How Hardship Loans Help You Get through Hard Times

Life is a funny thing. Not funny “haha.” More like it’s funny how quickly life can knock you off your feet and turn your world on its head. One minute you are going along thinking everything is fine. Next, you are trying to figure out how you got where you are.

Even many people who seem to have it all together have been thrown for a loop recently. This last year has turned life upside down for everyone. Of course, some people have suffered more than others, but there has certainly been enough suffering to go around.

Among other things, the suffering has reached our wallets and bank accounts. Many of us have wondered how we were going to make it through- how we would pay our rent and electric bills; how we would feed our families; how we will come back from all of this when it’s finally over.

In the midst of all of this, a term keeps popping up: Hardship loans. The term is fitting, of course, but it may not be a familiar one for most people. This guide will help clarify what exactly they are, how they can help, and whether or not they are a good idea for you.

What Are Hardship Loans and How Can They Help?

Let’s start with a little basic information. First, a hardship loan is not really a technical term. At its core, a hardship loan is just a personal loan- not something designed specifically for those experiencing hardship.

The term “hardship loans” is more of a marketing strategy to attract people in desperate need of a loan. It helps them to know that they might find relief through that lender. This relief typically comes in the form of short-term loans in small dollar amounts.

Hardship loans- like any other loan- come with pros and cons. Before you decide to apply, take some time to read the following so you can make the best decision.

Pros of a Hardship Loan

1. Take care of emergency situations

Hardship loans are there when you need them to take care of emergency situations. For instance, you can use them to prevent your utilities from being cut off, keep a roof over your head, put gas in your vehicle, or anything else you need to do to survive.

2. Help your credit

Another upside to hardship loans is how they can help your credit. As hardship loans are personal loans, they get reported to the credit bureaus. As long as you make your payments on time, they can help build your credit score. Of course, that also means if you do not make your payments on time, it can bring your score down.

Cons of a Hardship Loan

1. Marketed to people in needs

One downside to hardship loans is that as they are marketed to people in desperate situations, they typically come with higher interest rates. With some lenders, this interest might not be unreasonable.

However, you have to keep an eye out for predatory lenders who take advantage of such situations. They sometimes charge interest in the triple digits and give you only a few weeks to repay, making it nearly impossible to get out from under the loan.

2. Potential short repayment term

Sometimes, hardship loans also come with shorter repayment terms. This is not necessarily an issue if you have the money to repay coming in soon. However, people facing enough financial difficulty to need a hardship loan typically do not have money on standby. In these cases, a hardship loan might provide temporary relief but cause even more issues in the future.

3. They still have some requirements

Additionally, though they are marketed as loans for anyone who needs help, they still have requirements you have to meet. In short, if you do not have any income or other way to repay, you likely will not be approved. Plus, you need to know that most of them still check your credit score.

Alternative Options to Hardship Loans

As hardship loans are a big decision and can be risky- and not everyone will be approved- it’s important to consider alternatives. Some options are below.

1. Hardship Assistance

Before you decide to take out any kind of loan, try speaking to your creditors.

- Are you behind on your rent? If you haven’t already, ask your landlord for an extension. Or ask if he or she needs any help. It does not always work, but some landlords will let tenants trade out work for rent. This might include cleaning some rentals before new tenants move in, painting, or doing some handyman tasks. You never know until you ask.

- In danger of utilities getting cut off? Call the providers and explain your situation. Many have assistance programs in place that either push off your due date or have connections with organizations that help pay bills.

- Will you be late on your loan or credit card payment? Many lenders will defer your payment when you are dealing with a hardship. Try to negotiate with them!

2. Cash Advances

If you have a credit card, it might be more beneficial to take out a credit card cash advance. Yes, they typically come with fees, but those fees might pale in comparison to hardship loan fees.

3. Nonprofit Assistance Programs

Most cities have one or multiple assistance programs that can help you through rough times. Some are government-funded, while others are church-oriented or provided by private entities.

They are not just great for those that need money to pay bills, though. These programs can often help with food, clothing, and other basic necessities. Some can even help with housing, Christmas presents, and other needs.

If you do not know where to find them, ask friends and family, utility providers, churches, or community members on Facebook. Someone will have the information you need.

4. Secured Loan

If you own anything of value, a secured loan through a local bank or credit union might be a better bet. They often come with lower interest rates and more favorable terms. Different institutions accept different forms of collateral, but some common ones include:

- Car titles

- Land deeds

- Jewelry

- Electronics

Call around to different institutions to find out what type of collateral they accept. Do remember, though, that you are putting up that item in exchange for a loan. If you do not repay the loan, that financial institution has every right to take possession of your item. Before making this move, be sure you will be able to repay.

5. Family

If you are fortunate enough, you might have a family member willing to help you out a bit. This can be less risky in many ways, but it can also prove troublesome. Borrowing from family can create a sense of awkwardness, especially until you have repaid them. And if you happen not to repay, it can drive a wedge between you.

6. Pawn Shops

Pawnshops are another option when you are in desperate need of fast cash- and you do not need any credit for approval. You simply need an item or items that are valuable enough to the pawnbroker to warrant giving you a loan. Some commonly accepted items are:

- Laptops, game stations, and other electronics

- Tools, especially power tools

- Musical equipment

- Antiques and collectibles

- Jewelry

- Games and DVDs

Keep in mind, though, that pawnshops will only accept what they know they can sell, and that can constantly change. We once had this really nice- and almost brand-new- digital camera that we pawned in a desperate time. Within three months of getting it back, we hit another stumbling block and tried to pawn it again. Unfortunately, they would not accept it again because the demand for digital cameras had decreased due to smartphones. My point is that you cannot assume they will just accept something because they have before. It’s always best to call around to ask before wasting your gas.

If you have never used a pawn shop before, it’s a pretty simple process. You take in an item, and they appraise it. They determine how much they could resell the item for if you fail to repay them. They then offer you a loan amount based on that.

If you agree to the amount, they hold the item for 30 days. At that point, you can either repay the full amount to get your item back, or you can pay the interest to renew the loan for another 30 days. As long as you pay that interest, you can keep the loan open as long as you need.

Under most circumstances, you are not going to get a large amount of money from a pawn shop- unless you have an item of extreme value. However, this can be a great option if you need some cash for gas, groceries, or smaller bills.

Current Situation Fixed: What to Do Next?

For this part, we are going to assume that you have your current dire situation fixed- at least temporarily. Either you have gotten a hardship loan or used one of the options listed above to find a solution. What do you do next? Personally, I suggest two major steps.

Make Your Payments

If you got a loan- any kind of loan- make your payments on time, every time. This is imperative if you want to keep your credit in good standing, prevent any other financial issues, and keep this loan avenue open in case of another emergency. You have to commit to doing all you can to make it happen.

I know making payments is easier said than done, so try the following to help you out.

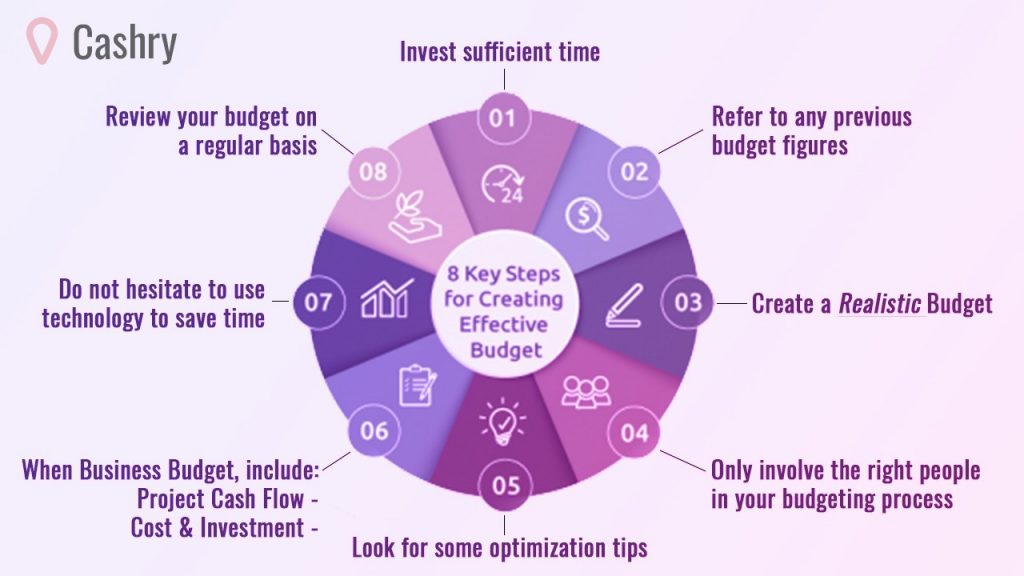

1. Rework Your Budget

I know I’m making a lot of assumptions in this area, but we are going to pretend that you already have a budget. If you don’t, stop what you are doing and start right here.

Assuming you do have a budget, you need to sit down with it and add in your loan payments. If there is no space for it, find it.

- Take out your daily coffee or trip to the drive-thru.

- Cut your cable and switch to a streaming service.

- Stop paying for ebooks- hit the library. Most of them let you check out ebooks on their websites, anyway.

- Start using coupons or a coupon app to save on your shopping.

- Don’t be ashamed to sign up for government assistance, such as food stamps, if necessary. Those programs are in place to help people in need. You don’t have to stay on them forever- just while you get back on your feet.

These are just a few ideas, and everyone’s budget looks different. Just do whatever you need to do in yours to help yourself make those payments.

2. Make Some More Cash

Finding work has been a struggle, I know, but there are still ways to make a little extra cash. With more people having things delivered to their homes, you can make some money delivering items from Walmart or through companies like DoorDash.

Additionally, many people are looking for ways to save on items they need. It’s a great time to try garage sales or selling stuff online. You might not make a fortune, but it can certainly help with your loan payment and small expenses.

Prepare for Future Hardships

Here’s another assumption: You probably do not want to end up in this situation again, right? No one does. No one wants to feel so helpless and out of control with their life or finances, but how can we stop it?

Okay, I will be the first to say that there are no guarantees. Sometimes, you do all you can, and things still fall apart. However, there are steps you can take to prevent some issues and lighten the impact of things you cannot avoid.

1. Work On Your Budget

Yes, I mentioned this above, but that was in regards to paying your loan. Now, I’m talking about really looking at and working on your budget. You should be sure you include all of your bills, your financial goals, and a strategy for saving and wealth building. And, of course, you want to be sure that you include building an emergency fund.

2. Work On Your Credit

Low credit scores and a bad payment history lead to fewer loan options, higher interest rates, and more unfavorable issues. Start trying to improve your credit- even if you cannot fit in more than $20 each month. Every step you take towards paying off debt is a step in the right direction.

3. Organize Your Finances

Being in control of your finances can be an impossible thing when your entire financial life is unorganized. If you have to search through several bills, bank statements, accounts, and websites just to get an idea of where you are at, there is a really good chance that you are going to drop the ball somewhere.

Take some time to really organize your finances. This can be done in many ways, from a piece of paper with all of the information to a spreadsheet to an app- whatever works for you.

Personally, I prefer something that makes the process a bit easier- like the Goalry Mall. Imagine being able to track your income, expenses, bills, loan payments, financial goals, bank accounts, debts, insurance, investment accounts, and more all in one location.

Goalry Inc. developed a 100% Free 30-Day Video Program to help you become financially independent! That could definitely help you organize your finances. And this, not to mention all the tools they offer to help you.

Conclusion

We all experience desperate times, which can lead us to desperate solutions. It’s imperative, though, that you take a moment to fully consider your options. Temporary relief of your current situation is no good if it leads you to a worse position in a few weeks’ time.

If after reading this article you still consider that getting a Hardship loan is the best solution for you to fix your current situation and get back on track, then you can visit Cashry, We are not a lender, but we can help you find hardship loans as well as other products and services .

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.