Smart Money Steps for Couples in Debt

Life is expensive and sometimes your income just doesn’t keep up with your spending. This can happen for a lot of different reasons. Sometimes an expensive emergency has come up that is just not affordable. Sometimes job situations change and that impacts salaries or bonuses or tips. The cost of housing or utilities might have gone up. Maybe you had to buy a new car because the old one was getting too expensive to repair. Sometimes debt happens all at once and sometimes it just gradually creeps up higher and higher. If you’ve gotten to the place where your debt has become too much to handle, here are some smart money steps for couples to take.

Get Organized

You can’t create a plan to attack your debt without knowing exactly how much you owe. It may seem overwhelming but it’s time to gather up all the statements, all the unopened envelopes from bill collectors as well as information about how much money you have in your own banking or investment accounts. Collect pay stubs as well so you can get a good handle on how much money each of you are earning on average. Once you have all the numbers in front of you calculate what you owe and how much you have.

There is more than one way to look at debt. Some couples in debt will want a grand total of what they owe – everything from car payments to student loan debt to the retail contract for the living room furniture. Others will want to visualize the debt in terms of what is due each month. In many cases it is helpful to do a little bit of both. That way you are aware of how much you owe, but you’ll attack it month by month.

But beware: it is difficult to pay off high-interest debt, like credit card debt, by only paying the minimum payment that is due each month.

Make an Honest Assessment

Now that you have the numbers in front of you it is time for a little honesty between you and your partner. Will you be capable of chipping away at this debt simply by paying the bills, or do you need to take bigger steps toward debt relief? One way for a couple in debt to move forward is to assess the depth of your debt problem is to create a budget.

A Budget is Your Financial Snapshot

A budget will help you understand how much money is coming in and how much money needs to go out each month to meet your obligations. You can create a budget in the way that is most useful for you. You can write “in” and “out” in two columns on a piece of paper. Another possibility is to open a spreadsheet and fill in the numbers while the program does the actual math. If you like things a little more technological and visual there are many apps out there that will let you work on a budget and they will turn it around in bright and bold colors on pie charts and graphs.

How to Create a Budget?

1. Honest Assessment

Your budget begins with an honest assessment of your average income and what you can expect it to be in the months ahead.

2. Line up your financial obligations

Then you have to line up your financial obligations. This isn’t just your debt. This includes the ordinary life expenses you face each month like housing, utilities, transportation and food.

3. Evaluate your monthly payments on debts

Then you evaluate your monthly payments on the debts you owe. While you are in the beginning stages of creating a budget you can enter the minimum amounts due to keep your payments up to date knowing that you intend to increase the payments when your budget allows to pay off the debt as quickly as possible.

Hopefully putting a budget together helps a couple in debt put the amount of money owed into perspective. Maybe it feels more overwhelming than it actually is, and you see how you can make lifestyle changes that will help you significantly pay down debt during a set period of time.

Maybe you didn’t realize how much money you spend on weeknight takeout dinners? Or you don’t have to pay for cable television and a full menu of subscription services. Has it been years since you asked if you qualify for a cheaper car insurance rate? When you have a clear picture of where your money goes, it is easier to adjust categories. If you want to pay an additional $100 on a month to clear a high-interest credit card within a year’s time, the budget allows you to see where you can pull that $100 from.

In this budget you should definitely try to include saving money. Opening a saving account to invest even a small percentage of your monthly income might help you with debts.

Three Ways to Tackle Your Bills

A couple in debt might consider tackling bills with one of three different styles: Avalanche, Snowball method or Emotional Debt Payments.

Avalanche

Paying off debt avalanche-style involves tallying up everything that’s owed. And begin by making the minimum payment due on each bill. The idea here is that you’ll be current on everything and will have a little something extra left over to apply to the debt that is accruing the highest interest rate. Making regular payments on-time is a good strategy for repairing or retaining your credit score. Avalanche-style payers look forward to reducing the monthly amounts due because of their consistent payments.

Snowball Method

If you decide you’re going to tackle debt with snowball-style payments, you begin by selecting the smallest amount owed and paying it off as quickly as possible. Snowball-style payers are usually encouraged by the small progress they make and are encouraged to keep working on debt.

Emotional

An emotional-debt system involves figuring out which debt weighs on your mind the most. Which is the debt that if you managed to clear it, would help you sleep better at night? For peace of mind, some couples in debt prefer to clear out emotionally troubling debt first.

But if you look at what you owe and feel it is more than you can handle with a straightforward budget, there are strategies to help you manage your debt. One of them is to consolidate it.

Debt Consolidation

Consolidating debt means bringing a variety of debts under one umbrella, with one interest rate and one payment each month. For some couples in debt it is easier to manage debt if it only requires writing one check each month and that is why they will choose to consolidate credit card debt in one place. Credit card consolidation mean the end of trying to remember which payment is due on which date every month. Consolidation is also an opportunity to get rid of the cards charging the highest interest rates. It also involves getting a loan of some kind to pay the existing debts. Where can that loan money come from?

Friends or Family

Friends or family may be willing to loan you the lump sum of your debt when you agree to a repayment plan.

Consolidation Companies

There are private companies who are in the business of offering loans to consolidate debt.

Personal Loan

Some people with good credit may be eligible for a personal loan from a bank or other financial institution that covers repaying the debts.

Consolidate to a Single Credit Card

Another strategy to consolidate credit card debt is to open a new card with attractive terms like lower interest or maybe even zero interest in the beginning, and transfer credit card balances there. This allows you to clean up all the different balances and interest rates and due dates and put them in one place.

There are two very important steps you need to take after any kind of credit card consolidation. Cancel the cards with zero balances and limit your spending to what you can afford with the cash on hand. Consolidating balances and then running up cards again is a vicious cycle that will hold you back from coming out of debt. A couple in debt needs to be on the same page when it comes to managing and paying off debt.

Debt Management Plans

Another strategy for a couple in debt is to enter into a debt management program. These programs are run by nonprofit credit counseling agencies. A counselor works with your creditors to set up payment plans with the company you owe. You pay the agency a single lump sum every month and the agency makes all of the payments to your creditors.

A debt management doesn’t hurt your credit score. While your credit report will carry a notation that you are participating in one of these plans, in the end it may be a positive for your score once you have erased your debts.

Debt Relief Programs

Debt Relief Programs are run by private companies with a focus on helping you settle your debt for less than what you owe.

These programs have counselors or advisers who work on your behalf to negotiate credit debt relief. Sometimes these programs require you to deposit money into a special account and once it reaches a certain amount then they will begin trying to settle debts.

There are no guarantees within debt relief programs that creditors will accept offers that are less than what is owed.

Payday Loans

Payday loans are usually small-dollar high-interest loans that provide an immediate source of cash. Those loans don’t require any collateral. However interest rates on these loans are usually in the triple digits. – sometimes as much as 500 percent. Payday loans are granted based on income and the money borrowed. The high finance charge is generally due within two weeks or it is tied into your next paycheck. If you don’t pay it back quickly the interest and the fees begin to soar.

Payday loans are only debt relief options. They are generally taken out by people who don’t have a good enough credit history to apply for a standard loan. If they aren’t managed well and paid back on time, payday loans can become a vicious and very expensive circle for a couple in debt.

Student Loans

Sometimes student loan payments are a financial obligation that puts a couple in debt.The first step to getting out from under student loan debt is to investigate whether you are eligible for a federal loan forgiveness.

Public Service Loan Forgiveness

Public Service Loan Forgiveness, PSLF, is for people who work in the government or non-profit sectors. You can only qualify for this type of forgiveness after you’ve made 120 payments on the student loan debt principle. You also have to be employed by a qualifying employer. The application for PSFL is very detailed and the requirements are stringent.

Volunteers with AmeriCorps and the Peace Corps may also be eligible for this type of loan forgiveness.

Teacher Loan Forgiveness

Applicants can qualify for Teacher Loan Forgiveness after working full-time for five consecutive years in a qualifying low-income school. This program usually only forgives some student loan debt, not all of it. This program forgives a maximum of $17,500 in student loan debt with the largest forgiven debt amounts going to those who teach science or math or special education.

Consolidate Student Loans

Consolidating student loan debt is a way to collect those bills in one place, with one interest rate and one single payment each month. If you student loans are through the federal government, you can investigate repayment options including consolidation and income-driven payments.

If your student loans were handled by private lenders you can look into merging them into one single payment by consolidating them. However, if you have a mix of federal and private student loan debt and roll them together into a private plan, you lose all of the repayment options that federal loans have.

If you have already consolidated student loan debt into one private loan, you can continue to keep an eye on available interest rates and if they go lower you might want to refinance. Refinancing to a lower interest rate can reduce the monthly payment and help you pay off debt faster.

Borrowers with better credit scores and histories qualify for lower interest rates on loans than borrowers with lower credit scores and spottier payment histories.

Bankruptcy

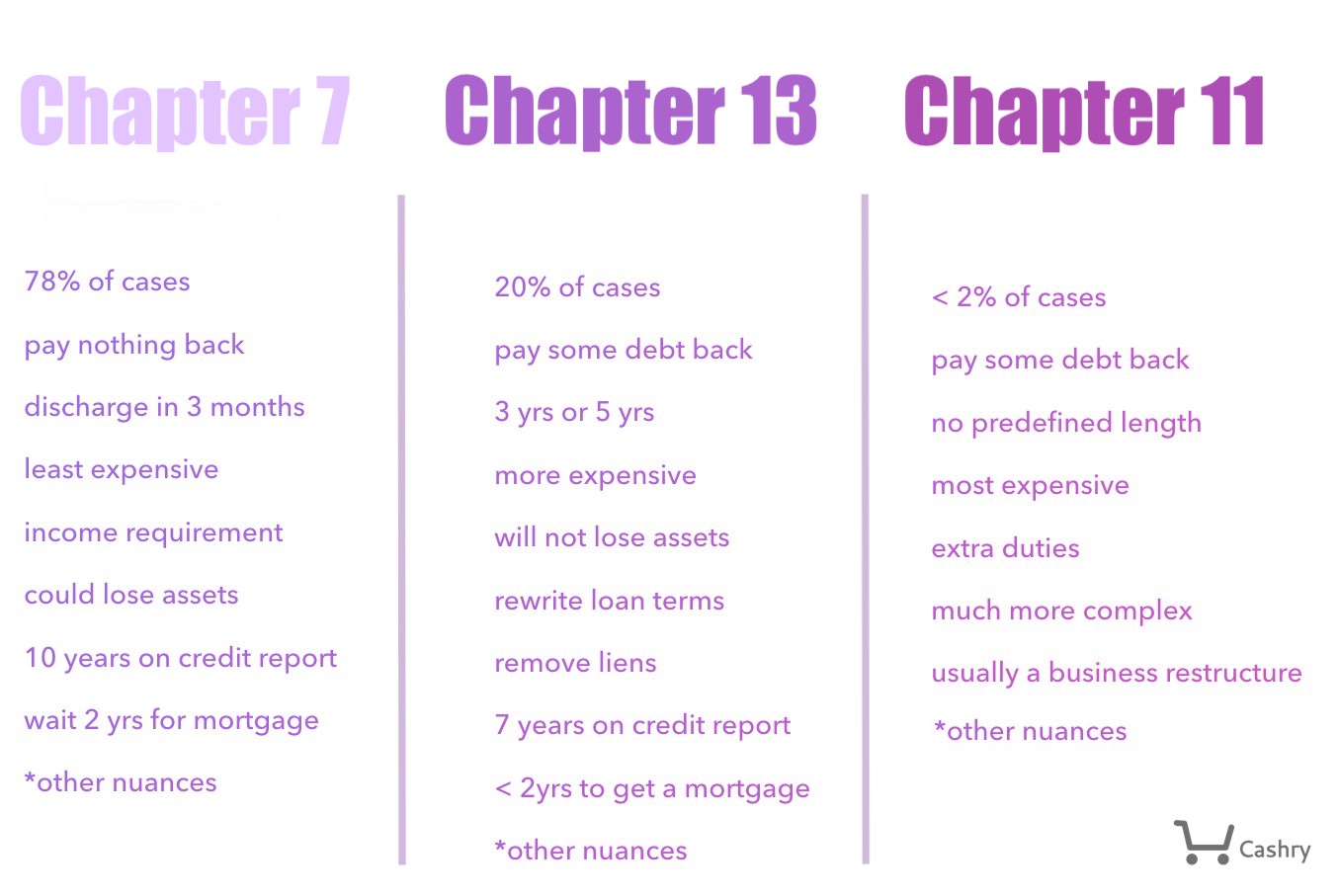

It is always a last resort choice, but sometimes a couple in debt will end up declaring bankruptcy. Bankruptcy is a ruling from a court do away with debt. Bankruptcies are always handled in federal courts. Often the bankruptcy filer is ordered into credit counseling. You may have already heard of the three most common types of bankruptcies.

Chapter 7

The borrower sells off assets like stocks, bonds and vacation homes to pay off debt and the rest of it is discharged, or eliminated by the court.

Chapter 11

These bankruptcies are for businesses, not individuals. A business under Chapter 11 is allowed to continue to operate while it reorganizes the company structure in the hopes of becoming profitable.

Chapter 13

These bankruptcies are usually filed by debtors with more assets than the typical Chapter 7 filer. Chapter 13 allows for a court-supervised debt repayment plan without liquidating other assets. Typically the debt repayment lasts for a set amount of time.

Conclusion

Being in debt can be both financially and emotionally overwhelming. But a couple in debt should take a careful look at the options. That shall get them back on their feet. The process begins by getting organized and understanding exactly how much is owed. Then you have to understand how long it would take to pay it off by only making minimum payments. This is the part of the process where a budget becomes a very helpful tool. That way you can see how much money comes in and exactly where it goes when it leaves. By looking carefully at lifestyle categories a couple in debt may find some obvious places to reduce expenses. What would free up more money to pay down debt.

A couple in debt can take the Avalanche approach to debt pay-down and faithfully make the minimum payments. A couple in debt could also try the Snowball method by selecting the smallest debt owed, paying it off completely and moving forward. Sometimes it makes better sense for a couple in debt to take the Emotional Debt Strategy. That way they begin by completely paying off the debt that worries them the most.

Along the way a couple in debt can look to consolidate debt into one single loan. This loan would have one single payment each month. The same way, credit card debt can be managed by moving all credit card balances to one single card. That way you can have a more favorable interest rate. There are credit counseling agencies and private companies that offer different debt management plans. They will often help negotiate settlements with creditors. And if student loans make up the bulk of the debt, borrowers should look into special forgiveness programs or opportunities to reduce interest rates or even repayment terms.

Carla Turchetti is a personal finance writer who lives in a world where dollars make sense. Some of her favorite topics include financial planning, budgeting, understanding taxes and the ins and outs of running a small business. Carla’s thoughts on money matters have appeared across digital, print and broadcast platforms including American Express OPEN Forum, Intuit’s Blog for Small Business, CanDo Finance, Progressive Insurance, Northwestern Mutual, Insperity, Kabbage and the Raleigh News & Observer. Carla budgets as much as she can to fuel her mad online shopping habit.