Monthly Installment Payday Loans: An Honest Guide

If you’re struggling financially, a payday loan can often be that beacon of light at the end of the tunnel. This may be especially true if you’re someone who has questionable credit. If your credit isn’t the best, you may not be able to obtain a conventional bank loan. However, even if you do have great credit, the amount you need to borrow may be insignificant. Which may make a payday loan seem like a better answer to your short term financial woes. In these circumstances, applying for a payday loan may quickly remedy your financial problems.

If used properly, a payday loan can truly be the short term financial answer you are looking for. However, if you fail to pay these short term loans off in the way they are supposed to be paid, you may end up spending a whole lot more than you imagined. Mishandling a payday loan could add more financial burden to your life than you can imagine.

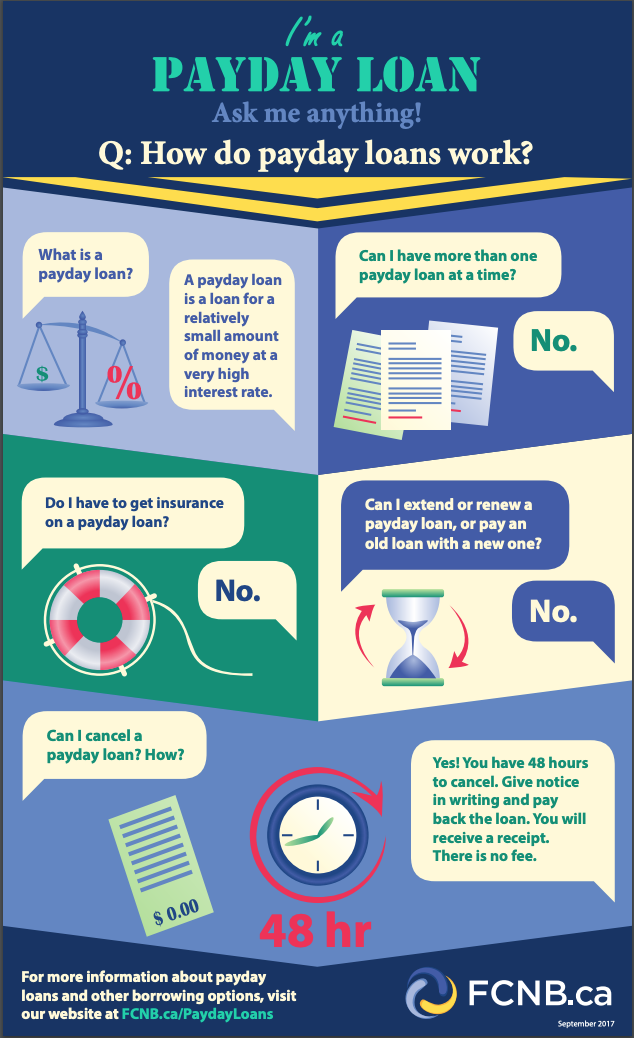

What Is a Payday Loan?

A payday loan is a small, high interest, short-term unsecured loan. Often, these Installment Payday Loans are income or employment based rather than being based on credit. However, some payday loans can be credit based. In essence, there is no concrete definition for a payday loan. However, they are referred to as payday loans because they are meant to be paid on the customer’s next payday. These loans can often be rolled over from month to month. Rolling until the customer is able to pay the entire balance including interest. If the loan is extended from month to month the patron pays the interest on the loan. Plus at the end of the term will pay the original loan amount in addition to the interest.

These loans are commonly called small short term loans, small cash loans, and fast payday loans and are usually five hundred dollars or less, although they can be larger. These loans are usually available both online or at a storefront. However, state laws that differ from state to state govern how and where payday loan companies can operate.

How Do Payday Loans Work?

Typically, a payday loan lender will draft the amount of the loan from a patrons bank account on an agreed upon date which is usually the patron’s payday. This can be done electronically online or at a storefront. The payday lender will hold a check until the patron’s next payday. It is then supposed to cover the total amount owed. Including the interest or the interest and finance charge only. When a patron is ready to pay the finance charge and the Installment Payday Loan in a lump sum, they can do so by using cash at a storefront, if available. They may also be able to pay online.

Is It Wise to Use Payday Loans for Emergency Cash?

If you choose to apply for Installment Payday Loans make sure you’re able to pay it back within the shortest time possible. Payday loans are high-interest loans that can double and sometimes triple the total amount you end up paying back. This is one of the main reasons why these loans are intended to be used as short term solutions. If you can’t afford to pay Installment Payday Loans back quickly, it may not be a good idea to apply for one. You may end up paying back double or triple of the original loan amount.

Check the pros and cons of payday loans to make sure it is wise for you.

The Pros of Payday Loans

Many people apply for Installment Payday Loans when they’re in a financial pinch. Especially when they have less than glowing credit. Payday loans usually have much looser terms. They are generally easier to attain than conventional loans. The process is usually quicker as well. These loans may be attractive to people for three reasons:

- Once approved, the cash is available quite quickly.

- The approval process is quicker than the conventional loan application process.

- Many Payday Lenders have a convenient online presence.

The Cons of Payday Loans

Just as there are many reasons why Installment Payday Loans can be extremely beneficial in a pinch, there are aspects of these types of loans that you should be beware of as well. Most of us understand that payday loans offer quick and easy approval terms. However, this comes at a cost. Payday loans usually have extremely high-interest rates. The interest amounts may double or triple the amount you have to pay back. Depending on how long it takes you to pay them off. Each state has its own laws that govern how much interest payday lenders can charge. However, high-interest rates are one of the distinguishing characteristics of payday loans.

These loans are also characterized as short term loans which means that there’s a relatively brief amount of time that the consumer has to repay the loan. In addition, if you default on a payday loan terms the collection process can be quite stressful. You may be contacted via mail and phone. If a lender fails to collect your debt within a certain period of time, they will often sell your debt to a collection agency. This can be quite stressful if the situation progresses to wage garnishment. How far a collection agency is able to go to collect a debt will be determined by the laws of the state. In a nutshell, the drawbacks of Installment Payday Loans can be summed up with three obvious characteristics:

- High-interest rates

- Short repayment terms

- Stressful Collection Practices

Other Ramifications

In addition to the high-interest rates and a short amount of time to repay the loan, defaulting on your payment term can ultimately impact your credit score heavily. Although these loans may have easier terms than traditional loans the impact on your credit can be just as negative as a conventional loan. At the end of the day, this is still a legal loan that has terms that must be adhered to just like any other loan.

Why Was My Payday Loan Rejected?

Although Installment Payday Loans have a fairly easy approval process, there are several reasons why a person might still be denied when applying for a payday loan. If you’re someone who frequently uses payday loans as a means for financial relief and has defaulted on some of them, your application may be rejected. It may also be rejected if you’re unemployed or have a recent bankruptcy. Some payday lenders may reject your application if you don’t have a checking account because this is usually how they deposit the loan and retrieve the subsequent payments. Each payday lender will have different approval terms. However, there are several common reasons why a payday lender may reject an application. Other reasons include unverifiable income or people who are paid in cash. You may also be rejected if:

- You’ve applied for too many loans thus have many credit inquiries

- You have many overdrafts

- You’re paying gambling organizations

What If I Can’t Pay Back a Payday Loan?

In the event that you can’t pay back your payday loans, there are several things that will take place if you can’t come to an agreement with the lender. They will attempt to draft your bank account on the agreed upon date for the agreed upon amount. If their attempt to draft your account is unsuccessful, there will more than likely be a fee charged by the lender as well as your bank. The lender will attempt to debit your account several times before issuing you a collections letter demanding the owed funds and starting collection calls. If you and your lender can’t come to an agreement, the lender may attempt to garnish your wages and or take you to court.

Be Proactive

You find yourself in a position where you are unable to pay back your Installment Payday Loans? Speak with your lender as soon as possible. In fact, it’s best to negotiate something before the due date. Most lenders would rather work with you because it usually means that the odds of getting their money back are greater. Attempting to negotiate with your lender shows that you are trying to settle your debt to the best of your ability. Plus, there may be things that your lender can do to make paying back your loan easier. For example, your lender may allow you to renegotiate the terms of your loan. Each lender will be different, however, an extension or a readjustment of the terms of your loan may help you to honor your obligations.

What Defines A Good Payday Loan?

Many people would find that using the word “good” and “payday loan” in the same sentence is a bit odd. However, there are characteristics that you should look for that define a good payday lender. As you shop for the best Installment Payday Loans to suit your needs, there are certain things you can look for that will ensure that you have a good experience. A good payday lender will ensure that the entire application and deposit process is secure. There are specific things that you can look for that will ensure that your experience is safe, however.

Safety First

First of all, any online payday lender you take an interest in should have a web address with “https” in it. When you see this, you know that your information and web experience is safe. If you can, ensure that the site uses 128bit SSL encryption technology. In addition, the lender should also have a reputable security system for the website and conduct security scans regularly. Your lender should also use encryption tools.

The Convenience Factor

Another sign of a good payday lender is one that makes it both easy and convenient to apply for Installment Payday Loans. Plus you receive the funds you need quickly and conveniently. A good lender also makes it possible to quickly qualify and receive the funds they need by making it possible to contact them via telephone, mobile device, or home computer. Desirable lenders make it possible for consumers to apply for loans from the comfort of their own homes. This without even having to visit a storefront. This eliminates the need to spend extra time and gas traveling to a location to apply for a payday loan.

Uncommon Facts About Payday Loans

Many borrowers are unaware of the current trends that seem to surround the payday loan borrowing process. The average borrower focuses on the relief that Installment Payday Loans will provide for them. However, there are certain facts that every payday loan borrower should consider that may help them exercise more caution when borrowing. There are several facts that borrowers should understand about payday loans:

- The average payday loan amount is $392

- Three out of every five payday loan borrowers pay more in fees and interest than the original loan amount

- Eighty percent of all payday loans become long term and must be renewed or rolled over

- It takes the average borrower almost six months to pay off a payday loan

However, the surprising and interesting facts don’t end here. The average APR for a payday loan is 400 percent. This fact can be quite daunting to someone who’s already strapped for cash and looking for a financial reprieve. Most payday loan borrowers earn less than 60K a year. Even more alarming is the fact that two-thirds of all payday loan borrowers earn less than 30K a year and take out at least eight payday loans in a year’s time. Furthermore, most payday loan borrowers are more likely to file for bankruptcy. Plus, the average payday loan takes up at least thirty-six percent of the borrower’s paycheck.

These facts paint a clear picture of the problems that many borrowers are prone to when it comes to payday loans. However, understanding these uncommonly known facts has the ability to encourage borrowers to pay off these high-interest loans as soon as possible and to handle these loans responsibly.

Protected Consumers

Payday loans are considered predatory to many people. This is primarily due to the fact that the interest rates and the short terms of the Installment Payday Loans can be quite overwhelming to most borrowers. Most payday loan borrowers don’t make a substantial amount of money annually. The fees and interest can keep the average borrower caught in a cycle for at least six months out of the year. However, there is a particular group of consumers that have special protections under the law.

Military personnel are a protected class of consumers as a result of the Military Lending Act (2006). This law was enacted because seventeen percent of all military personnel use Installment Payday Loans at one time or another. As a result, the Department of Defense determined that these loans placed undue stress on military personnel and families and set a cap on the interest at thirty-six percent which includes all interest and fees.

In addition, the Military Lending Act of 2006 blocks payday lenders from using personal checks, debit authorization, wage allotment, or vehicle title. This act also requires payday lenders to provide both written and oral disclosure of the interest rates and payment obligations before the loan is issued.

The Military Lending Act was designed to protect military personnel and their families from predatory loan practices. The guidelines that govern this act place specific constraints on what payday lenders can do when it comes to military personnel. These guidelines help protect military personnel and their families from the stress and financial burden that can be created by high-interest short term loans. Many of the guidelines forbid certain practices that might otherwise be legal for non-military consumers or borrowers.

States that Don’t Allow Payday Lending

Payday lending is not legal in all states. In fact, payday lending laws vary from state to state. However, there are some states that choose not to allow payday lenders to operate in their jurisdiction. Many states have taken a more protective stance when it comes to payday loans. Studies conducted in several states showed that borrowers often incurred more debt than they could handle and it kept them in a vicious cycle. As a result, states that banned these types of loans often had other financial institutions that stepped up and were willing to offer consumers smaller loans with better interest rates.

Although many states have banned Installment Payday Loans, these bans aren’t backed by the federal government. Many states have placed bans on payday loans to protect the financial well being of its residents. Many state consumer advocates wanted to end the cycle of financial debt, particularly among low-income people. Statistics have also shown that low-income people often use payday loans to meet basic needs which have kept them in a cycle of high-interest debt. As a result, many states have become proactive in banning these types of lenders from practicing in their state. Payday lending is banned in:

- Arizona

- Arkansas

- Connecticut

- Georgia

- Maryland

- Massachusetts

- New Jersey

- New York

- North Carolina

- Pennsylvania

- Vermont

- West Virginia

- District of Columbia

How Can I Manage My Payday Loan?

Once you have an understanding of what a payday loan is and how it works, you are armed with enough knowledge to properly manage one. Of course, payday loans carry a high interest rate. Which makes it essential to pay them off as soon as possible. The longer you let these loans accrue interest, the more money you will expend in the process. Follow your payment schedule and pay more than just the interest if possible. However, focus on paying off your loan as quickly as possible. This should be your main goal.

Don’t ever mistake your payday loan for a conventional loan by treating it as such. Conventional loans can be paid off slowly without great harm because they carry much smaller interest rates. A payday loan will accrue substantial interest fairly quickly. This is why you should treat it as a short term loan by following the payment schedule and paying off the interest and full loan amount as soon as possible.

Thinking Outside the Box

Installment Payday Loans and want to find alternative ways to pay for it, consider exploring other ways to pay off or do away with your loan. You can take the bite out of a high-interest payday loan by consolidating the loan to get a lower interest rate. This can be beneficial because it eliminates the need to pay for the loan quickly. Once the interest rate has been greatly reduced, the amount of interest will be considerably less giving you ample time to pay off the loan. You can also try to negotiate a better payment plan with the lender. You might benefit from an extended payment plan that allows you to make smaller payments over a longer period of time.

Payday loans can be helpful at times when you need to secure a small amount of money quickly and easily. These loans can come to your rescue and do very little harm if you’re able to pay them off in the time allotted. These loans become hazardous when they are rolled over or renewed on a monthly basis. Often, when this happens, the interest and fees begin to exceed the original amount borrowed. As a result, the borrower ends up paying more in interest and fees than they originally borrowed.

Final Thoughts

What once was a small amount of money in a financial pinch, can become a huge financial burden and end up devouring a large amount of the borrower’s paycheck. This is why it’s a good idea to use payday loans sparingly and only when you know you can pay them back quickly. These loans are designed to be short term financial help. However, for many low-income people who may have questionable credit, a payday loan is their best bet for fast cash. Borrowers in situations like this should understand the hazards of these loans and use them responsibly to avoid financial stress.

However, if something unexpected comes up that prevents a borrower form paying off a loan as agreed or they are unable to pay off the loan in a timely fashion, its best to speak with the lender as quickly as possible. Renegotiate your terms or create a new payment arrangement. Many lenders are willing to work with borrowers that show sincere intent to honor their financial obligations.

Nwayita Perry is a personal finance writer who knows the value of getting the most out of her dollars. She understands that financial savvy is the key to making her budget stretch. She takes pride in sharing her financial planning and spending advice generously and prolifically. Her passion lies in helping millennials, as well as people of all ages and from all walks of life, develop rich habits they can use for life.