How to Get Cash Advance for Social Security Recipients

It’s not uncommon for a recipient of social security to want a cash advance. You should know that you can borrow even if your only income is from social security. Fortunately, it’s possible to get cash advance for social security recipients. If you rely on social security, you should still be able to qualify for some loans out there. However, you might have to look a little harder than those who are employed. You may have to look a little harder, but eventually you should be approved.

Having a fixed social security income can be challenging. You might find yourself short on funds once in a while. That’s why it’s important to know about borrowing options that are available to you. With a borrowing option, you can get funds you need quickly when you can’t cover expenses. A loan can make it possible to stay afloat financially.

Get started researching your borrowing options as a social security recipient. The first thing you should do is learn as much as you can.

Staying informed is one of the most important aspects of getting ahead financially. Do your research now and you may be surprised about all the loan options out there. There are lenders offering products that are designed for someone in your situation.

What does it mean to be on Social Security?

To be “on social security” is the term used in the US for OASDI (Old-Age, Survivors and Disability Insurance). It is a program developed by the Social Security Administration (SSA) which both the disability income and the survivor benefits.

Loans secured by social security payments

A borrower’s income is an important consideration regarding loan approval. Typically, loan applicants are employed. They receive income through wages or salaries from their labor. However, lenders will also work with borrowers who receive other types of income. If you receive only social security payments, you could still qualify for a loan as social security payments could secure a loan for a borrower.

If your only income comes from social security, you may want to look out for loans that are specifically designed for social security recipients. There may be some unique aspects of these loans as lenders might not offer the same loan products to social security recipients that they offer to employed loan applicants.

What to know before getting a cash advance when you are on Social Security

If you can indeed get a loan when on social security, there are things you should consider before actually applying or pre-qualifying for it. Indeed, getting a loan could change your supplemental social security income.

Social Security Administration considers that a loan is not a new source of income, therefore you should be able to get one without impacting your social security income. However, if you don’t spend it in the same month, it will be taken into account when it the time comes to count your ressource limit. And if you ressources exceed the allowable limits fixed based on your situation, then that one month you will not receive your Social Security Income benefits.

Therefore, if you plan to apply for a loan when on Social Security, you should probably consider getting it the month you plan to spend it, so you avoid losing your next month SSI due to that cash advance.

Where to get cash advance for social security recipients

Getting a loan when on Social Security goes through the same process as getting a regular loan, except that as your income might be lower it might be harder to find a lender willing to give you this cash advance.

Firstly, you should understand what exactly is a loan, either a Personal Loan or a Mortgage Loan, based on what type of loan you want to apply for.

There are many different borrowing options out there. You’re not limited to loan options from one particular lender or financial institution. The terms of loans from different lenders can vary widely. Whatever you found till now, you should probably keep looking for it as you could find a better deal. Put time and effort into your search for a loan. There are different things you should pay attention to when applying for a loan:

- Interest rates: The higher the interest rate, the more your loan is going to cost you. Unfortunately, a lot of lenders out there charge high interest rates that might even be considered predatory.

- Loan amounts and terms: You probably have a particular amount in mind that you want to borrow. You don’t want to be forced to borrow more or less than you need.

Find the loan offers that are most affordable while also aligning most closely with your needs.

Process of acquiring a loan for a social security recipient

There is the process that you’ll need to go through to take out a loan. This process is quite similar to the process of taking out any kind of loan, and it will remain the same regardless of what lender you work with. It’s important to learn as much as you can about the process before you get started. The more prepared you are, the less stress you’ll experience. These are four key steps you’ll want to go through to take out a loan as a social security recipient.

1. Providing proof of income

Your income is a key consideration in your loan application. The lender is going to want to see documentation of your income. Fortunately, this is an easy type of document to provide for a social security recipient. If you receive social security, you should have a statement of your benefits that you can provide to the lender. This is clear proof of how much social security you receive and when you receive it. Make sure that you have this document handy when you are ready to apply.

2. Supplying necessary personal information

The lender is not only going to be interested in your income. The lender will also need basic information about you. This basic information will typically include your social security number. With your social security number, the lender may run a credit check. As the lender will consider your credit score, it is also important for you to be aware of what this score is.

The lender will also want you to provide your address. Other information you may need to supply includes your desired loan amount, date of birth, ID information, and bank account information.

3. Applying for a loan

To apply, you’ll have to fill out a loan application with the lender. This application will ask you for any pertinent information. It’s important to fill out the loan application completely. If you fail to provide any requested information, your application may be rejected. After you submit the application, you will get a response back from the lender letting you know if you’ve been approved.

4. Getting the loan funds and repaying the loan

After you’ve been approved for a loan, the lender will provide you with the loan funds. These days, it’s common for loan funds to be deposited right into the borrower’s bank account. You’ll typically just have to supply the lender with a routing number and account number for your account. You’ll have to start making payments at some point after you receive the loan funds. The terms of your loan should detail when repayment starts. It may help if you set up automatic payments. This way, payments on your loan will automatically come out of your account. You won’t have to remember to make payments and will therefore be less likely to forget them.

Mistakes social security recipients should avoid when borrowing a cash advance loan

As a social security recipient, your loan could have a big impact over your financial situation. That’s why it’s so important to avoid mistakes during repayment. The following are four mistakes to avoid to ensure that your loan process goes as smoothly as possible. They are mostly the same as the one any other loan applicant should avoid, but it seems always important to read them once more before making any important financial decisions.

1. Not researching the lender enough

You want to borrow from a lender that you can count on to be fair. Make sure you’ve researched the reputation of a lender before borrowing from that lender. It’s a good idea to choose a lender that you know will provide good customer service. You might have questions or concerns regarding your loan. It will help you to have someone to talk to if questions and concerns come up.

2. Having no payment alerts set up

Missing a payment can negatively impact your credit. This could make it more difficult for you to borrow again in the future. If you take out a loan as a social security recipient, you should set up payment alerts on your phone. These will remind you when a payment is due and will need to come out of your bank account.

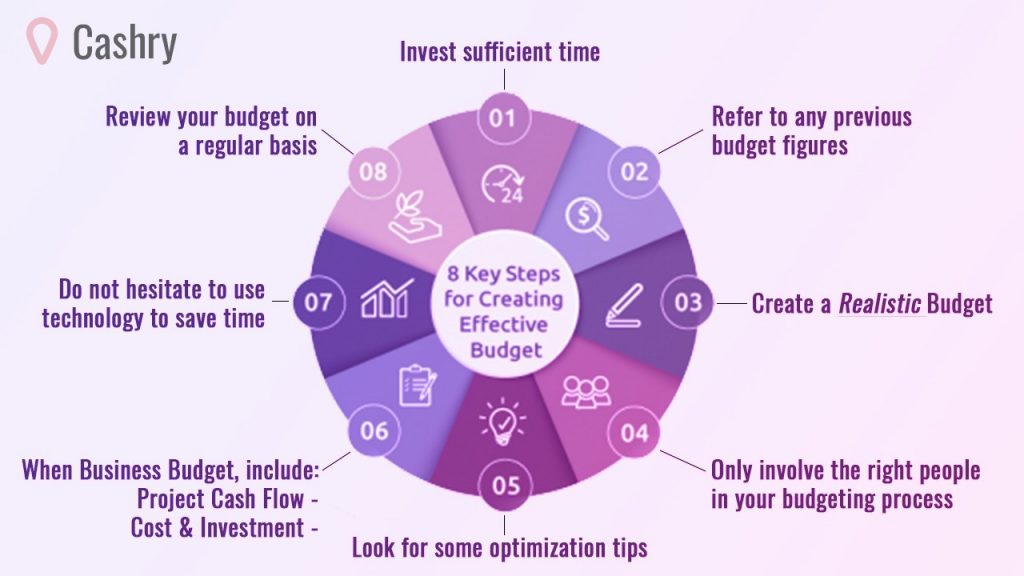

3. Failing to set up a budget

Once you get your loan funds, you’ll have to start repaying your loan. You need to make sure you have adequate funds available each month to make your loan payment. You also need to make sure that you have adequate funds to meet your other financial responsibilities. That’s why it’s so important to set a budget. With a carefully planned budget, you can track money that’s coming in and going out. This is the best way to optimize your finances going forward.

4. Providing inaccurate information on an application

It’s important to double-check all of the information on your loan application carefully. Any mistakes could create problems for you down the road. Errors on your application could decrease the chances that your application will be approved. Errors could also complicate the deposit of your loan funds or repayment of your loan.

Go out and look for the right loan based on your situation

You should now understand some basics about how to get cash advance for social security recipients. Now is the time to go out and look for loans. Use the resources available to you and you can find an appropriate financial product. One of the most important things to remember is that you shouldn’t jump into any loan agreement before first researching thoroughly.

If you need a loan, you might be stressed out. You might be worried about your finances and unsure of how you’ll pay your bills. However, it’s important to relax. Getting stressed out will only make things worse. You can achieve your financial goals if you’re careful. You just need to find the right loan offer. If you receive social security, you should have regular and reliable income. This means that you should be able to reestablish yourself financially with some focus and effort.

Rest assured that your financial issues will soon be a thing of the past. Find a loan offer, set a budget, and soon you’ll achieve success. Although it might not happen overnight, you can get where you want to be financially. It takes dedication and persistence to achieve financial goals. However, it is easily possible if you put your mind to it.

And if you are looking for some help along the road, Goalry might be the right place to look for it and achieve your financial goals!

Katherine Davis is a freelance writer specializing in the subjects of finance, banking, and investment. Based in New York City, Katherine’s experiences combating the Big Apple’s outrageous real estate costs and living expenses have provided her with some great budgeting insights on stretching a dollar. A graduate of Penn State University, Katherine advises millennials to be disciplined when it comes to their finances and to start investing as soon as possible.