Lenders Eagerly Offer Fast Cash Loans Online: Be Aware

There are many opportunities out there for borrowing online. However, a lot of fast cash loans online should be avoided. As a consumer, it’s up to you to educate yourself about loan products. Many loans out there can help you financially. However, others might leave you in a bad financial situation. The more informed you are, the easier it will be for you to pick out the right borrowing opportunities.

Online loans can be dangerous in numerous ways. Understanding the potential hazards of borrowing from online lenders is important. Online loan scams are out there. These types of scams can cause many negative consequences for borrowers. They can cause a consumer to fall into excessive amounts of debt. They can also lead to identity theft issues.

You need to know the signs to look out for that indicate fast cash loans online that you should avoid. You also need to know how to pick out legitimate lenders.

Doing Your Due Diligence

It’s up to you to do your due diligence before you borrow. You definitely don’t want to borrow from any lender out there on the Web. Remember that you are going to have to give some sensitive information away to any company you borrow from. This information will include your social security number and address. You don’t want to give this information out to just anybody. That could result in identity theft, what you definitely don’t want!

You’re also going to be depending on your lender to treat you fairly. Your lender is going to be able to impact you financially when it comes to your debt load and your credit score. It’s essential that you only conduct financial transaction with financial institutions that are dependable and legitimate.

When you need a loan, it can be tempting to act quickly. This is especially true if you get a loan offer or pre-approval. However, don’t give in to the temptation to borrow without conducting due diligence. This could really hurt you down the road. Financial decisions require careful research and reflection. Any consumer needs to know that there are a lot of scams on the Internet. You need to know how to pick out and avoid the scams. This is essential for protecting yourself financially.

Things to Do Before You Take Out Fast Cash Loans Online

You can best protect yourself when you know the steps to taking out loans on the Web. There are a few things you need to do before borrowing. Again, you don’t want to make any impulsive decisions. Always carefully evaluate the situation before signing a loan contract.

Every time you borrow, there are certain steps you should go through beforehand. These steps help you avoid getting overwhelmed by debt. They also help you to avoid making decisions you’ll regret later. Don’t underestimate how damaging working with a predatory or unscrupulous lender can be for your future. You could find yourself dealing with severe troubles if you borrow from the wrong lender online and you could lose a lot of your hard earned money. You could even find yourself the victim of identity theft.

If you do the following four things before borrowing, you can minimize your chances of falling prey to online loan scams.

1. Evaluate Your Finances Carefully

The first thing to do is evaluate your finances. Make sure that you can afford to borrow. Figure out exactly why you want to borrow. You don’t want to skip this step. If you skip this step, you’ll be more susceptible to predatory lenders. You’ll also be more susceptible to getting in over your head with debt and ending up with bad credit.

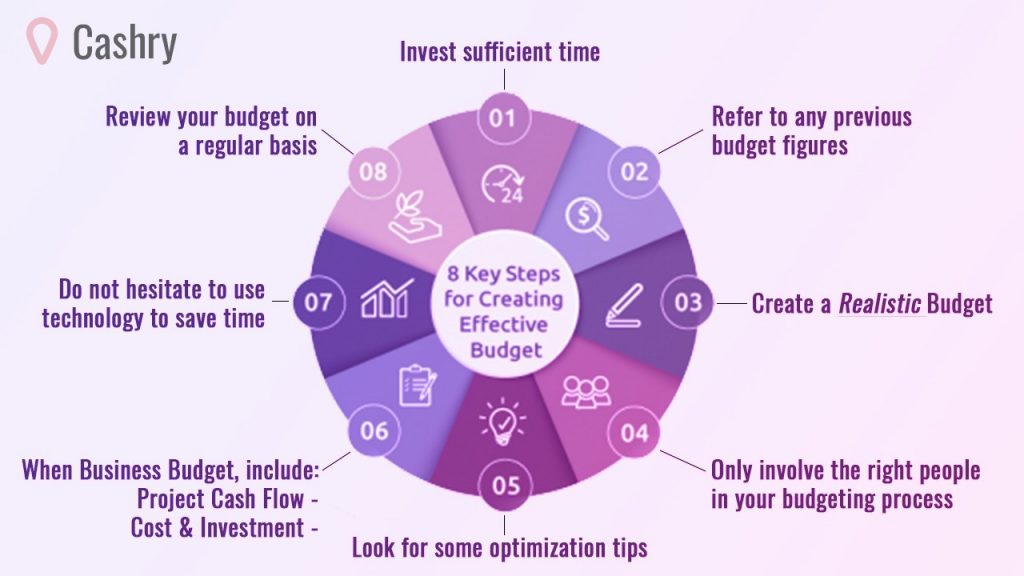

Many consumers make the mistake of taking on too much debt. You don’t want to be one of them. Before borrowing, you need to have a budget set up. You need to understand your income versus your expenses. If you decide to go through with borrowing, it’s important to determine how much you’re going to borrow. It’s important to know what you’re going to spend borrowed funds on. So first thing first: set up your budget!

Create a detailed plan as part of your evaluations. Look to the future. Consumers often borrow too much because they’re focused on the present. You need a long term plan to meet financial goals. You also need a long term plan to avoid borrowing mistakes that will hurt you financially.

2. Thoroughly Research the Lender

The reputation of any lender you borrow from is an essential detail. You never want to borrow from an unknown lender. This is a huge mistake when it comes to fast cash loans online. Ideally, you want to always borrow from a well known lender. If you’ve never heard of a lending company, you need to carefully research them.

Research lenders by using the Internet. Online reviews are a great source of information so you should consult them. If there are numerous reviews claiming that a loan product is a scam, you should obviously look elsewhere.

You might also consult your accountant or financial consultant. These professionals might be able to warn you of scams. Another great source of information is the Better Business Bureau. Look up the Better Business Bureau rating for the lending company in question. If the rating is very low, it’s a good sign that you should not borrow from that particular lender.

3. Compare Lenders

You should never borrow without gauging your various options. Failing to compare option is a good way to end up with a problem loan. You always have numerous options when it comes to borrowing. You are not limited to borrowing from any particular lender.

If you qualify for a loan from one lender, you should be able to qualify for a loan with other lenders. If only one lender will approve you, this could be a sign that the lender is running some type of scam. One great advantage of borrowing online these days is that you can usually easily get quotes from different lenders.

When you get quotes from different lenders, you can compare offerings. This is a good way to get the best possible deal. It’s also a good way to avoid interest rates that are so high that they indicate predatory lending. Remember, the final aim is to help you out with the current situation, no to make it easier now but harder later!

4. Evaluate Data Security

You have to provide sensitive information when you take out small cash loans online. It’s important to make sure that your sensitive information is secure. That’s why you should pay attention to data security.

Research the past of the company you’re interested in working with. In particular, pay attention to any security breaches in the past. That can seem really hard to do, but you only need to google it. For instance you could write “security issue [NAME OF COMPANY]” and Google will let you know if there is anything you should be aware of.

Also, look at the website itself to evaluate data security. You should know that a website beginning with “https” is more secure than a website beginning with only “http”. Indeed, “Https” means that the website is secure and that data that is passed to the server of the website is protected against hackers.

Possible Problems Regarding Quick Cash Loans

There are certain potential hazards that stand out when it comes to borrowing online. Understanding what these hazards are helps you to avoid them. Scams regarding fast cash loans online usually fall under one of three categories. If you know what these categories are, you can more easily pick out problem lenders online.

Usually, online loan scams to be aware of stay away from will involve one of the following three scenarios.

#1. Predatory lending

Probably the number one issue to be aware of is predatory lending. A predatory lender may very well loan you the money that you seek. However, this loan will come with huge drawbacks. Perhaps a loan from a predatory lender will come along with such high interest rates that you will struggle to pay the loan back. A predatory loan could also come along with a lot of hidden fees.

Predatory lenders are known to target those who are already facing financial difficulties to begin with. Predatory lending is particularly common when it comes to secured loans. These include mortgage loans and vehicle title loans. Predatory lenders often deal in secured loans because there is little risk for them. If the borrower doesn’t pay the loan back, the lender can repossess the home or vehicle.

If a lender asks for high fees up front or wants to charge interest over 100% APR, they are probably a predatory lender that you should stay away from.

#2. Phishing scams

Phishing scams are another common scenario regarding online lending scams. With a phishing scam, the party running a website is basically just looking to steal sensitive information from a consumer. The lender is probably not going to provide any loan funds at all to the prospective borrower. Instead, the lender wants to succeed in committing identity theft.

With phishing scams, a website will seek to get the social security number or other personal details of a consumer. A phishing scam could also involve a party posing as a lender who tries to get a consumer to provide his or her bank account or payment information.

#3. Wire transfer requests

There are some online lending scams out there where the owner of a website might try to get a consumer to wire transfer funds. Perhaps the lender will claim that a loan will be provided after prepayment. After this, the payment will never come and the party posing as a lender will disappear. Unfortunately, this type of scam is quite common. In many cases, parties running this type of scam are located outside the country. This means that they are very hard to track and bring to justice. Once a consumer sends a wire transfer in this scenario, it is very hard to get the funds back.

Signs of an Online Loan Scam

How will you know when you’ve come across a scam? Fortunately, there are certain signs that are usually prominent when it comes to scams with fast cash loans online. If you look out for these scams, you can best protect yourself.

Legitimate lenders will share some common traits. The process of applying for a loan with them and receiving the money will generally follow a standard procedure. Anything unusual could indicate a loan scam.

With a legitimate loan, the lender shouldn’t advertise too aggressively. Legitimate lenders generally expect prospective borrowers to come to them. Legitimate lenders will be interested in your income or credit history.

The following are five pieces of evidence that a lender may be running some type of scam.

#1. Asking for Prepayment

A legitimate lender should never ask for prepayment. A loan could include fees like an origination fee. However, when a lender charges a fee like this, it should just be deducted from the loan amount. Asking for prepayment is an indication of a loan scam.

If a lender request any type of advanced payment, you should be wary of that lender. Some legitimate lenders may charge an application fee. However, this is somewhat rare these days when it comes to online personal loans. You should avoid borrowing from any lender requiring an upfront payment.

#2. Pushing You to Sign a Contract Quickly

A professional, reputable lender knows that borrowing involves making a big decision. That’s why a lender should never push you to borrow. An overly pushy lender is a sign of a scam. If a lender is putting a lot of pressure on you, chances are they are offering a deal you should stay away from.

Lenders that are pushy often don’t want you to take the time to evaluate the situation. This is because they know the loan product or deal they are offering is not in your best interests.

#3. Guaranteeing Approval of Applicants

No legitimate lender can guarantee every loan applicant. Legitimate lenders always need to evaluate the financial details an applicant presents. A lender claiming to approve all applicants is a bad sign. This is a sign that the lender is running some sort of scam.

Don’t allow yourself to be fooled by lenders claiming to approve everyone. This can be hard for consumers who are struggling to get approved to borrow. However, there is going to be a catch if a lender claims to approve everyone. Such a lender may charge very high interest rates. Also, such a lender may be running some type of phishing scam.

#4. Having No Physical Address

Having a physical address is a sign that a lender is legitimate. If you look over a lender’s website and can’t find a mailing address, it’s a very bad sign. This could mean that the website is a front for an illegitimate operation. Any business should have a physical address.

If a business doesn’t have a physical address, it generally means that it is not a real company. Without a physical address, you won’t be able to file a complaint against a company or pursue the company legally. Make sure you know the physical address of any online lender you do business with.

#5. Expecting You to Submit Bank Account Info

Be aware of premature requests for your bank account information. Online lenders will often deposit loan funds right to your bank account. However, online lenders should not be requesting your bank account information before approving you for a loan. This is a sign of a scam.

Don’t give out your bank account information to an online lender. You need to protect your sensitive information. Once an online entity has your bank account information, it can easily access your funds. That’s why it’s essential to only give out bank details if you’re absolutely certain you can trust an online lender and have already been approved to borrow.

Final Thoughts

You should now have the information you need to pick out the right fast cash loans online. With this information, you can more safely borrow online. You will avoid the scams and find the legitimate lenders. Being able to take out a loan online really increases your borrowing prospects. As a consumer, you probably know how important it is to have borrowing opportunities readily available.

With the information you’ve learned, you can start researching online loans. You can weed out any loans that are likely to be predatory or compromise your security. At all times, you need to remember to borrow responsibly. You don’t want to allow yourself to get carried away with borrowing. Getting out of debt can be challenging. It’s best to keep your debt level manageable.

Be patient when researching borrowing opportunities. If you’re careful and put in the effort, you’ll find the right loan product for your needs. Make borrowing work for you. Use loans to build your credit and finances. In the long term, borrowing can help you meet your financial goals if you do things right!

Katherine Davis is a freelance writer specializing in the subjects of finance, banking, and investment. Based in New York City, Katherine’s experiences combating the Big Apple’s outrageous real estate costs and living expenses have provided her with some great budgeting insights on stretching a dollar. A graduate of Penn State University, Katherine advises millennials to be disciplined when it comes to their finances and to start investing as soon as possible.