Basic Money Skills to Get You Through Anything

The average person is going to go through some financial struggles at some point in life. Economic depression and job layoffs are just two of the many types of financial obstacle that can come up. Those who have the money skills to handle these situations enjoy the most success.

People are especially focused on overcoming financial hardships in light of the recent pandemic. The Covid-19 pandemic of 2020 has already caused many people to lose their jobs and their livelihood. It remains to be seen how severe the financial consequences of the current situation will be. It’s likely that this event could negatively impact the economy for some time to come.

The Money Skills to Get You Through Anything

Therefore, now is a better time than ever to work on your money skills. While challenges come up, there are always ways to overcome them. If you want to get through financial hardship as successfully as possible, start building your money skills.

Staying positive

Maybe the most important of all money skills is staying positive. If you let yourself become overwhelmed by financial hardships, you’re more likely to struggle. You need to see the glass as half full rather than half empty. Regardless of the troubles you’re going through, there are probably some positive aspects of your situation. There is bound to be a silver lining in your rain cloud. Things can always be worse.

Identify the positives of your financial situation. Once you’ve done this, you might be able to use those positives to find ways to improve things.

For example: Any income source you have is a potential positive. By focusing on a particular income source, you may be able to increase your income. This income increase could make up for possible income losses that you’ve suffered recently.

Staying positive is not just important in terms of money skills. It’s important for being successful in many different aspects of life. Make sure you start overcoming financial obstacles by reminding yourself that everything is going to be ok. Even if you’re currently dealing with some struggles, you can overcome them. Consider any adverse situations as an engaging challenge rather than an irreparable loss. If you’ve lost your job, there are bound to be opportunities elsewhere.

Being Frugal

The number one thing you need to do if you’re dealing with some financial challenge is to tighten your belt. You’re just going to have to deal with not being able to spend as much as you could before. Until you get your finances back in order, you need to learn to be frugal. This might be the first of all these money saving tips you should focus on.

Inevitably, we all spend more than we absolutely have to. Even the most frugal among us still probably occasionally spends money that they could have saved. Really maximizing frugality in your spending habits requires a lot of research. There are so many different ways to cut costs.

Brainstorm possible ways to cut costs. Make a list of your necessary expenses. These are expenses like your rent or mortgage payment, food expenses. clothing purchases, and transportation expenses. Consider how you can cut back on each one of these individual expenses. Be thorough. You could bring down your living expenses by moving into a more affordable apartment, for example. You might even be able to stay with a family member rent-free for a while. Do everything you can to cut expenses as quickly as possible. This will minimize the blow of losing your income. Consider how you can cut back each one of your expenses. That’s what being frugal is all about.

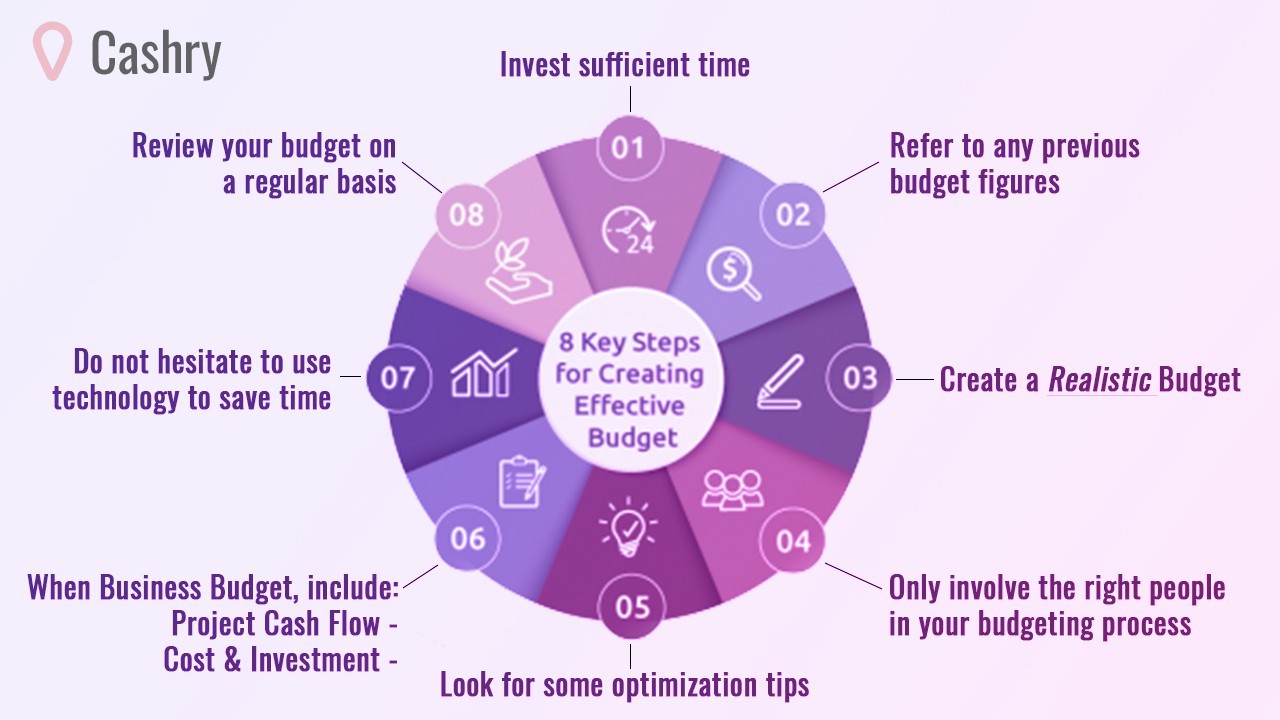

Budgeting

Being able to budget is one of the most important money skills. If you’ve never dealt with financial troubles before, it’s possible that you’ve never set a budget before. Fortunately, it’s not very difficult. But it does require you to be detailed and organized. When you set a budget, you look at how much money you’re making and how much you’re spending.

When you have an effective budget, you know what to spend all the money on that you bring in each month. You should know in advance how much money you’ll have left over. However, it can be a little more challenging to set a budget if your monthly income is not pre-determined. This could be the case if you make money based on commissions or work on an on-call basis. In this case, you might make more money one month than you do the next month. If this is your situation, it’s important to put money aside in the months when you make extra to tide you over during months when your income is reduced.

If you’ve completely lost your income as the result of economic circumstances, cut your expenses as low as possible. In the meantime, look for another job to replace your lost income.

Taking Advantage of Opportunities on the Side

The most important thing to realize if you’ve recently lost your job is that income is always out there. No matter how bad economic problems get, there are always ways to make money. Essential money skills involve knowing how to find income sources. This is where resourcefulness really comes in to play. Anyone who has recently lost their income needs to learn how to make extra money.

If you’ve recently lost your job, it’s possible that similar positions in your industry will be unavailable as well. In this case, it’s time to think about changing your industry at least temporarily. You need income to cover expenses until you can find full time work again. If a lot of businesses in your area are shut down, you can consider work online. There are many online income opportunities available like doing online surveys or consulting work from home.

In your area, there should be employment resources available. These could include temp agencies or government-run employment assistance offices. Local authorities might arrange job fairs in your area to help fight unemployment. Use resources available to you to find another job if you have recently been laid off as the result of economic issues.

Keeping Emergency Funds Available

Resourcefulness for overcoming financial problems isn’t limited to being able to find income sources. Resourceless could also help you accumulate or find emergency funds when you need them. Hopefully, you always have an emergency fund available for when you need it. An emergency fund of at least $1,000 can help out a lot when you’re trying to make ends meet. If you don’t have an emergency fund available, there are other possible solutions.

A good credit score often becomes particularly important when you’re dealing with financial challenges. With decent credit, you could borrow some money when you’re having trouble covering expenses. Financial institutions could be willing to offer you a loan if you have a promise of continued income down the road. A loan could be a life saver for coping with short term financial woes.

Perhaps your credit score is not great and you need a loan. In this case, it might be possible to find a secured loan. If you have a good amount of equity in a home or vehicle, you could be approved for a second mortgage or a vehicle title loan. These types of loan are often available to those who don’t have a strong credit score.

Anticipating the Challenges

Planning ahead and being able to anticipate financial challenges before they arrive is important. Don’t let yourself get so caught up in the present that you overlook a looming financial problem. Some financial problems can be prevented with foresight. How can you anticipate financial challenges? For one thing, you can follow the news. Those who have good money skills know how news items could potentially impact the economy and their income.

When you follow the news, you’re aware of the development of economic problems. In particular, you should pay attention to news in your industry or at your company. Obviously, you need to know if there’s a chance that you will get laid off in the near future. If you find out that layoffs are possible at your company, you can start saving up money and looking for another position. This allows you to anticipate challenges and thereby decrease their impact.

Anticipating economic challenges is all about being aware of what’s going on around you. It’s also about being aware of what your risks are. Think about what scenarios would create financial struggles for you. Then, think about what you could do to prevent problems before they happen or deal with them once they do.

Putting Savings Aside When Possible

Being a habitual saver goes a long way when things go south with the economy. The most financially successful people have money skills that involve constantly squirreling away money. Work on the skill of minimizing your spending to maximize your saving. Too many consumers out there have little or no savings. Too many consumers make excuses rather than save. Even if your income isn’t as high as you’d like, you can still save. Saving is an essential behavior for financial success.

We all have to deal with the fact that we can’t buy everything we want. Saving up money to protect yourself financially when problems occur is more important than accumulating unnecessary possessions. Remember that you never know what will happen tomorrow. You’re better safe than sorry when it comes to managing your spending. You’ll never regret putting money toward savings rather than wasting it on another extravagant night out on the town.

Focus on developing the skill of saving. This is one of the most important possible financial skills out there. Don’t get discouraged if it’s not easy at first. Looking to the future rather than satisfying immediate desires is never easy. But it definitely pays off in times of trouble when it comes to finances.

Being a Good Negotiator

When you think about money skills, negotiating might not come to mind at first. However, being a good negotiator is actually an important money skill to have. When you’re short on money, you’ll find yourself needing to negotiate with creditors and landlords. You also might find yourself needing to negotiate with buyers if you decide to sell off valuable assets. The better you are at negotiating, the easier it will be to acquire more time when you need it to pay bills.

In fact, you should focus on building up good relationships with your creditors even before financial problems come up. The better your relationships are with those you rent or borrow from, the more understanding they’ll be. Be flexible and available to others and they’ll be flexible and available to you when you need help. In terms of money skills, strong negotiating capabilities are essential.

One of the most important things to remember about dealing with creditors is that being present is always best. Ignoring calls from creditors or others you owe money to never works out well. Being available to discuss your outstanding debts shows that you are responsible. Therefore, always be ready to negotiate rather than run away from a financial responsibility.

Pinpointing the Problems

When you experience a financial challenge, it’s best to look at the experience constructively. What can you do to learn from the experience? What can you do to ensure that you won’t face the same problems again in the future? You want to be able to pinpoint your financial problems to best overcome them.

This means that you need to look at your financial behaviors critically. You might feel that you’re dealing with financial challenges as the result of events outside your control. You might have a point. Maybe you were laid off because of an economic downturn.

While you might not have been able to prevent being laid off, you possibly could have prepared for the situation better. It’s always good to have a plan B regarding how you will make money and pay bills. Also, there is always the factor of savings to consider. With savings, you’ll be ok with losing your income at least temporarily.

Economic fluctuations are cyclical. If the economy is going through a recession now, it will eventually come out of the recession. But surely there will be another recession in the future, and the next time you should try to be better prepared.

Overcoming Temptations

Some of us are more susceptible than others to temptations to spend money unnecessarily. Discipline is probably one of the money skills that is the hardest to master. All of us have things that we want to spend money on. However, we all have limitations. Even those who win the lottery or make millions per year go into debt if they can’t handle temptations.

Individuals often get into financial trouble because they spend too much. Even if economic problems have led to your financial troubles, overspending makes these situations worse. Anytime you deal with financial troubles, you need to start focusing on overcoming the temptation to spend. The less you spend, the more you have available to put toward funds that can help you get through financial troubles in the future.

A savvy consumer will learn from a financial setback. It is when we deal with financial hardship and economic problems that we truly learn the value of saving. This is when we become fully aware of the frivolity of unnecessary and extravagant purchases.

If you have trouble overcoming the temptation to spend, there are a lot of possible solutions. One thing you should do is set up automatic savings. Have a portion of your paycheck directly deposited into a savings account. This will make extra funds unavailable to you for everyday spending. In the long run, this is an effective way of overcoming or minimizing the temptation to spend.

Conclusion

These are some of the money skills that get savvy consumers through just about anything. Now’s the time to get started developing these skills. Who knows what tomorrow brings? While economic recovery and strength may come quickly, it’s possible that things will get worse before they get better. You need to brace yourself for possible financial obstacles in the near future.

To get started, evaluate your current situation. Hopefully, you’re still financially stable. Hopefully, you still have your livelihood and a regular income. If not, you’re really going to need to develop some powerful money skills quickly.

Consider which of the above-mentioned skills will be most helpful to you in your situation. Everyone’s situation is different. Being resourceful and doing some fast thinking are essential if you are particularly badly hit by recent economic events. Stay positive and don’t get discouraged. There is always a solution to any financial problem. Be creative and resourceful and you’ll be in better financial shape than ever before.

Katherine Davis is a freelance writer specializing in the subjects of finance, banking, and investment. Based in New York City, Katherine’s experiences combating the Big Apple’s outrageous real estate costs and living expenses have provided her with some great budgeting insights on stretching a dollar. A graduate of Penn State University, Katherine advises millennials to be disciplined when it comes to their finances and to start investing as soon as possible.