How to File for Bankruptcy After Running Out of Options

Are you at the point where you need money to pay bills because you are drowning in debt? You are not alone! Indeed, many people are experiencing the same thing and want to know how to file for bankruptcy. Anyone who is thinking about filing for bankruptcy is initially in an awkward position, though, since this is an unpopular way to get out of debt. However, if you have depleted your emergency fund or have tried all other options to save yourself, bankruptcy may be your only option.

What to Expect

When the mountain of debt can no longer be reduced, then it is time to file for bankruptcy. However, you do not file for bankruptcy every day and inevitably do not necessarily know what to look out for. Often it is not even clear what to expect. Many people do not take this step for various reasons. Most of them try to avoid this step out of embarrassment that they can no longer handle their own finances and some because they fear being judged by others. However, bankruptcy is not a reason for feeling embarrassed because it affects many more people than is generally believed.

The Legal Requirements

The legal requirements of how to file for bankruptcy are not always so understandable for laypeople and you should therefore; never dare to take such a step alone. There is legal aid help or you can contact a bankruptcy lawyer or debt counselor who specializes in bankruptcy and who can provide valuable support, if you have to file for bankruptcy.

Consumer Insolvency Proceedings

First, in the consumer insolvency proceedings, an attempt is made to reach an out-of-court settlement with the creditors. That is, the latter waives the total amount if you can agree with on making small payments. In such cases you can save yourself from bankruptcy.

The Insolvency Period

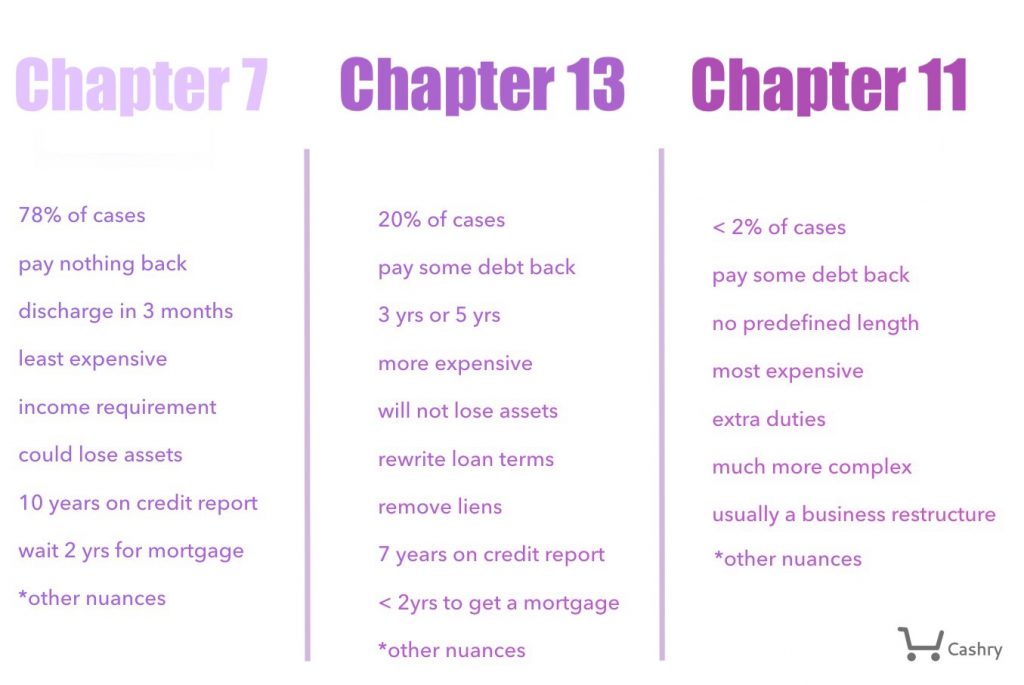

If you want to file for bankruptcy, you have to be aware that this will not be done within a few months. The insolvency period is usually between seven and ten years; depending on the type of bankruptcy you file. During this time, you credit report will show that you have filed bankruptcy and it will be more challenging to acquire credit.

Different Types of Bankruptcy

We must begin by explaining that there are two kinds of bankruptcy: Personal and Business. Depending on the type of debt you have, you can declare one or the other. This is mentioned because there are many people who have financial problems derived from problems with business, therefore it is important to identify.

Personal Bankruptcy

In the case of personal bankruptcies, there are two most popular chapters are 7 and 13.

Chapter 7

Chapter 7 is a liquidation bankruptcy in which all debts are erased and is primarily for people with insecure debts, credit cards, medical bills, repossessed cars, which are the most common cases.

In Chapter 7 bankruptcy, debts are forgiven in exchange for the delivery of assets and their sale with profits destined for creditors. Some assets are exempt, as are certain debts like child support and unpaid taxes. For Chapter 7, there are no limits on the amount with which a bankruptcy can be requested, whether it is little or large debts and a person can file for bankruptcy every seven years.

Chapter 13

Chapter 13 is a personal reorganization bankruptcy and the most common case is when people fall behind on their mortgage, car payments, Internal Revenue Service tax debts and need a repayment plan to catch up. In this case, a monthly payment plan is made for 3 to 5 years.

With Chapter 13 a plan is designed to pay off existing debts using disposable income after subtracting essential living expenses.

Business Bankruptcy

Regarding business bankruptcy, there are 3 chapters you could be interested in: Chapter 9, Chapter 11 and Chapter 12. You should consider filling Chapter 9 if you are a city or municipality. Otherwise, chapter 11 and chapter 12 might be better for you. Below are some details about those 3 chapters.

Chapter 9: Debt Adjustment of a Municipality provides reorganization, similar to Chapter 11.

Chapter 11: Debt Adjustment Reorganization, reducing debt, extending repayment time, or by a more comprehensive reorganization. It’s generally used by commercial businesses.

Chapter 12: Debt Adjustment of a Farm Family with a Regular Annual Income. This chapter works in a similar way to Chapter 13.

Before Filing For Bankruptcy

To know whether you qualify, you have to go through an assessment showing your available means to meet your financial obligations. You should also go through credit counseling and do so within six months of filing Chapter 7 bankruptcy.

Keep in mind that you have access to a wide range of credit counseling services approved by the federal government. You can do the credit counseling course online, in person or over the phone. When you have received your certificate for the credit counseling course, make a copy of it for the bankruptcy court since the course is mandatory and you have to show proof.

An Overview Of Your Debt

Anyone who is toying with the idea of filing for bankruptcy has to get a precise overview of all debts. If this has become difficult due to the lack of past bills, reminders and letters, every creditor, (i.e. companies that are owed money), will be happy to send a statement. In this way, the total debts are listed with all possible ancillary charges and you can see everything at a glance.

In the event of bankruptcy, the entire assets are listed. Assets also include a condominium, car or house and everything else that is not directly relevant to one’s lifestyle. Consideration is being given to what can possibly be sold to use the proceeds to reduce debt. The remainder of the debt reduction is carried out by indicating income.

Will You Lose Credit Power?

Once this assessment is done of how to file for bankruptcy, the most frequent question that scares some people when starting a bankruptcy process is the loss of credit and the difficulty of starting a good record again.

People who file for bankruptcy in general already have damaged credit due to late payments. Bankruptcy allows individuals to rehabilitate credit. Although the bankruptcy appears for seven to ten years on the credit report, it will also appear that there are no more debts. Therefore, if you want to buy a house or a car; even though the bank will see that you have a bankruptcy, at the same time, the bank will see that you do not owe anyone anything anymore. That is something you should consider when applying.

Plus, even if it takes time, there are always some ways to improve your credit score.

Starting Over

Bankruptcy really is an opportunity for people to start over fresh and can rebuild their credit immediately after bankruptcy. This is the case if people who have payments for their house or cars, continue to make them on time, which will reflect positively on credit. For those who receive new credit card offers, generally the credit line is not very large and you can use them for $20 or $30 a month purchases and pay on time.

How to File for Bankruptcy?

Assess the Facts

Now, to file for bankruptcy, the first time is assessing. It is time to analyze or assess your debt and you must make sure that all are listed for bankruptcy since you cannot go back and fix anything once the bankruptcy process begins. Put the debts into categories to see which ones qualify for being absolved. If you are unable to eliminate most of your debt with bankruptcy, then it shall not be the best option to take. Be aware that each state has their own provisions for your assets in terms of exemptions, which a lawyer will explain.

For instance, here are some debts that you won’t be able to eliminate through bankruptcy:

- Child support

- Specific student loans and taxes

- DUI debts from personal injury

- Alimony

- Debts incurred after filing bankruptcy

- Loans obtained fraudulently

- Specific debts you incurred 180 days before the bankruptcy filing

- Secured loans, which are subject to equity foreclosure

Choose the Right Type of Bankruptcy

In assessing the need to file for bankruptcy, consulting with a specialized attorney is primarily recommended, but your bankruptcy lawyer will have a list of key questions that can help decide the type of bankruptcy to file. It will also help to reflect on the financial situation in which you find yourself.

The following characteristics should be carefully considered before filing for bankruptcy. Have you:

- Tried unsuccessfully to control your spending and use of credit and failed at it or even tried to get help from a debt counselor and failed

- Tried staying on a debt consolidation plan

- Failed to meet your debt obligations to your debtor

- Failed to meet the creditor’s repayment plans

- A greater debt ratio than your yearly income and it is more than than 40-50%.

Start the Process

The consumer bankruptcy process consists of five main steps:

- Out-of-court settlement attempt

- Complete the form and go to court

- Judicial process

- Conduct phase

- Debt discharge

1. Out-Of-Court Settlement Attempt

The out-of-court settlement attempt is the specialty of consumer bankruptcy proceedings. Here, with or without the help of a debt counselor, an attempt is made to reach an agreement without the court. The debtors draw up a debt settlement plan and present it to their creditors. That could be, for example, agreeing a smaller installment to pay off the debt. If all creditors agree to the debt settlement plan, the out-of-court settlement attempt is considered successful. If the debtor manages to repay his newly agreed installments regularly and in full, he is debt-free after all debts have been paid off.

However, if only one creditor does not enter into the out-of-court settlement attempt, consumer bankruptcy proceedings will begin after the debtor has filed an application.

2. Complete the Form and Go to Court

When the out-of-court settlement attempt doesn’t work, it is time to file the bankruptcy form. You will have to take credit counseling and then file the bankruptcy form. To do so, you will have to pay filing fees and print the form. Then you’ll go to court to file in the form and mail your document to your trustee.

3. Judicial Process

In that case, a debt settlement plan is drawn up with the help of the court. If assets are still available, they will be evenly distributed among the creditors after deducting the court costs. A solution will be found for the repayment of the remaining debts.

4. Conduct Phase

The judicial process follows in how to file for bankruptcy. There is also the option of discharging the remaining debt. Critics say that these regulations are rarely crowned with success because the total amount can usually amount to around 50% of all debts. Very few debtors still have that much money.

5. Debt Discharge

In the conduct phase, the debtor repays his debts as agreed and adheres to the agreements imposed on him. If the conduct of business phase has been successfully completed, the remaining debt will be released. This means that the debtor will be forgiven the remaining debts.

The bankruptcy process is a complicated business. In order to do justice to all interests, bankruptcy law has to be regulated.

Contact a Bankruptcy Lawyer

To file for bankruptcy, it is best to contact a bankruptcy lawyer to assist you. There has to be an overview or list of your creditors. In this way, the bankruptcy lawyer will get a precise overview of your current situation. You will be sent or given paperwork to enter your creditors. If you do not know all the creditors or have forgotten which ones, the lawyer will determine them for you by using the credit record system.

In addition, direct inquires will be conducted with the creditors in order to complete all the information required to file for bankruptcy. In this way, the lawyer will ensure that your bankruptcy application is drawn up and completed correctly.

Information on Income and Assets

To file for bankruptcy, the bankruptcy lawyer also needs detailed information on your income and financial situation. In this way, the lawyer will ensure that you are really insolvent or threatened with irreversible insolvency. Otherwise, the lawyer will consider another solution for your debt relief such as an out-of-court settlement with your creditors. Here, too, you will be sent a questionnaire specially tailored to the needs of an insolvency application.

Is There a Right Time to File?

There is no all-inclusive right time on how to file for bankruptcy. Fundamentally, financial problems, payment gaps or continuously dwindling income should always be viewed as a warning sign.

Even in the early stages, it makes sense to seek debt counseling in order to put your own economic situation to the test and thus, not even have to file for bankruptcy. Individuals can also turn to a free debt counseling service, while debt counseling for the self-employed usually comes with a fee. If insolvency of one’s business is imminent or has already occurred, it can already be too late to avoid bankruptcy. However, if the insolvency cannot be resolved in the foreseeable future, debtors should file for bankruptcy.

What Are My Other Solutions?

At the end of this blog, you might think that bankruptcy is not the right solution. Indeed, if you now understand that there might be another solution “less radical”, then it means you should not consider bankruptcy. In that case, you could consider:

1. Taking a side-gig as a short-time solution to fix the situation

Getting a side-gig might be a good solution to help you out. You could consider getting some side-job such as working for Uber/Lyft, or even some “from-home” jobs which could help you make more money until you fixed your financial issues.

You might even like your side-job that much that it would become your main job! There are some jobs your could consider:

2. Getting a loan to temporarily solve your financial issues

Getting a loan is another solution which you could consider as a temporary way to fix your financial issues. Indeed, when you get a loan, you only get the money for a pre-determined amount of time, and you will have to pay it back. Therefore it cannot be a long-time solution, but it can definitely help you if you just need cash right now. However, you should apply for a loan only if you are sure you will be able to pay it back! Otherwise you might find yourself with even more debt after having taken the loan than before, which is definitely not what you are looking for!

Conclusion

Filing for bankruptcy is not an easy step. Many shy away from taking the step of how to file for bankruptcy, although it would be a great relief for some. Most of them fell into the debt trap through no fault of their own. Often just a short period of unemployment is enough and you can no longer get out of this situation on your own. In such a situation in particular, you shouldn’t be ashamed to admit that you need help. You should always keep in mind that after a completed insolvency procedure you will be released from the remaining debt and look forward to a new start in financial terms.

And if you are afraid of what could happen after you filed for bankruptcy, just keep in made there are steps to recover from bankruptcy! The quality of your life after bankruptcy can definitely improve.

Cheryline Lawson is a personal finance writer who lives in Fort Lauderdale, Florida with her husband and two boys. She has worked as a mortgage broker and loan processor in the most recent past. She shares a lot of her experiencing in financial planning, real estate investing and budget advice with national media outlets like GoBankingRates, Intuit, Bustle, Buzzfeed and CBS News. Ms. Lawson is a graduate of Broward College in Florida. She came into her own as a mortgage broker after realizing so many people need help to get into their first home. She has a passion for helping others, especially those who need financial advice to use in their daily lives.