How to Get Payday Loan Debt Relief When You Need it Most

It is no secret that it takes money to live or that most people are barely getting by. It would be wonderful if we always made enough to take care of necessities, but that is not the case. So few “average” people have enough left out of their checks to save, so when an emergency comes up or a paycheck is too short to cover a utility bill, most people have to find a loan. The trouble with this is that many people cannot get a loan with a low interest rate, if they can get a traditional one at all.

Most low-income and paycheck-to-paycheck borrowers have to look for less desirable sources, including payday loans and title loans. I know from experience that these are not the types of loans you want to find yourself needing. The good news, though, is that there is a way out. If you are in need of payday loan debt relief like so many people, continue reading.

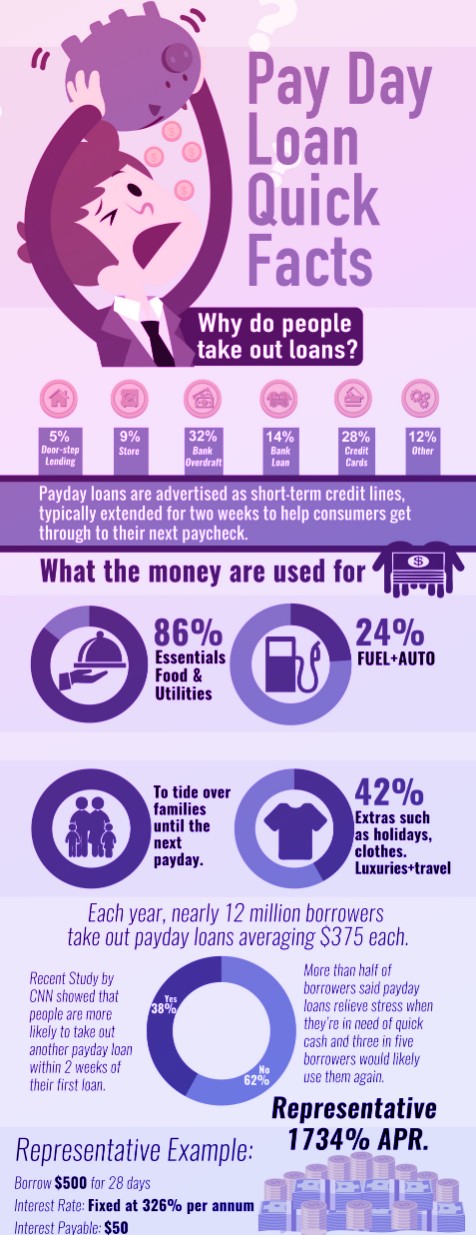

Reasons People Get Payday Loans

There are people out there who have never been in such dire straits to have had to get a payday loan. It is often those people who ask questions like, “Why on earth would you get a payday loan?” “Why would you put yourself in that kind of debt?”

Most people who resort to payday loans do not do so as a first option. It is typically because they really need the money and cannot get approved for a traditional loan. Payday loans are not the type of loans that anyone gets to buy a house or go on vacation- not under any normal circumstances. These are the loans we go for when our lights are about to get cut out, we need gas and groceries until the next payday, or our car is going to be repossessed if we do not make a payment immediately.

Payday loans are much easier to get than traditional loans, especially for those who have bad credit, which is why so many people get them. There are pros and cons to paydays loans. Here are the biggest benefits to them:

Easy Qualification and Approval

Payday loans are some of the easiest loans to get. To qualify, all you need is the following:

- You must be 18 or older

- You have to a valid ID

- You need a regular income, though this can be from a job, disability, or any other regular and verifiable source

- You have to have an active checking account

You do not need:

- Credit: These lenders could care less if you have not paid any bill you have ever had. As long as they have a check they can deposit, they are not really risking anything.

- Any collateral other than your check: Your check is your collateral. If you do not pay, they can deposit that check and get the money. No biggie.

Basically, any adult with a checking account and income can get approved.

Convenience

Because they are so easy to qualify for, they are one of the most convenient loans to get. You walk into a payday loan lender, show your income and checking account activity, write a post-dated check, and walk out with the cash. The process usually takes no more than 30 minutes. What this means for most people is if you do not have the money to pay your electric bill, you can get a payday loan on the day before cutoff and keep your electricity on. There are very few other loan types that do this, especially without a credit check or some other form of collateral.

Why You Need Payday Loan Debt Relief Now

As easy to obtain and convenient as payday loans are, they can really do a lot more harm than good. Some of the biggest drawbacks are the following:

- They are expensive: Interest on these things is absolutely nuts.

- You can easily get trapped: Because you have to repay so much interest, you often have to get the loan again- and again and again and again.

- They do not help build credit: Payday loans do not get reported to the credit bureaus at all.

- They specifically target the desperate and those without other options: They are there to prey on those who have no choice but to pay really high interest.

They can easily take your money if you do not repay on time. Honestly, no one thinks, “Ok, I’m going to go take out this loan and not pay it back.” No, we have the best of intentions. Unfortunately, good intentions do not make things happen. If, for some reason, you cannot pay your loan off on the first due date, too bad. All they have to do is deposit the check and the money comes out of your account or overdrafts it.

Let’s dig a little deeper into how they work so you can get a full understanding of these drawbacks.

Understanding Payday Loans

If you have never had a payday loan or you are still new to them, you may not fully understand how they work. Let’s lay out a scenario:

We’ll say you need $100 right now. Your credit really is not good, so you know that you cannot get a loan from a traditional lender, but you have heard you can get a payday loan. So you gather the necessary documents and head to the nearest lender.

Once you are approved, they give you an amount you get approved for. This amount will depend on your state laws and your income. Let’s say you are approved for $150, so you accept. To get the money, you have to make out a check for the $150 plus interest, sign it, and post-date it for your next pay date. Seems simple enough, doesn’t it? It usually never is.

On payday, you go in to pay off the loan and learn that you can take the loan out again. It has been a pretty tough week, so you decide to get the money again thinking that you can pay it off the next week. Somehow, you are still convinced that you are coming out on top with the loan, but that could not be further from the truth. The interest, which can be anywhere from 5 percent to 36 percent is eating you alive already.

My own experience

Quite a few years ago, I had been pretty sick and missed work for almost a week. We all know, though, that the bills do not stop rolling in just because your body refuses to work like it’s supposed to. On the week I would be getting the small check due to my sick days, my power bill was also due. Unfortunately, we were already behind, so we were very close to disconnection. I had no option but to go to a payday loan company and get enough to hold the power company over until I got paid again. I got a $150 payday loan, which means I needed to pay back a total of $181 on the next payday.

On payday, I go to pay off the loan, but as I still had to pay on my power bill, I had to get the loan back. This happened about four more times until I could finally do without that money. Sure, I was able to get my power paid. The problem? Over the six times, I had to take the loan out, I ended up paying out $186 in interest alone. That is more than the $150 I borrowed in the first place. Truthfully, I did not have any other options at the time. It was just something I had to deal with. But think about it, if I had had to continue taking that loan out- like so many people have to do- I would have been paying out an astronomical amount of debt.

Payday Loans Have Even Been Outlawed!

Did you know that payday loans are considered so predatory that some states outlawed them? Most states that still allow them have set very, very strict rules. That should be a big enough indication of how much they can hurt you.

Payday loans should really be avoided at all costs. If you must get one, you need to do everything in your power to pay it off on the first due date. If, however, you are already in over your head with them, we have some ideas you can use to get payday loan debt relief so you can breathe again.

How to Get Payday Loan Debt Relief

Now that you understand what you are fighting and why it is so important to get away from it, it’s time to get to work and get debt relief. There are many methods for doing this, but here are some really effective ones:

Ways to Get Payday Loan Debt Relief

If you are ready for some payday loan debt relief, let’s dive into some solutions.

Find the Money

When is the last time you really took the time to look at your budget and purge it of unnecessary items? Most people who feel strapped for cash could easily find an extra $50 or more in their budget by letting go of some things.

If you are thinking to yourself, “Nope, no way am I giving up my Friday night pizza or my Monday morning Starbucks run!”, that’s okay. You do not have to give them up forever or even give it all up. Try just slashing what you spend in half, or just sacrifice them for one month. Then, you can enjoy them guilt-free after you have repaid your loan.

Make the Money

Unfortunately, one solution to getting out of debt requires you to make more money. You may want to roll your eyes and say, “Yeah, okay! If I could make more money that easily, I would not have needed a payday loan in the first place.” I hear you, I really do. Just read on a little longer.

Here’s the thing: Making more money does not always require that you make an extra $1,000 or more, though that would certainly be helpful. You just need to make enough to handle this loan right now, and there are plenty of ways to make an extra $200 in a month without changing up too much.

1. Declutter

I say it all the time, so I will not go into a long explanation here. Bottom line: You have stuff in your home that you no longer use or want. Stop hanging on to it for “just in case”- sell it to someone who actually needs it and will use it. Even if it is an old, broken down appliance, there are people that will buy them from you for a little money so they can fix them and resell them.

Sell your items at a yard sale, on Facebook, on the Let Go app, or Craigslist. You might have enough to pay off that loan over the weekend.

2. Extra Hours

Pick up a shift or two, or just a few extra hours. You might consider delivering pizzas for an hour or two on the weekend. Seriously, every little bit counts.

3. Side Hustle

Are you good at cleaning houses? Can you cut and style hair well? Do you have weekends free so you could babysit? Do you grow tomatoes or carrots in your garden? Any of these things -and many more- can net you the cash to pay off your loan pretty quickly. You do not even have to turn it into an all the time thing. Sacrifice some free time for just a couple weeks or a month to get your payday loan relief. And who knows- you might decide you enjoy it enough to make it a full time gig.

4. Surveys and Points

There are also a lot of survey sites and apps that you can make some side coin on. Inbox Dollars is a great survey site, but you have to remember that you will not get rich on it. Surveys are helpful, but they will not pay all your bills.

There are apps like Ibotta and Rakuten that help you earn cashback from your regular shopping. Fetch Rewards and Receipt Hog pay out points for taking pictures of receipts, and you can turn those points into gift cards, including PayPal ones. Shopkick gives you points for scanning items in the stores you shop at, and you can turn those points into PayPal cash. Finding a few of these small task-related apps can earn you the money you need for payday loan debt relief, though one alone probably will not- at least not very quickly.

Borrow the Money

If you are asking questions like, “How does borrowing more help?” or “I couldn’t borrow before. How can I borrow now?” don’t worry. I will address both questions.

First of all, not all borrowing will help, but some can. The idea is to get another loan that has better terms, pay off the payday loan with that money, and repay the new loan. If you can find a loan with a lower interest rate, you will be saving cash immediately. If you are fortunate enough to find an installment loan, even better. With personal installment loans, the interest is calculated at the beginning and divided among a set number of payments. These are almost always easier to pay off than payday loans.

Second, as crazy as it may sound, just because you could not borrow from someone else before does not necessarily mean you cannot now. If you own any type of collateral, especially a piece of land or a vehicle, you might be able to get a secured loan. The interest rates are often higher than unsecured loans but usually much lower than payday loans.

There is also a chance that you can use the payday loan to get a better loan. Payday loans are not automatically reported to the credit bureaus, but you may be able to use them to prove creditworthiness. Some traditional loan lenders work with people with bad credit, so they allow them to use things like utility payments and other loan receipts in place of a credit score. With some research, you might just find all you need and more at a very low interest rate. Start your search online where there is a wide array of lenders. You can start here, on Cashry. Here are some credible lenders to consider:

How to Keep Your Payday Loan Debt Relief

Once you have achieved payday loan debt relief, you want to keep it, right? Let’s talk about how to do this.

1. Be Proactive

With some planning and a little work, you can prevent yourself from ever needing another one. Here are some ways to do so:

Improve income: If it is at all possible, increase your income. Find a better job, even if that means returning to school for a degree or certification. Or pick up a steady second job or turn your side hustle into a regular thing.

2. Improve Credit

Work on your credit piece by piece until you are in a better position.

3. Save

It is vital to your present and your future to start saving. If you cannot squeeze anything out of your check, try using the ways we discussed to make money above to jumpstart your savings.

Sometimes one should even wonder if it is better to pay off debt or to create an emergency fund!

In Emergencies

That’s all good and great, right? But what if you find yourself in another emergency situation before you can make those moves?

Good question. While I cannot guarantee that you will never need another payday loan -life is too unpredictable for that- I urge you to try some other things first:

- Talk to family and friends. Ask them if they can loan it to you or if you can clean their house, babysit, mow the lawn, or something else to make it.

- Look for a secured loan. As just discussed, with any type of collateral, you have a chance of finding a secured loan.

- Advances. Ask your boss for an advance- probably not if you just started the job though. Also, if you have a credit card, they may allow cash advances.

If all else fails and you must get a payday loan, work towards your payday loan debt relief as soon as possible- like start the very next day.

Conclusion

Payday loan debt feels like a noose around one’s neck, so of course, you want to get payday loan debt relief. How else are you going to breathe? Though it may take a little time, with dedication, research, and some work, you can absolutely get out of this debt and stay out of it.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.