How Often Can You File for Bankruptcy?

Bankruptcy is a legal process where, if you can’t repay your debts, you can seek relief from some of all of your debts. In many jurisdictions, bankruptcy is imposed by a court order and is usually initiated by the debtor. Despite their best efforts, some people find themselves in a situation where they need to file for bankruptcy more than once. Whether this is due to repeated job loss, recurring medical bills, or other financial problems, it is possible to file for bankruptcy more than once but there are some certain things to know.

Types of Bankruptcy

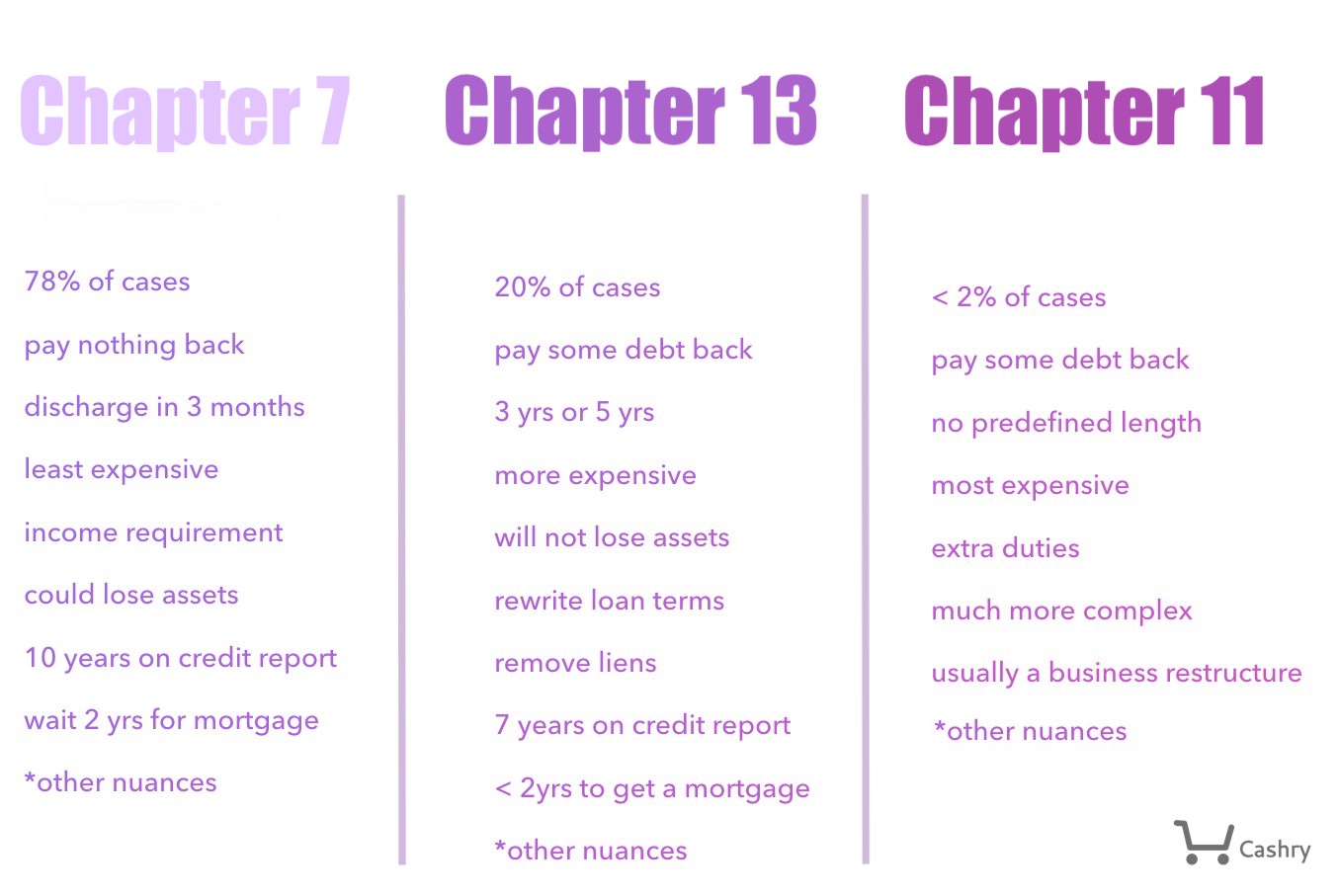

When you file for bankruptcy, there are three different types of bankruptcies you need to know.

Chapter 7

This is known as straight bankruptcy or liquidation and it’s one of the most common types of bankruptcy for individuals. With this type of bankruptcy, a court-appointed trustee will oversee the liquidation and sale of your assets in order to pay off your creditors. Remaining unsecured debt, such as medical bills or credit cards, are usually erased. There are some types of debt that won’t be forgiven by bankruptcy, such as taxes and student loans. Depending on where you live, some courts won’t force you to sell. Many people are going to be able to hold on to necessities, such as their home, but it’s important to note that nothing is guaranteed.

Chapter 7 isn’t able to stop a foreclosure but it can postpone it. The only way you can keep some of the stuff you own is to reaffirm the debt. This means you recommit to a loan agreement and continue to make payments. With some Chapter 7 cases, many are no assets cases, which means there is no property with enough value to sell. You are only able to file for Chapter 7 bankruptcy if the court says you don’t make enough money to pay back the debt. This will be based on a means test, which will compare your income and look at finances to see if there is disposable income to pay back your creditors.

If you income isn’t high enough then you may qualify. If you do qualify and file then you have to go to a meeting of creditors, where those you owe money to will ask you many different questions about your debt and finances.

Chapter 13

When chapter 7 usually forgives your debt, Chapter 13 bankruptcy reorganizes your debt. The court will approve a monthly payment plan so you end up paying back a portion of the debt over a period of three to five years. What you will pay monthly depends on your income and the amount of debt you have. The court will also put you on a strict budget and will be monitoring your spending. Chapter 13 can help you stop foreclosure since it helps you bring your mortgage up to date. Anyone can file for this bankruptcy but there are certain limitations about how much secured and unsecured debt you have.

Chapter 11

Chapter 11 bankruptcy is used to organize a corporation or business. A business will come up with a plan for how to continue operating while paying off debt and both the creditors and court approve this plan. Some individuals, such a real estate investor, may have too much debt to qualify for a Chapter 13 bankruptcy and those who also have a lot of high value assets and properties can choose to file under Chapter 11. Most individuals wouldn’t have to worry about this.

When Can You File for Bankruptcy Again?

The answer of when you are able to file for bankruptcy again will depend on what happened in your previous bankruptcy filing. If your past case ended with a successful discharge of unsecured debts then the time limit allowed between different discharges will depend on the bankruptcy you filed first and the type you want to file now.

Chapter 7 to Chapter 7

If you have filed for Chapter 7 bankruptcy in the past and got a discharge and now are hoping to file for Chapter 7 bankruptcy again then you have to wait eight years before you are able to do so.

Chapter 7 to Chapter 13

If you first filed for Chapter 7 bankruptcy and now want to file for Chapter 13, you have to wait four years before you can file again. This time limit only refers to getting another discharge. There can be circumstances where you want to file Chapter 13 after Chapter 7 without getting a discharge. For example, your student loan payments can be more than your monthly income can handle and when you file under Chapter 13 you can get relief by getting into a payment plan without needing a second discharge.

Chapter 13 to Chapter 13

If you have filed for Chapter 13 and got a discharge and want to file for Chapter 13 again then you have to wait at least two years.

Chapter 13 to Chapter 7

If you have gotten a Chapter 13 discharge and now want to file for Chapter 7, you will have to wait six years. This waiting period can also be waived if you have already paid back 100% of your unsecured creditors in the Chapter 13 plan and the case has been found to be in good faith.

Many of these rules are going to be conditional. The court can prevent you from filing a second bankruptcy case for a certain amount of time by dismissing the case with prejudice. If you fail to obey a court order then it can result in the court dismissing your case. You can also have problems if you file multiple matters in order to delay creditors or try to abuse the bankruptcy system.

Should You File for Bankruptcy Again?

If you have gone through bankruptcy before then you already understand that your financial situation can be unique. If you are deciding if bankruptcy is right again, you need to consider whether or not you have the type of debt that is dischargeable, the amount of property you are able to keep, the difference between the types of bankruptcy, and which one is best for you. You also need to consider the timing issues to make sure that the second filing will go as smoothly as possible.

If you have questions, consider asking your attorney. For instance, if your spouse is able or not to file bankruptcy. Or if it’s too early for you to get a discharge on a second case for yourself. You may also want to ask if you are able to file bankruptcy for a second time if your spouse is currently going through bankruptcy. Whether or not you file for bankruptcy again will depend on each unique situation.

Why File for Bankruptcy?

There are certain instances where bankruptcy can be unavoidable.

Putting Everyday Necessities on Credit Cards

If you are always paying bills or putting gas on a credit card since you have no available cash, it’s a red flag that you are in a big hole of debt. Many people end up doing this because they are spending their entire paycheck on payments for debt. This cycle makes the situation worse. Then your total debt goes up because of interest.

You Are Paying One Credit Card with Another

Paying one credit with another is just stalling and doesn’t make your debt go down. If it’s only a one-time thing then it may not be a red flag but it if it happens regularly then your debt will go up.

Interest Rates Have Already Gone Up

It can be hard enough to get out of debt when you have a reasonable interest rate. However, if you have already missed a payment then your interest rate may be exceptionally high. Once the rate is at 30% then the payment each month is mostly going toward interest and not much goes to principal. The interest on its own increases the payment, which you may already have a hard time making.

You Are Already Working a Second Job

If you are already earning your maximum income with a second or third job then you may need to take some more extreme measures, such as bankruptcy.

Wages Are Being Garnished

In extreme debt cases, a lender can get a court order that garnishes your wages. This means money is taken out of your paycheck. Since you may not making enough money to begin with you can develop additional problems financially. If you have received a notice that a lender is attempting to garnish wages then declaring bankruptcy will stop this temporarily and you may have the debt dismissed.

You Have Already Tried Other Options

If you have already tried different options to make a dent in your debt then it may be time to consider bankruptcy.

When Is It a Bad Idea to File for Bankruptcy?

In certain cases, there will be other ways to deal with unsecured debt and bankruptcy may not provide options for certain kinds of debt.

You Can’t Make Payments on Small Amounts of Debt

Unsecured debt, which includes most medical bills and credit cards, won’t affect any collateral you have. Lenders for unsecured debt don’t have a lot of recourse when it comes to getting their money back. Negotiating your payment terms or interest rate can work well with unsecured debt. As long as your creditors think you are likely to declare bankruptcy, they will want to negotiate with you because they know they won’t get much if you file for bankruptcy.

You Just Want the Collection Agents to Stop Harassing You

Collection agents aren’t permitted to call people who know you or contact you at work if you ask them to stop. In order to do this, you need to send the company a certified letter with your request. Recording calls and saving voicemails can be a way to show collectors are continuing to call you even after you already asked them to stop. The original lender is still permitted to contact you but they are not usually as annoying as collection agencies.

Most of the Debt Is from Court Judgments, Child Support, Income Taxes, or Student Loans

A bankruptcy treats different kinds of debts differently. Court judgments, student loans, child support, and income taxes are some of the debts that can’t be erased. If a lot of your debt is made up of these obligations then bankruptcy may not be the right choice for you.

You Don’t Have Any Assets

Except for certain debts, creditors can’t touch Social Security, welfare, or unemployment benefits. Even if you are sued, they aren’t able to take this money. Filing bankruptcy in this case wouldn’t be helpful.

When to File Bankruptcy?

Many people think you should file for bankruptcy when you are broke. However, it’s best to file for bankruptcy while you still have some cash. Being without money can make the process much harder. If you are positive you are going to be headed toward bankruptcy then you may want to stop paying certain bills. For instance: credit cards that can be discharged. You may want to save the money to get an attorney to help you through the process.

Keep paying your car loan or mortgage since you will have to make up those payments plus fees if you want to keep these items. Once you declare bankruptcy creditors are notified. Then they will likely reduce your available credit. So if you have been living entirely on your credit card, you will want some cash on hand for your living expenses.

How Can a Bankruptcy Attorney Help?

A bankruptcy attorney isn’t able to help you file bankruptcy any sooner than the time limits set forth by law. However, they can help you file a different type of bankruptcy than you filed before. It would give you a different timeline. For example, if you have filed a Chapter 7 bankruptcy and can’t file another one just yet, a bankruptcy attorney can help you with the process of a Chapter 13 bankruptcy. A bankruptcy lawyer can better help you calculate if you are eligible for Chapter 7 bankruptcy. This can be true if you have already filed Chapter 7 and it was dismissed without discharge.

What Are Alternatives to Filing for Bankruptcy?

No matter how much debt you have, it can be possible to avoid bankruptcy and get financial debt relief. There are other options so you can get out of debt before you file for bankruptcy.

Take Care of Your Necessities First

Before you make a plan, make sure your necessities are covered, such as utilities, food, transportation, and shelter. You won’t likely have the energy to get out of debt if you don’t have any food to eat or a house to sleep in. Make sure you are taking care of your family and yourself first and know the collectors can wait. There can be free money to pay off debt for your necessities with different government grants.

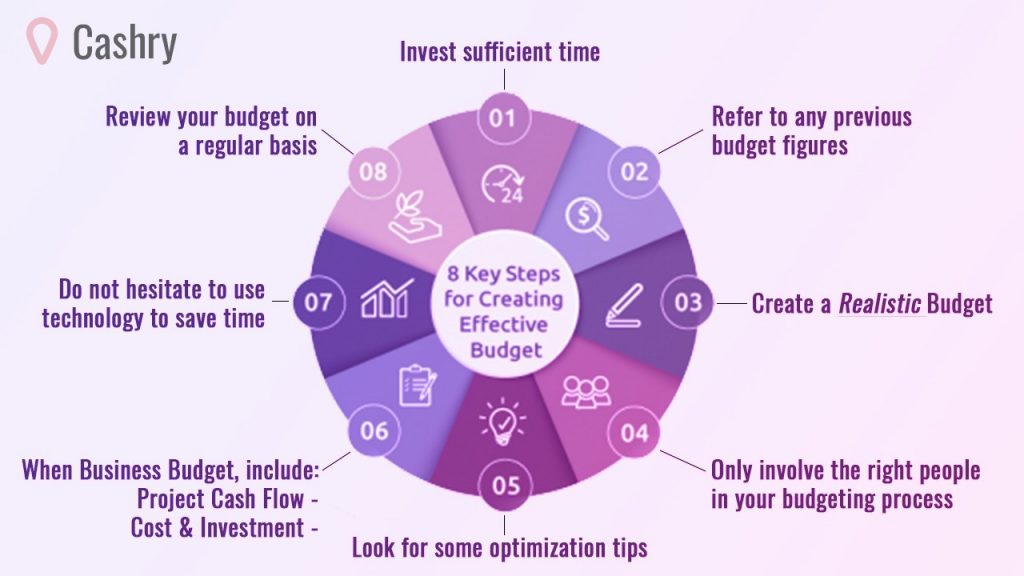

Get on a Budget

In Chapter 13 bankruptcy, the court will put you on a budget and track spending.

However, you are able to do this before you file for bankruptcy. If you are on your last leg with your debt, a budget can really make a difference. Instead of wondering where your money is going, make sure you are tracking your different obligations and purchases. You may even find money you didn’t realize you have. Budgeting does mean cutting out unnecessary expenses to pay your debt. The subscriptions and cable have to go if you are serious about avoiding bankruptcy. Instead of the government telling you how to manage money, you can be the one calling the shots if you avoid bankruptcy.

Boost Income

Income is powerful for building your wealth but it’s also a powerful tool when it comes to fighting debt. The more money you are making, the more you are able to put toward your debt. You may need to work more hours at your job or find a higher paying job. Another solution is to pick up a second job in order to help you keep up with monthly payments. Yes, it can be hard but the sacrifice can be worth it in the long run.

Sell Your Stuff

In Chapter 7 bankruptcy, the court will liquidate assets for you. Instead, you can sell stuff that you have of value that you aren’t using. It may sound extreme but this is what happens when you file for bankruptcy. This way, you have control over how your things get sold. You could consider selling them online or even organize a garage sale.

Get on a Plan

Many bankruptcy courts make you go through a financial literacy course before your debt can be forgiven. This is because debt can become a cycle of life. However, it doesn’t have to be this way and you can get on a plan and take a class on your own to learn about better money habits in order to pay off your debt.

Final Thoughts

Filing for bankruptcy is not something to take lightly. However, if you do file for bankruptcy, you may not fix your financial situation completely. You may also have to file again at another point in your life. Especially if you aren’t careful. Depending on the type of bankruptcy you file the first time, you will have a new timeline before you can file the second time. There will be different rules. Those based on whether or not your case was discharged and what type of debt you currently have.

Whether you finally decide to file for Bankruptcy, always keep in mind that from now on you should save money by launching a savings account. Not only will it be useful as an emergency fund if need be, but it shall also offer you some annual interests.

Jackie Strauss is a finance writer with a background in economics living in Los Angeles. She has a passion for helping readers learn more about personal finance, insurance, home loans and paying down debt. As a college student during the Great Recession, she has had to learn budgeting and money saving techniques to become a new homeowner.