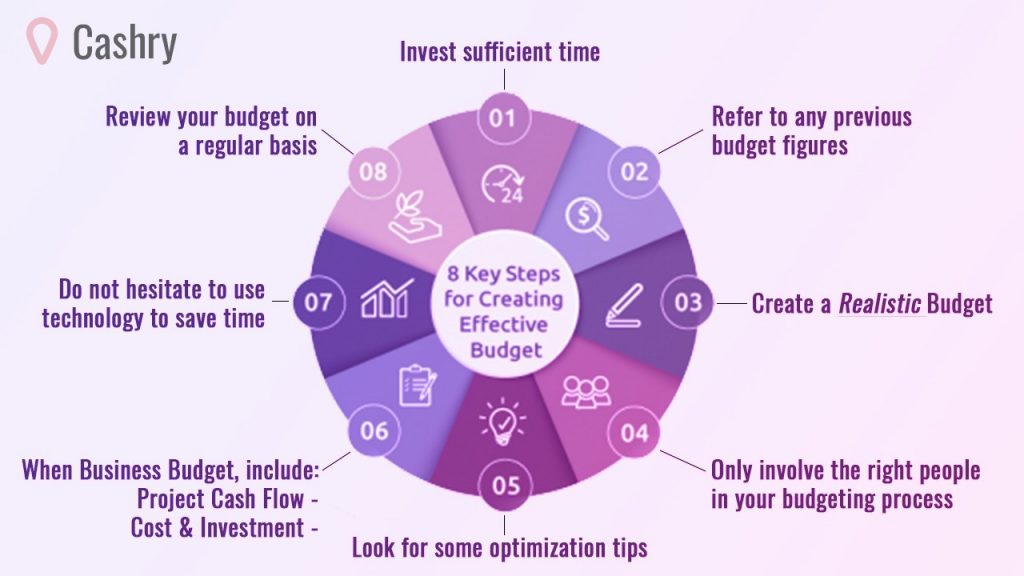

How to Create a Budget

Start by writing all of the money you make in one column and all of the money you spend in another. You should track all the money over a month. To do so, you may need to refer to several months of bank statements to make sure you capture it all. You want to make sure that you have an accurate idea of the money you are spending. You also want to include a pot of money that may come up for your children on occasion, such as field trips and school supplies. Once you have listed out all of these items, you can see where you are spending the most money and you can begin to make smart decisions about your spending, but I will get to that in a little more detail further down in this article.

Saving

I know, I know, you are probably thinking that you can barely pay for the items you need, much less save any money. However, saving money is incredibly important and even more so if you do not have much to spare. This is another on of those important parenting money tips. It is really important that you have some money saved for the unexpected. That way, you do not have to get yourself further in debt to pay for those bills that may pop up. You will not have to worry about where is the money going to come from because you will have it right in a savings account.

One key tip to saving money is to have it go directly into a savings account with each pay check. If it goes straight to your savings account and not into your checking account, you never actually see it. It is almost like you do not even have that money to begin with, so it is easier to not spend that money. When you have the money automatically going into a savings account, you do not have to be responsible for moving the money, it happens automatically. This is a great way to encourage you to save, especially when you think that you cannot save otherwise.

Emergency Fund

Having an emergency fund is one of the key parenting money tips and one of the best tips on budgeting your money. Everyone’s situation is different and because of that, there is not one set amount of money that you should have saved for an emergency. Some experts say that you should have enough money saved to cover three to six months worth of expenses. For some people, that may seem like an unreasonable target because you have a high amount of bills and not much money coming in per month. You could aim to save about 10 percent of your paycheck per month until you get there.

There is another thought that you should have at least $1,000 saved in an emergency fund. If you want to go this route, you should pay only the minimum on your bills until you have $1,000 saved. Once you have that amount saved, then you go back to paying as much as you can towards your bills and debt while saving money.

You will find that proper budgeting also mean finding the right balance between saving, paying off debt, and being in control of your spending. It may take some time for you to find that right balance and to get you money in order. What is right for you and your family is not going to be the same as what is right for someone else. Budgets are meant to be fluid and change as needed. It is important that you are constantly assessing your needs and adjust your budget as needed.

Spending Reduction

This may come as no surprise to you, but if you want to save more money, you have to spend less money. One of the top parenting money tips is to reduce spending as much as you can. I know on the surface, it may seem like there is no way you can reduce any spending. I am going to say, there is probably some area where you can make reductions. When you have a low income, you need to go with some useful money tips. It may seem as though all of your money is going to essential items. While it may be, there is probably some room for extra savings.

You created a budget a few steps back, look back at the budget and see where you are spending money. For a moment, let us put the essential bills to the side. These are items like food, rent / mortgage, car, and utilities. We will come back to those.

For now, I would like to focus on all other spending, if there is any. If all of your money is going to those items, this section may not apply to you. However, if you are spending money on fast food or eating out, I encourage you to halt that spending. I know it may be easy and quick, but it is a huge drain on your pocket. You may not even realize how much money you are spending by a quick stop at your local fast food joint. Once you have it all written down in front of you, it is much easier to see. If you are spending any money eating out, you should stop that immediately. This money could be better spent in your savings account, or towards bills.

Pay Less For Food

I think we can all agree that food at the grocery store is expensive and it only seems to get more so each week. While it is important to purchase more food from grocery stores in order to stop eating out as much, you must also to that in a smart way.

First Top Parenting Money Tips

One of the top parenting money tips when it comes to shopping is to create a list before you leave your house. You should meal plan for each week, so that you already know what food you are going to prepare. If you are smart about it you can make more than one meal with the same ingredients, so that you do not have to buy as many items with each grocery store trip. You should also buy in bulk whenever possible. When you go grocery shopping, you should only buy the items on the list. When you make your list, you should check your kitchen to make sure you really need these items.

Second Top Parenting Money Tips

Another one of the top frugal money saving tips is to use coupons. There are many apps that you can use to find and use coupons. Believe it or not, there are coupon databases available that give you access to coupons in one spot. You can even find out that stores will double coupons. In those cases, if you have a coupon for $1.00, the store will give you another $1.00 off that item, so you pay $2.00 less. Whenever non-perishable items go on sale, you can stock up on them so that you can take advantage of a lower price. You should watch the prices so you know when they go down. This prevents you from finding yourself in a position where you absolutely need something and have to pay whatever price it is at that time.

Household Bills

Household bills tend to be incredibly expensive and you may find yourself cutting out items such as internet and television because the price is so high. You may be able to contact the providers of these services and negotiate lower prices. Often times, these providers can offer sales and reductions in order to keep you as a customer. They know there is a lot of competition out there, so they are often willing to reduce the price you pay in an effort to maintain their customer base.

Another one of the parenting money tips is to reduce the cost of your necessary household bills. You can adjust your thermostat by just a couple of degrees to save yourself hundreds of dollars per year. You probably will not notice a difference of a few degrees in the temperature, but you will notice the decrease in your bill. Believe it or not, if you unplug all of your appliances when they are not in use, you can also save yourself some money. Even when you are not using those appliances, if they are plugged in, they are using some small amount of electricity, for which you are paying. If you unplug these items, you will see some reduction in your electric bill.

Assistance

Another one of the great parenting money tips that you may not be aware of is, you may be able to find some government assistance to pay for your bills. This type of assistance may be short term and temporary. It does not have to be long term. You may only need to use it to help you get in a better place with your finances. You may be able to obtain assistance with rent, utilities, and student loans. Another possibility would be to find help with medical bills, food, and even mobile phones. There are requirements to determine if you are eligible for this type of help. Not everyone is able to receive assistance. It is best if you reach out to the specific agencies to find out if you qualify.

Many of these programs are Federally run programs, however, some of them are managed at the State level. They may vary slightly on where you live as each State may offer assistance in different ways. Keep in mind that any type of assistance that you receive allows you to redirect that money to a bill. I will say that if you have managed to save money in your emergency fund, you may not be able to qualify for any type of assistance. So, if you plan to apply for assistance, you might want to do that before saving any money.

Reduce Debt

It probably goes without saying that one of the top parenting money tips is that you should reduce your debt as much as possible. When you have a lot of debt, it ties up your money that you could be saving or spending on items that you need. When you have a large amount of debt, it also negatively impacts your credit score. It is the same when you have a low credit score, it can impact your ability to get decent rates on insurance and loans, when you need them.

You should work hard to reduce your debt as much as possible and as quickly as possible. There are a couple of different ways that you can address debt reduction. You can focus on your debt with the highest interest rates first, so you are working on the debt that is going to have the most in interest payments. Another approach is to list all of your debt from least amount owed to the greatest amount. You focus on paying off the lowest debt first. This allows you to pay off one whole debt quickly so that you can feel as though you have accomplished reduction. You pay the minimum amount on the other debts while you are paying as much money as possible to the debt on the top of the list. That is called the Debt Snowball Method!

Side Jobs

This may seem like one of the least exciting parenting money tips, but it is something you should seriously consider. That is getting some type of side job. There are many jobs that you can get where you can work from home and make your own hours. If you are trying to maintain a household a care for a family, it may be challenging to get another job. However, I would not completely rule it out without seeing what might be available to you. If you have a lot of items in your home that you are not using, you could always sell them online or during a garage sale. All you need is an electronic device, the ability to take a picture and type up a description of the item and you may have a way to make some extra income.

If you are able to get out of the house and like to drive, you may consider working for a driving service, such as Uber or Lyft. There are also ways you could do some consulting work, if there is something, such as writing that you may be able to do from home. A quick search may help you find ways that you are able to work from home.

Conclusion

I have provided a few parenting money tips for you. Some of them may work for you while others may not. You must keep in mind that your situation is not like anyone else’s. What you need to find is the parenting money tips that work best for you in your current situation. You also must be willing to be flexible when deciding what works for you. You should also be aware that what works today may not be what works 6 months from now.

Julia Peoples is a long-time business manager focused on providing decision making assistance to the public. She works with people at key points of their lives who are making important retirement and financial decisions. She has had many articles published that educate the public on sound financial decision making.

Julia writes for those who are working towards financial freedom or a better understanding of how finances work. She has shared her financial insights with individuals on a one on one basis for years.