How to Use Amazon Financing to Purchase Almost Anything

Amazon financing is becoming a popular topic, especially as more and more people shop online and Amazon is expanding their financing options. However, it can be a little overwhelming to understand all of these options and which one you should apply for. This quick guide is intended to simplify Amazon financing for you so you can make an informed decision.

Benefits of Using Amazon Financing

Amazon financing can be a great help to help you when trying to get your money in order. You can buy what you need now and pay over time- and let’s face it, pretty much anything you need is on Amazon. It also allows you to take advantage of some of the great deals if you do not have the funds available in your checking account. Additionally, it can help you build your credit.

Know the Types of Available Amazon Financing

There are several types of Amazon financing available.

1. Amazon Store Card:

If you are not an Amazon Prime member but you still shop on Amazon a great deal or are looking to make a large purchase, this is the card for you. There are three significant downsides to this card, though:

- Just like other store cards, the Amazon Store Card can only be used on Amazon purchases.

- This card does not come with any rewards.

- It comes with a really high-interest rate– 27.99 percent. In short, for every $100 you spend, you will owe $27.99 in interest.

Fortunately, the Amazon Store Card qualifies for no interest financing, which we discuss in more detail below. Additionally, there is no annual fee, so you save some money in that area. To qualify for the Amazon Store Card, you need:

- To be a U.S. resident.

- Have a valid social security number or Individual Taxpayer Identification Number (ITIN).

- To be at least 18 in most states- 19 in AL and NE.

- Typically a credit score of 640 or more.

2. Amazon Prime Store Card:

The Amazon Prime Store Card is the Amazon Store Card with more requirements and more benefits. It also comes with a 27.99 percent APR, but it, too, qualifies for the special financing options discussed below. There is also no annual fee, but it does require a Prime membership that costs between $59 and $119 a year depending on if you are a student or not.

Just like the Amazon Store Card, the Amazon Prime Store Card can only be used at Amazon. Unlike the other card, though, this one earns you 5 percent cash back on your Amazon purchases. If you shop from Amazon enough, the card is likely to pay for your Prime membership- or at least a chunk of it. However, if you do not shop there often and are not already a Prime member, you might want to stick to one of the other cards.

To qualify for the Amazon Prime Store Card, you must:

- Be 18 or older and a U.S. citizen.

- Have a valid social security number or ITIN.

- Have credit clear of any bankruptcies or major issues.

3. Amazon Rewards Visa Signature Card:

This is another great card for those who do not have an Amazon Prime membership but shop at Amazon a lot. The upside to this card is that it can be used anywhere and earns you cash back on all of your purchases. You earn 3 percent cash back for Amazon and Whole Foods Market purchases. All other purchases earn you 1 to 2 percent cash back depending on the category the purchase falls into.

The annual fee varies according to the applicant’s credit and other factors. It can be anywhere from 15.74 to 23.74 percent variable APR. While this is lower than the Amazon store cards mentioned above, the Amazon Rewards Visa Signature Card does not qualify for the special financing options. This means that you begin accruing interest as soon as you make a purchase- there is no interest-free period.

On the upside, though, there is no annual fee and you do earn that cash back. If you can qualify for this card and use it for all of your purchases, you might earn enough cash back to make the interest sting just a little less. Also, if you pay the bill in full each month prior to the end of the billing period, you should be able to avoid the interest entirely.

If this sounds like the card for you, these are the requirements:

- Be 18 or older and be a U.S. citizen.

- Have a valid social security number or ITIN.

- Have an excellent or really good credit.

4. Amazon Prime Rewards Visa Signature Card:

The Amazon Prime Rewards Visa Signature Card is very much like the Amazon Rewards Visa Signature Card, but there are a couple of differences. First, you must have a Prime membership to qualify, and second, you earn 5 percent cash back on purchases from Amazon and Whole Foods Market.

Like the regular Amazon Rewards Card, the Amazon Prime Rewards Card charges no annual fee. However, you have to have a Prime membership to qualify, so you will be paying the membership fees. The variable interest range is the same as with the other card: 15.74 percent to 23.74 percent.

To qualify, you need:

- To be 18 or older and be a U.S. citizen.

- A valid social security number or ITIN.

- Excellent or really good credit.

- An active Amazon Prime membership.

5. Amazon Business Prime American Express Card:

The Amazon Business Card is an option for those making business purchases. It is available for those with an Amazon Prime membership and has a unique benefit: You get to choose between earning 5 percent cash back or having 90 days free of interest on your purchases. There is no annual fee, but you are paying for the Prime membership. The APR tends to vary from 14.24 percent and 22.24 percent.

When I say “business purchases” here, I am not just referring to office supplies. This card also earns rewards on travel, fuel, dining, and more. It can also be used through other Amazon services, such as Amazon’s web services and Amazon Business- both excellent companies for business owners. If you spend money on your business at all, you should seriously consider this card.

If you make a lot of business purchases, consider this card. To qualify, you need:

- To be 18 or older and be a U.S. citizen.

- A valid social security number or ITIN.

- Excellent or really good credit – usually above a 670.

- An active Amazon Prime membership.

6. Amazon Corporate Line of Credit:

For those who own or manage a company in which there are multiple buyers, the Amazon Corporate Line of Credit is a great Amazon financing option. You can authorize buyers to make purchases on the account. You then have at least 55 days to pay your balance. There is no annual fee and no interest, so it can be an incredible help to business owners. It is important to note, though, that this credit can only be used on Amazon purchases.

What You Can and Cannot Purchase With Amazon Financing

Amazon financing is basically paying for the items you want to purchase with a credit card. As shown above, the store cards can be used to purchase anything from Amazon. Amazon has just about everything you can imagine on their website, so if it is legal and there are no regulations on the product, you should be able to find it on Amazon and purchase it with your Amazon financing.

The Visa Signature Cards are like other credit cards, so you can use them to buy things you normally buy at other locations. You can pay for dinner, swipe them at the gas pump, pay bills, and so on. If you can legally buy it with a credit card, you should be able to use these cards anywhere that Visa is accepted.

Repayment Options

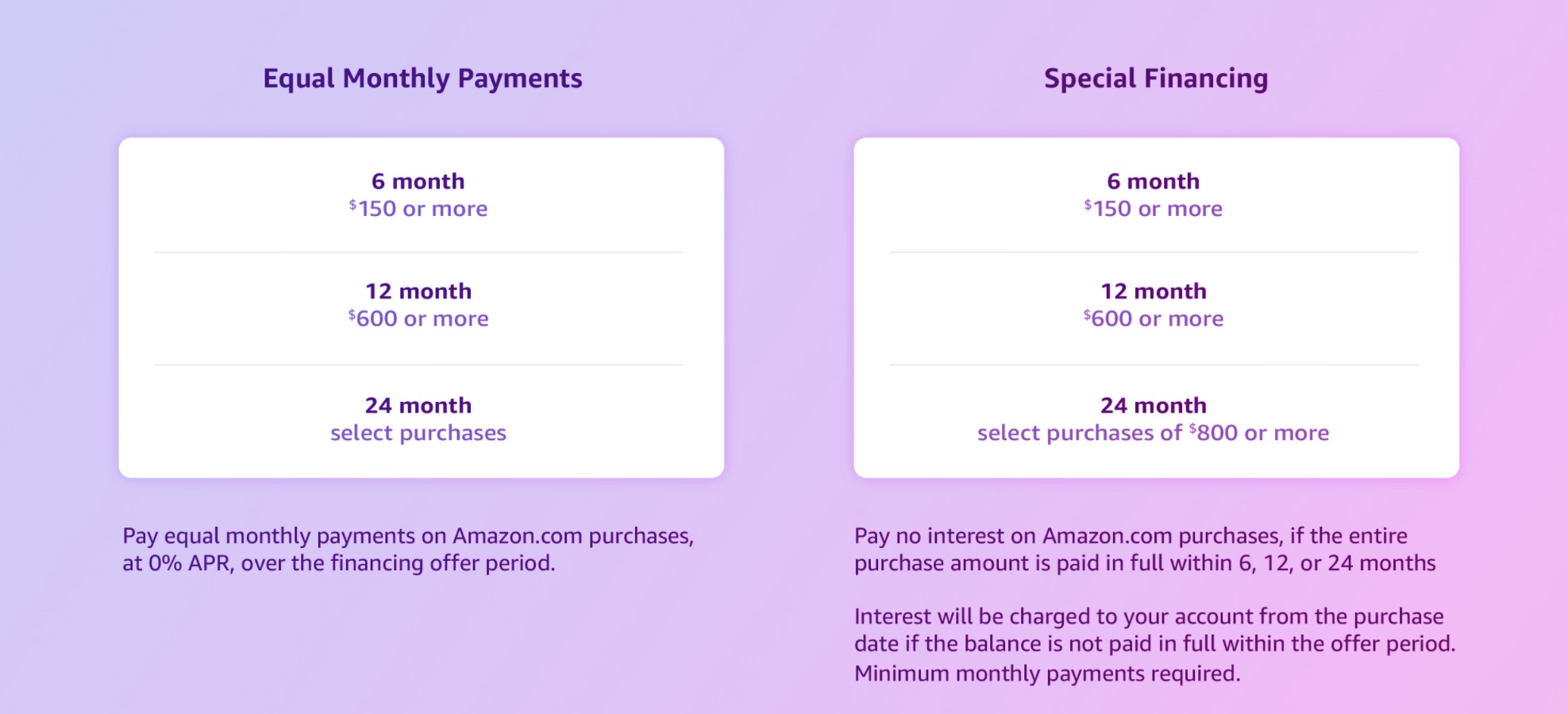

Amazon offers two types of financing for Amazon Store Cards and Amazon Prime Store Cards: Special financing and equal monthly payments.

Special Financing

With special financing, you pay no interest as long as your purchase is paid off during a set time limit. This time limit depends on the amount of your purchase and currently follows this:

- $150 or more on Amazon.com– 6 months interest-free

- $600 or more on Amazon.com– 12 months interest-free

- $800 or more on Amazon.com– 24 months interest-free

During your interest fee payments, you must still pay the minimum monthly payment, but you can choose how much more to pay each month. As long as your total is paid off before your special financing period, you pay no interest. If you do not have it paid off on time, you will not only begin to accrue interest but will also owe all of the interest that was deferred during your interest-free period.

Equal Monthly Payments

With this option, your total is divided into equal payments– the number of which depends on the total of your purchase. This is a very simple method. If you owe $600 and you have 12 months interest-free, your payments should be broken down to $50 per month. If you make these payments as you should, your purchase will be paid off before the end of your interest-free period. This method is also helpful for budgeting as you know what needs to go out each month.

Ways to Save With Amazon Financing

One of my favorite ways to save money is through shopping in bulk. That is some of the best free financial advice a person can get. This can easily be done on Amazon. For instance, my husband and sons all use Degree deodorant. When I buy the type they use in the store, I easily spend between $5 and $6. On Amazon, though, there is a seller who sells a four pack of the same type of deodorant for a little over $15.

I have a subscription with this seller so it automatically gets sent every two months. That alone is worth the money to me. With my busy life, the more I have automated, the more I can dedicate my time to what really matters.

However, there is another benefit I love about this deal. There are only three guys using the deodorant, so every time the package comes, I put one away. If we ever have a tight month or two and need to cut costs somewhere, I have enough deodorant put away for them that I can skip that month’s subscription. Saving that $15 may not seem like such a big deal, but it can be- especially when combined with other savings.

Additionally, sometimes Amazon sellers put things on crazy low sales or Amazon itself offers some really special deals. Having one of these types of credit from Amazon can help you take advantage of the deals while they are available. The key is to only put things on credit that you would normally buy.

Let’s take an example:

For instance, buying 20 sticks of deodorant for a quarter each is not worth it if my boys are not going to use it. While it is okay to take advantage of generic brands- which I do a lot- there are some things that you cannot go cheap on. In my opinion, with two smelly teenage boys, deodorant is definitely one of those things.

It is also important that you check the quality of the product. Those 20 sticks of deodorant are not worth it if they do not work, either. You want to check out two things before purchasing: The seller and the product. Read the Amazon reviews and check the seller rating. You might also Google the product to see what others say about it. Make sure that the product is worth the money you spend or you might as well stay away from it.

The bottom line here is that having an open avenue of credit with Amazon can be incredibly beneficial to your family and your wallet. However, it does not mean you should treat it as an open invitation to shop like crazy. If you really want to know how to save money with Amazon financing, here it is: You still need to follow a budget and think your purchases through. Otherwise, what was meant to help you financially will end up costing you a ton in interest.

Avoiding Interest and Fees With Amazon Financing

We talked earlier about the special financing options tied to the store cards- you get a certain period of time interest-free. Before you decide to go for it, let’s talk a little more about how this financing works. If you pay that purchase off within that time frame, you are good- you will pay no interest. However, if you do not pay it off in that time frame, you are in for a serious surprise.

Let’s say that you purchased $200 worth of products and have six months interest-free. The best thing you can do is either pay it all off with your next check or pay something like $40 per month for five months. This will get you paid off way ahead of time and save you money.

What Happens, Though, if You Miss the Six-Month Mark and Still Owe a Balance?

Does the interest start growing on the first day after the six month period? That would be a no. You see, if you do not have it paid off in that six month period, you owe all of that back interest. Every dime of interest you did not pay during that six months is added to your bill, and then the new interest begins to grow.

Amazon financing can be very, very helpful for you and your household if it is handled responsibly. However, if you will be using Amazon financing, pay your balance as soon as you can and try to pay it in full each month. Those are the most effective ways to avoid paying interest or fees.

Conclusion

Amazon financing can be a lot of help for you, but you have to handle it with care- just like you should with every other credit card or loan. Only purchase what you need or would normally buy. If it is a big purchase, like electronics, think through the purchase before hitting the checkout button. The benefits of Amazon financing can quickly be outweighed by the trouble it can bring if you do not handle it responsibly.

However, if you prefer to save money the old way, creating a savings account has always been a pretty good solution. You can start by having a look at this widget:

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.