Can You Get Credit Cards after Bankruptcy?

It’s been a long, dark, weird, discouraging time. You’ve tried to be responsible and follow the rules, but you’re tired of all the limitations – even if they’re supposedly for your own good. It feels like things will never get back to “normal,” whatever that was. Maybe they shouldn’t. Maybe that’s the whole point. Surely there are a few important things you should try to start doing differently, even after the worst of it has passed?

Bet you thought I was talking about 2020, didn’t you? Fair guess, but if that were true, I’d have thrown in a snarky reference or two about “murder hornets” or “Tiger King.” What I had in mind this time around, however, was personal bankruptcy.

Personal Bankruptcy

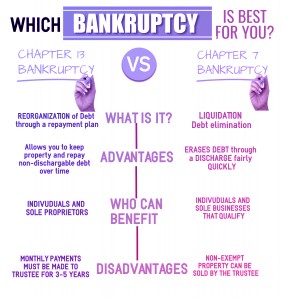

Few things can make us feel like complete and utter failures like enduring Chapter 7 or Chapter 13 bankruptcy.

We’re broken – both figuratively and financially – and there’s all that paperwork and those court mandated classes (counseling sessions is more like it)… not to mention being pretty sure strangers in the street are looking at us thinking, “That one looks like they haven’t been paying their bills on time lately.”

The thing is, bankruptcy isn’t about you being a monumental failure. Personal bankruptcy is the civilized, legal, responsible way for good people to confront, manage, and move past financial disaster.

Are there lessons to be learned from it? Choices we could made differently or should handle better next time? Maybe so – that’s how personal growth works, after all. But bankruptcy is not a prison sentence or eternal damnation, at least not in the modern world. It’s a big deal, and a huge pain to manage, but the goal is to do right by as many of your creditors as possible and then move forward.

Moving Forward After a Bankruptcy

Important word, that one – “forward.” You’re no good to anyone sitting alone in the dark feeling useless and poor. At some point, doing right by those around you means learning whatever lessons there are to be learned, then making like vintage Taylor Swift and shaking it off. Haters gonna hate, hate, hate, hate, hate, and the fakers gonna fake, fake, fake, fake, fake. You need to suck it up, up, up, up, up and figure out how to rebuild and get back to being a self-sufficient and semi-productive member of society.

There are a number of things you’ll want to consider as you begin this new and improved you. Somewhere on that list is re-establishing a little credit for yourself and deciding whether or not you’re going to carry a credit card or two moving forward. That’s what we’re going to focus on today.

Credit Cards After Bankruptcy

It almost seems counterintuitive, doesn’t it? Having just overcome unmanageable debt, why would you want to start the cycle again by taking out new credit cards?

Those two things aren’t necessarily the same, however. It’s imperative that you NOT resume bad habits as you rebuild your credit and your financial world. If that means no credit cards for you, then stick to that. It’s not easy to navigate the 21st century without any plastic in your wallet at all, but it’s possible. Don’t use credit cards to make purchases you simply can’t afford. Use them to make purchasing more convenient and paying for things more flexible.

In my personal view, there’s almost never a good reason to take out cash on your credit card. A credit card advance of that sort comes with all sorts of fees and the interest rates tend to be outrageous. There may be situations in which it’s your least horrible option, but I can’t think of any at the moment. I’d probably try selling the fillings out of my teeth or laying out a hat and doing mime in the park before I’d take out a cash credit card advance.

But that’s just me.

Why Would I Consider Credit Cards After Bankruptcy?

There are several good reasons to consider limited, responsible credit card use even after a bankruptcy, however.

1. Responsible card use helps rebuild your credit score

Responsible credit card use helps rebuild your credit score and a positive credit history. Keeping your balance manageably low and making payments on time establishes immediate credibility which only strengthens over time. Most credits score models weigh recent behavior more heavily than past behavior, so responsible use of credit gives those models something fresher and happier to plug in to their algorithms and magical prediction games.

Chances are that eventually you’re going to want to finance a vehicle or purchase a home, and your credit score can dramatically impact both how many options you have and how much that financing will cost you.

2. Credit cards can be a financial pit

Credit cards can be a financial pit, but used properly they are a modern financial convenience right up there with being able to check your balances, manage your investments, or set up payment notifications on your phone. Getting a credit card after bankruptcy mean you can make purchases online, pay for out-of-town travel, lodging, and meals, or handle unexpected opportunities or emergencies with grace and style. “OMG, Aniaya – is that YOU? I’d love to grab lunch with you and catch up! Let me just walk eleven blocks to an ATM and I’ll be back in about an hour and a half if you’re still here.”

3. The right card can be a safe way to practice new budgeting habits

The right card and a modest balance can be a relatively safe way to begin practicing those new budgeting habits and that financial organization you’ve probably sworn (a few thousand times) that you’ll be doing from now on.

Whether you’re budgeting with an old-fashioned spreadsheet or using one of our freshly re-imagined financial apps to keep track of spending and manage your accounts as easily as you can watch yet another annoying teen dance video, it’s all about establishing new patterns and new norms.

Why Would Lenders Offer Credit Cards After Bankruptcy?

Great question. You have to remember that while credit card companies are happy to issue cards to folks who have excellent credit and pay their balances in full every month and never drop spare change into the couch cushions and probably make their own artisanal cheeses at home with their brilliant, emotionally stable children each week, that’s not where they make their real money. Card companies want customers who pay regularly enough that they don’t have to chase them down, but who are just messy enough that they can make some interest along the way – and maybe a few late fees here and there.

That doesn’t mean they’re evil or dishonest or anything else. It means they’re in business. For what it’s worth, Wal-Mart and Amazon and that hidden gem of a café down the street all want to make money, too. So do you, presumably – that’s why you go to work every day and why bankruptcy was so painful.

Different but limited options

As a recent bankruptcy, your options will be somewhat limited at first. On the other hand, for companies which specialize in such things, you’re an ideal candidate for the right credit card after bankruptcy. Why?

- You can’t legally declare bankruptcy again for several years. You’ll have to pay what you owe.

- Much of your debt has recently been eliminated; you probably have more discretionary funds to spend each month now than you’ve had in years.

- You’re probably wanting to rebuild your credit score, establish a positive credit history, and begin nudging up some credit limits for future needs. That means you’re likely to be particularly careful about making payments and staying within your limits – at least for the foreseeable future.

- Because you’ve just been through a bankruptcy, card companies know you have fewer options than someone with excellent credit. Supply and demand – fewer lenders willing to take a risk on you means those that do can charge you a higher interest rate.

What Kinds of Credit Cards After Bankruptcy Should I Consider?

Your options may be limited for the first few years, but that’s OK. It usually takes a long time to end up in unmanageable debt; it makes sense that it would take awhile to rebuild your credit afterwards. But you know what they say about the journey of a thousand miles: wear good shoes. Or, wait – it begins with a single step.

In my defense, either of those makes for pretty good advice.

You usually have at least a few options. Even within these general categories, it’s worth shopping around. Not all cards are the same, whether you have amazing credit or you’re just recovering from bankruptcy. Take a little time to compare your options.

The only remaining question you should ask yourself is should you go with a secured credit card or an unsecured one?

1. The Secured Credit Card

Most of the time, your best starting point is a secured credit card. You’ve probably heard of these, even if you haven’t used one yourself, but you may not know exactly how they work or why you might want one. Secured credit cards are designed for folks without much of a credit history one way or the other (often these are young people who’ve just moved away from home or perhaps gone off to college), or who need to rebuild particularly bad credit – say, if they’ve recently gone through personal bankruptcy.

A secured credit card requires you to make an initial deposit with the credit card company issuing you the card. This is “collateral” in its most basic form – cash they have which belongs to you but they keep until you ask for it back. In exchange, you’re issued a credit card with a credit limit equal to the amount of the deposit (or perhaps a bit higher, depending on the company and your exact circumstances). You can now use that card just like any other credit card.

Interest rates

Interest rates on a secured credit card may not be amazing, but they’re kept in check by the fact that your creditor is operating with minimal risk. Don’t be surprised if the rates you’re offered are still higher than what others are getting for unsecured cards, at least at first. Higher interest rates don’t mean they’ll all be the same, however.

It’s easy during a grueling process like bankruptcy to forget that once you emerge on the other side, you’re the customer again. You’ve “served your time.” You’ve “paid your dues” – perhaps literally. You should be prepared to confront more fees and higher interest for a while. But that doesn’t mean you have to humbly accept the first thing you’re offered or that you don’t deserve anything better. Let’s get out of that “thank you sir, may I have another?” mindset right now, before you even begin shopping for credit cards after bankruptcy.

Monthly payments

You make monthly payments just like any other credit card, paying down your balance and freeing up those funds to be spent again if you so choose. Your initial deposit isn’t impacted one way or the other unless you miss a payment. In that case, the lender may withdraw the missing amount from your deposit, along with whatever late fees or other charges have incurred. Under most arrangements, you can withdraw your deposit any time and cancel the card as long as you’re paid in full.

What about a checking account?

Now hang on, you may be thinking – this sounds like I’m paying someone else interest to use my own money. Why not just open a checking account and get a debit card tied to it? You’re right, and you can absolutely do that if you wish. (Actually, you should probably have a debit card tied to your checking account whether you end up with a secured credit card or not.) The secured credit card is a means to an end. Your bank doesn’t normally report your checking or debit transactions to the major credit bureaus. Why would they? You’re not using credit, just spending your own money. Secured credit card companies, on the other hand, treat your payment history just like they would with a regular unsecured card. Your secured credit card impacts your credit history starting on day one, for better or worse.

Some secured cards offer perks comparable to regular credit cards. And most provide the same sort of security as major credit cards against fraud or loss. If you establish a good history with a specific card company, chances are good they’ll eventually offer you a credit limit above your actual deposit, and may eventually approach you about switching to a standard, unsecured credit card. Plus, you’ll be establishing good budgeting and money management habits along the way with relatively little risk. In short, a secured card is a staggered stone path to better things.

2. Unsecured Credit Card

If you don’t love the idea of a secured credit card, or you don’t have the resources to make that initial deposit, there are options for traditional, unsecured cards out there. If you’re going through bankruptcy right now, or finished the process recently, you may even have noticed a sudden flood of offers coming in the mail, your email, or showing up in ads pretty much everywhere you go online. (Yeah, it’s creepy and annoying, I know – but that’s a whole other topic for another time.)

If you decide to go this route, recognize that the interest rates you’ll be offered will be noticeably higher than market average at the moment, often by as much as 5%. Initial credit limits will be low. And there may be additional upfront fees and particularly punitive late fees or other charges. You may not be able to get premium terms at this point, but I want to emphasize again that you are not at the mercy of the lenders with the biggest advertising budget. You are still the customer, and it’s up to you what you’re willing to accept, or not.

If you don’t like any of the offers, don’t take them. You’ll figure out something else. And you don’t have to be passive. Don’t wait for the offers to come to you – do some digging, some comparisons, some pros and cons lists.

3. Use Someone Else’s Cards

OK, I’ll admit it – I phrased it that way just to make sure you were still paying attention. I’m not suggesting that you steal someone’s credit cards. That would be wrong. And illegal. Plus, it’s so easy for folks to lock that mess down with a single swipe of the app that it would be pointless even if it weren’t illegal and wrong. Which it is.

But if you have a family member with good credit and who’s willing to help you out a bit, consider asking them to add you to their existing credit cards. Purchases and payments with those cards will reflect on both of your credit records, so be very clear in advance about what is and isn’t acceptable to both of you. This can be a great way for young people to build credit, however. And a solid part of rebuilding credit for users of any age.

Conclusion

Take a breath. Don’t sign anything until you’ve processed it with a clear mind and low blood pressure. The road back won’t always be easy, but you’ve probably been through the worst of it already, and here you are looking good and pushing forward.

If we can help you compare your credit card options or navigate through any other financial questions, let us know. Otherwise, we’ll be here when you need anything.

Seriously. You got this. You survived personal bankruptcy AND 2020. What could possibly stop you now?

Blaine Koehn is a former small business manager, long-time educator, and seasoned consultant. He’s worked in both the public and private sectors while riding the ups-and-downs of self-employment and independent contracting for nearly two decades. His self-published resources have been utilized by thousands of educators as he’s shared his experiences and ideas in workshops across the Midwest. Blaine writes about money management and decision-making for those new to the world of finance or anyone simply sorting through their fiscal options in complicated times.