Is it Better to Pay Off Debt or Build An Emergency Fund?

Most of us understand the value of saving. Many of us grew up being told that it’s best to have a nest egg or rainy day fund to cover unexpected events. However, what happens when debt outweighs saving? What should you do? Is it possible to save and pay off debt? What’s the best approach. Fortunately, the answer to all these questions is heavily dependent on the type of debt that you may have and how much debt you have.

In some situations, it may be best to focus on saving more than paying off debt. However, in most situations, it’s best to try to do both. Thoroughly reviewing your financial situation, which should include the type of debt you carry as well as your emergency fund, should be the best gauge when it comes to determining what and how you should go about handling debt and building savings.

The Power of an Emergency Fund

Most of us clearly understand that having money in reserve creates peace of mind and can be quite helpful when it comes to unexpected situations. You may lose your job or have a costly car repair or medical issue that requires you to have reserve funds to cover. Regardless of the issue, it helps to have money saved to take care of it. Reserve funds create peace of mind and keep you from going into debt unnecessarily. More often than not, an emergency fund will keep you from having to borrow money to take care of an unforeseen issue.

Debt gets in the way of saving money and adds to any other debt that you’re currently trying to get rid of. In essence, you’re working against yourself by creating more debt. An emergency fund not only helps you cover unexpected expenses, but it also keeps you from creating more debt when you don’t have funds to cover unexpected emergencies.

The Power of Debt

Debt can be overwhelming. Most of us understand this. Debt makes us feel as if we’re walking around with a hole in our pockets that we can’t mend. It creates stress and keeps us from saving for unexpected events or even big purchases. For many, debt can be a burden that restrains us for years and keeps us from moving forward financially. Credit card debt, student loans, medical bills, as well as a whole host of other forms of debt. It’s easy to feel as if there’s no solution in near sight. However, this is far from the truth. Debt can be managed. However, It requires taking a close look at the type of debt you have and making strategic moves to handle it.

Going Into Debt to Pay for Unexpected Expenses

Many people don’t have an emergency fund to handle unexpected expenses when they arise. As a result, many people take out loans to pay for unexpected needs. However, depending on your credit, many of these loans may be high interest or require collateral. Unfortunately, defaulting on these types of loans may cost you the collateral you put up in addition to damaging your credit.

You may end up solving one problem and creating several others. This is one of the many reasons why building your savings over time is your best defense. Emergency cash loans can often carry a high-interest rate. However, even if they don’t, going into more debt to pay for your unexpected needs thwarts your financial goals. However, deciding whether or not to pay Off debt or build an emergency fund should include considering various variables before making a decision.

Some Debt is Worse than Others…

High-interest debt is burdensome. If you have this type of debt, you may want to focus on paying this off as soon as you can. You may need to be more conservative with your saving plans if you carry this type of debt because time is of the essence. As time passes, high-interest debt continues to grow at an accelerated rate. This is why this type of debt should be eliminated as quickly as possible. It may be wise to focus on this type of debt in lieu of saving, to eliminate it as quickly as possible.

Conversely, if you have debt that doesn’t accrue interest or the interest is relatively low, you may want to focus more on building your savings and paying this type of debt off slowly or later. Ideally, you want to try to pay off debt and save at the same time. However, the determination should only be made based upon your personal situation and the type of debt you have. In some instances, you don’t have to question whether you should Pay Off Debt or Build An Emergency Fund. Sometimes it’s best to clear out your debt first.

The Debt Cycle

Many people never make it out of this cycle of debt. They find themselves stumbling through life financially, unprepared for unexpected expenses and unable to save money for their hopes and dreams as well. People that don’t have good credit, often invest in payday loans and other high-interest forms of lending to deal with financial emergencies.

As a result, they find themselves paying back double or triple of what they originally borrowed. Even people that have good credit may find themselves buried in extra debt behind unplanned for loans. Even if you borrow from a friend or relative, it can be unsettling to know that you owe somebody that you’ll have to pay back, sooner or later. This is another reason why it’s a good idea to take a close look at the type of dent you carry and devise a plan to decrease it and build your savings or emergency fund.

If you are pondering whether you should Pay Off Debt or Build An Emergency Fund, consider your dent and the amount of time it may take to end the current debt treadmill you may be on. Make a choice based on your situation.

When You Can’t Keep Up with the Expense of Debt…

When debt becomes unmanageable, it can lead to financial ruin and the loss of essential assets. If you fall behind on your mortgage, you can lose your house. If you can’t pay your car note, you may lose your car. However, even if your debt isn’t linked to your car or your house, carrying debt that you can’t keep up with often leads to poor credit and the inability to plan and save the way you may want to.

The consequences can be devastating when debt becomes unmanageable. In particular, consumer debt or credit cards and business loans can be particularly damaging for a wide variety of reasons. Credit cards require discipline that many people don’t have. This often translates into careless spending habits and missed monthly payments. Many consumers don’t fear consumer debt because they feel that they have nothing to lose, unlike a missed payment for a house or a car. If you find yourself in a situation where you can’t pay a bill, notify your lender or lenders right away. You may be able to get an extension or renegotiate your monthly payments.

Communication is key.

Your lender will appreciate the fact that you let then know that you were having problems meeting your financial obligations and took action to manage the situation. When you miss payments or make late payments this reflects poorly on your credit. When you go to apply for more credit, lenders see this type of payment history and may decline a credit line offers. Many lenders look at this type of credit track record and may assume that you don’t know how to use credit properly.

However, if a creditor or lender does offer you credit, you may be offered credit with a substantially higher interest rate based on your credit history. When debt gets out of hand, you may need to question whether it’s best to pay off debt or build an emergency fund.

Debt Management Programs

Debt management has many faces. In other words, there are many options available to you when it comes to managing your debt. Debt management companies take all your bills and consolidate them into one monthly payment. This method allows all your bills to be paid with one payment.

Often, these companies can renegotiate interest rates or eliminate interest altogether. It depends heavily on what your debt companies are willing to agree to. The credit counseling agency can negotiate the terms of your payments and debts to make it easier to pay off your debts. For many, debt service is just the help that’s needed to improve a person’s financial situation.

One simple monthly payment may make it possible for you to focus on slowing building your emergency fund. Even if this begins with saving as little as a few bucks every week or fifty dollars a month its worth it. The road to developing a sound financial situation can be improved when you use a debt service to help you meet your goals. Debt service will work closely with your debt companies to establish the best financial plan for you. Often, debt service has the ability to talk to a company about eliminating interest or lowering monthly payments.

Debt management programs may make it easy and eliminate the need to either Pay Off Debt or Build An Emergency Fund. You may be able to do both.

When it’s Best to Eliminate Debt First

In some situations, paying off debt should be a priority rather than saving. When it comes to high-interest debt the longer you have the debt, the larger it grows. As a result, logic dictates that this type of debt should take priority over saving. If you have a high-interest loan or credit card, pay it off as soon as possible. It may be wise to forego saving until this type of loan or credit card has been paid in full. Another scenario where paying off debt may be wiser than saving is when you’re having difficulty paying your debts. This can and often does wreak havoc on your credit score.

It’s also a testament to your creditworthiness according to most lenders. If paying your bills have become an uphill battle, focus on them until you’ve gotten them under control. Then save. Both scenarios are urgent situations that should be prioritized and focused on because they can do a number on your finances and credit. If you have this type of debt, focus on paying off your debts before saving. Logically speaking, high-interest loans and credit cards can make it extremely difficult to save money. This is why its best to eliminate these types of loans and credit cards as quickly as possible.

In some situations, a low-interest loan may be a good idea to get rid of a high-interest loan and pay off quicker. In some situations, you don’t have to question whether or not you need to Pay Off Debt or Build An Emergency Fund.

The Problem with High-Interest Debt…

High-interest debt accrues at an alarming rate. Within a few months, the amount that you owe on debt may even double or triple, depending on the interest rate. This is why you should be more aggressive when it comes to eliminating this type of debt. It accrues quickly and may leave you blindsided if you ignore it, even for a few months. Picture this, if you have a credit card balance with a twenty percent interest rate and a savings account with a 1.5 percent interest rate you’d obviously benefit more form paying off your high-interest debt first before saving. A low-yield or interest savings account paired with a high-interest credit card is no match when it comes to savvy prioritization.

Get rid of your high-interest debt first. If you don’t, or if you ignore it, you may find yourself buried under a mountain of worry. HIgh-interest debt eliminates the question of whether you should Pay Off Debt or Build An Emergency Fund.

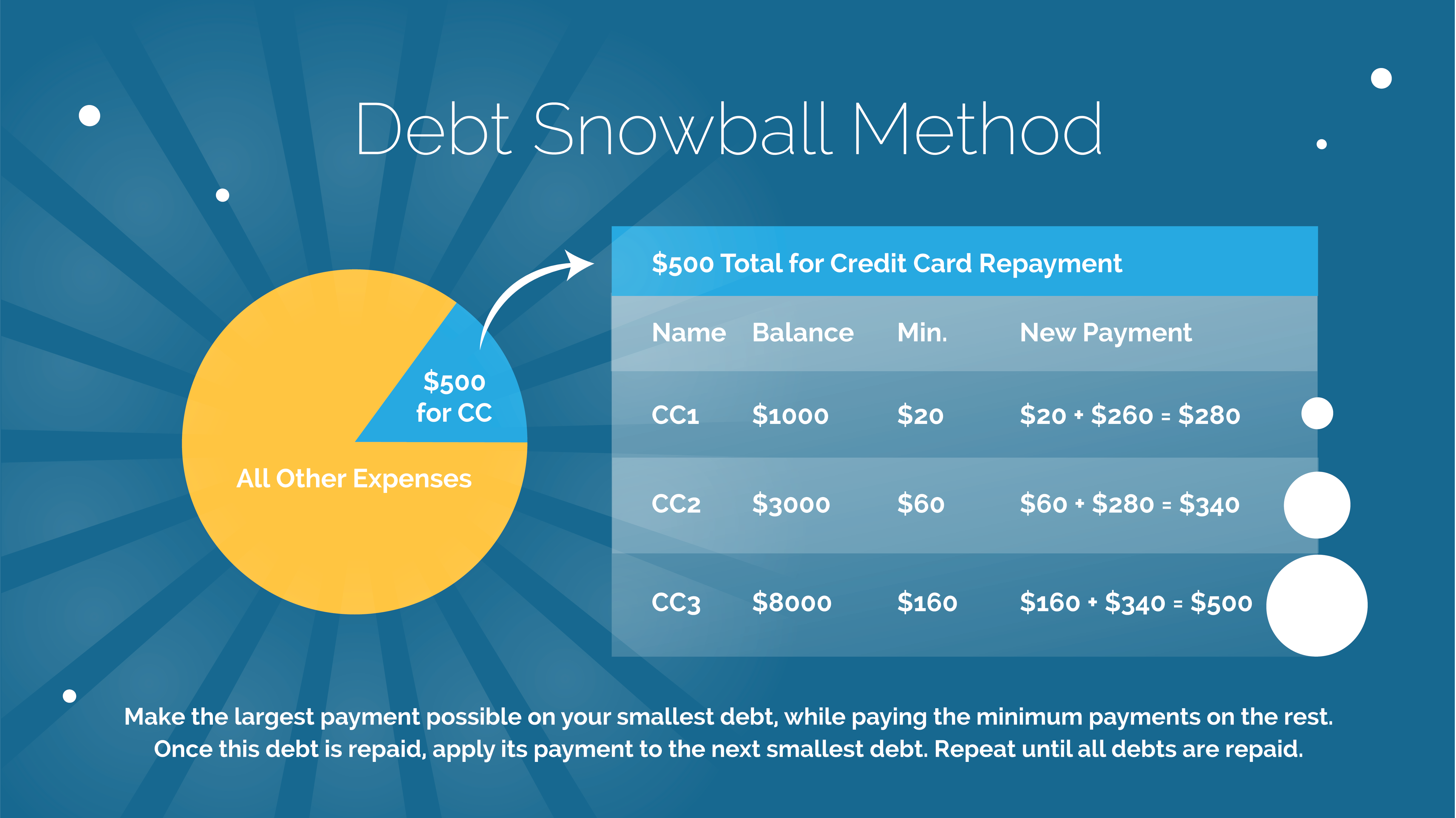

The Debt Snow Ball Method

There are many methods that can be used to reduce debt. However, some are best utilized when you are caught up on your bills and in the process of building your savings or emergency fund. The debt snowball method is an effective strategy to use if you’re caught up and saving and ready to know out debt. You simply start by outlining all of your bills from the largest to the smallest. However, do not include your mortgage in this list of bills. The bills that should be included for this payment method are:

- Payday loans

- Medical bills

- Credit card balances

- Auto loans

- Personal loans

- Home equity loans

- Student loans

This method shouldn’t be used for a mortgage. Start by making large payments towards your smallest bill until its paid in full. Focus on paying more than the minimum amount due on your smallest bill first. However, make minimum payments on all of your other bill until your smallest bill is paid off. Next, use the same method with the next smallest bill. Make aggressive payments until it’s paid in full while paying the minimum amount due on all other bills.

Complete this process until all of your debt is paid. This method is best utilized when you have extra funds to put toward your bill. Your debt free living plan will be much closer if you used this method. If you want to create extra money to use the debt snowball method, consider cutting your spending when it comes to non-essential items. You can do this by eating out less, spending less on clothing and other nonessential items. This strategic method allows you to strategically knock out debt starting with your smallest bills first. This leaves more money to handle the bigger debts as you pay off the smaller ones first. The Snowball method may eliminate the need to Pay Off Debt or Build An Emergency Fund. Using this method, you may be able to do both.

When Its Best to Save First

If you don’t have interest-bearing debt or have low-interest debt, it may be wise to focus on saving rather than paying off debt. If you don’t have a savings account or an emergency fund. There are financial experts that feel that your emergency fund should be more of a priority than your low or no interest debt. As a guideline, any debt with double-digit interest rates should be prioritized before building an emergency fund. Low-interest debt includes anything that is four percent or less.

If building your emergency fund won’t greatly impact your debts, save first and build your emergency fund. Lastly, building your emergency fund should also be a priority if you don’t have any savings set aside at all. Being debt-free and having an emergency fund go hand in hand. Even with a modest income, try to save a few dollars a week. Anything you can save is beneficial. Start wherever you are. Watching your balance grow will truly inspire you to do things that will add to your emergency fund.

Should I Pay Off Debt or Build An Emergency Fund?

Pay off debt instead of building your emergency fund if you have high-interest credit cards or loans. Conversely, you may want to focus on building an emergency fund first if you don’t already have one and you have low-interest loans or credit cards. Of course, there may be other financial variables to consider when answering this question, however, these should be basic guidelines. Ideally, if your bills are paid up and you have a saving, you should be doing both. Work on paying off debt in addition to steadily building your savings if you can. The question of whether or not you should Pay Off Debt or Build An Emergency Fund is highly individual. You must thoroughly explore your situation before making a choice.

Save a Little if You Can’t Save a Lot

If you don’t have a lot of money to save, save whatever you can. If all you have is a dollar to save, add it to your emergency fund. The idea is not to wait until you have lots of money that you can save. As your financial situation improves, continue to build your emergency fund as much as you can. The main point is to focus on saving something, regardless of how small the amount is. This is not difficult and can even be ideal if you have no or low-interest debt. Sometimes you can do both. As a result, there’s no need to Pay Off Debt or Build An Emergency Fund.

Balancing Multiple Goals While Growing Your Savings

It’s possible to save and pay off debt. However, the way in which you go about doing this should be determined by the type of debt you have as well as other financial factors. If you have no emergency fund, it may be a good idea to invest in your emergency fund or savings. There are a wide variety of different tips and strategies that you can use to defeat debt. It just requires taking a close look at your overall financial situation and debt status to determine this.

However, ideally, the goal should always be to do both. Paying down debt and building your emergency fund requires discipline but it can be done. Many of your financial goals can be achieved by both paying off debt and saving through the use of savvy strategies like the snowball debt method and paying off high-interest debt. The idea is to look at your situation realistically as you explore whether or not you should Pay Off Debt or Build An Emergency Fund.

Can You Build Your Emergency Fund and Pay Off Debt?

For some, saving money may feel impossible. If this is the case you may want to break your goals down into micro-goals. The idea is to personalize your situation as much as possible by having a thorough understanding of your financial landscape, which includes your debts and your savings. Personalize your goals and do one or the other in those situations that dictate that you should.

If you’re carrying high-interest debt, pay it off and don’t worry about saving for a short period. Conversely, low-interest debt and a lack of an emergency fund may make it possible for you to build your wealth and emergency savings without doing real harm to your overall financial situation and creditworthiness. Ideally, you shouldn’t need to choose between whether or not you should Pay Off Debt or Build An Emergency Fund. The idea is to do both.

Sometimes Bill Consolidation Loans are a Good Way to Achieve Your Financial Goals

Although its best not to go into more debt to pay off bills or build an emergency fund, there are some circumstances when a personal loan may be a savvy way to achieve both. If you can consolidate your bills and get a low-interest loan, you may be able to move faster when it comes to achieving your financial goals. A bill consolidation loan can be a leg up when it comes to paying off debt sooner.

This, in turn, can lead to more funds available to build your emergency fund. In addition, a bill consolidation loan allows you to make one simple payment monthly to handle your debt. However, you should note that a bill consolidation loan may not carry a modest interest rate. Instead, you may be paying a high-interest rate if you have less than glowing credit. However, this is why its best to way the pros and the cons thoroughly before deciding to take out a bill consolidation loan.

However, poor credit and high-interest rates may not be a total deal breaker if it means that you will get out of debt sooner and have more money to save. All your financial decisions should be based on your personal financial situation and the type of debt that you have. Sometimes, a bill consolidation loan may eliminate the need to choose to Pay Off Debt or Build An Emergency Fund in lieu of doing both. But it is important you find a good lender, one who will tell you how it is and honor their part of the deal.

Take Inventory

The first step is to start by taking your financial inventory. Assess your debt. Assess your emergency fund. List your bills and determine which ones are more problematic for you. High-interest loans and credit cards are generally more problematic. However, you may have a mixed bag when it comes to your financial situation.

You may be struggling to pay all your bills. In situations like this, it may be best to look for a debt management company that can help renegotiate the terms of your financial obligations and reduce your payments. Your financial situation may greatly benefit from investing in bill consolidation loan to make your monthly payments more manageable. Of course, with each situation, there are different pros and cons.

A financial advisor can help you to navigate all the twists and turns of your financial situation and arrive at a good plan for building your savings and paying off debt. Itemize your bills by considering interest rates, terms, and the amount of your debt as well. If you’re not saving, developing a modest savings plans should be implemented if you can. Some people may feel that it’s impossible to save with so much debt, but that’s usually not true. With consistency and focus, you can build your savings and pay off debt.

Conclusion

It may take some time and some strategic decisions to fight your way out of debt. However, there are numerous methods that you can utilize to knock down debt or create your emergency fund. It does require understanding how different types of debt can affect your credit score, lifestyle, and creditworthiness. Not all debt is the same. As a result, some types of debt may require you to focus solely on paying it off whereas other types of debt may be more flexible in terms of allowing you to build a nest egg or rainy day funs.

Generally, if your bills are caught up and you already have some money saved, you should be able to continue to knock out debt and save money as well. However, there are many people who don’t have an emergency fund and may need to focus on that. Conversely, others may have high-interest debt that demands their attention before they can begin to start comfortably saving money. Know your status and act accordingly. And do not hesitate to get financial counseling if you find yourself confused.

Nwayita Perry is a personal finance writer who knows the value of getting the most out of her dollars. She understands that financial savvy is the key to making her budget stretch. She takes pride in sharing her financial planning and spending advice generously and prolifically. Her passion lies in helping millennials, as well as people of all ages and from all walks of life, develop rich habits they can use for life.