Loans for People With Credit Scores Between 560 and 650

I am sure that you have heard the term credit score at some point. Do you have a full understanding of what that term actually means? I am willing to bet that most people do not. When people do not fully understand how credit and credit scores work, they may not make the best decisions. I know that term also scares people. It has been ingrained in us to people are out to steal our credit information, we find it to be scary and overwhelming. I am going to shed some light on the topic of credit scores and reports. It will give you some understanding of your own credit score. I will help you navigate the world of low credit score loans. There are more options to you than you might think.

What Are Personal Loans?

Before I dig too far into talking about credit scores and credit reports, I want to talk about personal loans. Personal loans may be referred to as signature loans because they are unsecured. This means that they do not have collateral attached to them. As a result, the interest rate tends to be a little higher. Personal loans can have fixed or variable rates. A variable rate loan means the interest rate can change based on the Federal reserve rate. It usually starts at a lower interest rate, but it almost always goes up. A fixed rate loan has the same interest rate throughout the life of the loan.

Personal loans typically range anywhere from $1,000 to $50,000. The repayment term is usually anywhere from three to five years. Another point of note, the interest rate offered to you by the lender is dependent on your credit score. The lower your credit score is, the higher your interest rate may be. When you have a poor credit score, it is harder to obtain a personal loan. It is possible to find low credit score loans, but it requires much more research.

Credit Scores Explained

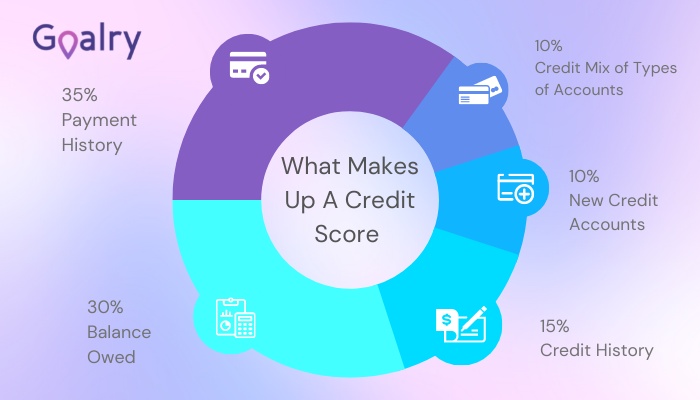

Your credit score has an impact on almost every aspect of your life. It has the power to come between you and a new home, or a new car, sometimes even a new job. It is important that you understand your credit score and what it means. A credit score is a three digit number that appears on your credit report. It is important to understand the difference between your credit score and your credit report. Your credit report is a detailed listing of all of your activities involving credit. That includes any credit cards, loans, and mortgages that you have or had in the past. It shows your payment history, how much debt you have and how you use it. It also shows the age of your credit.

If you have defaulted on loans, yes, that is on there, too. If you have not paid some bill, also on your credit report. It can show some other identifying information such as current and past addresses. Your credit score is also highlighted on your credit report. You credit score is built over time. It is a reflection of how you have used your credit and made, or not, your payments. It also tells lenders your credit worthiness. While you want to do everything you can to maintain a good credit score, if it has dropped into the bad zone, you can still work to improve it. You can still find low credit score loans.

I want to tell you a little bit more about that number

A credit score ranges from 350 to 850. The higher your credit score is, the better your credit. A credit score of 850 is perfect and difficult to achieve. A credit score of 800 or higher is in the excellent range. Good credit falls somewhere between 670 to 800. Anything below 570 falls into the danger zone of bad credit.

Most people have a credit score somewhere between 600 to 750. When you are in the range of 560 to 650, your credit score is considered fair. Some lenders consider you a risk to loan money. Other lender may not be willing to lend you money. You should do everything you can to protect your credit score and keep it as high as you can. It is difficult to build good credit, but only one or two missed payments sends it spiraling into the bad area.

What If I Have Bad Credit?

You already know that you have missed a few payments. Some of your other payments have been late and you are worried about your credit score. Chances are that your credit is in fair shape, falling into the 560 to 650 range. It probably is not good, but it might not be bad. The first thing you need to do is get a copy of your credit report to find out for sure. I understand that scares you. Right now, you do not know. Once you look at your credit report, you are faced with your actual score. However, once you know, you put yourself in a position to do something about fixing your credit score.

You can get a free copy of your credit report from each credit bureau every year. Take advantage of that and get a copy today. If you see things on your credit report that you do not believe are correct, you can fix them. You should make every effort to correct anything that is wrong. This can improve your credit score, sometimes, significantly.

So, let’s have real talk for a moment. You have bad credit. It is possible to get low credit score loans. It requires some work from you. You have to do some shopping for low credit score loans, but it is possible. There are low credit score loans, but they come at a price. That price is usually higher interest rates and loan terms that are not great. You may also come into contact with lender trying to scam you or make the most money they can from you. You may feel compelled to look for cash online with bad credit. Proceed with caution when considering this type of lending.

Can I Get A Loan With Bad Credit?

Yes, you absolutely can find low credit score loans. As I mentioned above, it may take a little more time and some research but you can find bad credit loans. There are some loan options available specifically for those who have bad credit. I am sure you have heard of, or the signs for cash loans for poor credit. There are definitely lenders out there willing to give money to those with bad credit. Those loans come at a price, though. They are not always bad. You just have to know how to use them properly.

The most important thing is to make sure you can pay back the loan on time. If you cannot pay it back, you are setting yourself up for failure. Lenders always get their money. They will get it from you, too. Anytime you do not pay back a loan, you are in default. Defaulting on a loan negatively impacts your credit. If you already have bad credit, you may not have much money to spare, so tread carefully.

Some loans you could consider when you have bad credit are title loans. Title loans are money that you borrow against the value of your vehicle. You present your title to the lender, they give you cash that is less than the value of your vehicle. They do not check your credit. If you do not pay the loan, they take your vehicle. Believe me, they will take your vehicle. This type of loan is easy to obtain. There is no real approval process. The lender checks the value of your vehicle and gives you some amount less than that. The interest on this type of loan is really high. Make sure you can repay a title loan. You may want to consider some other options.

What Are Short Term Loans?

You may also want to consider a short term loan if you are looking for low credit score loans. Short term loans are just that, something for the short term. You may also hear them referred to as cash advance loans. Typically, the lender allows you to borrow small amounts of money for a short period of time. The period of time could be about three months. These loans can be convenient because they are easy to be approved. However, the repayment is typically due in about three months. The lender expects repayment divided into three even amounts. The interest rate on this type of loan is fairly high. As with any loan, be sure you can make the payments on time. If you cannot make the payments, you should not apply for this loan.

Forbes warns about the dangers of short term loans. Due to the high interest, these loans are incredibly expensive. If you miss a payment, they become even more expensive. When used properly, short term loans can be the vehicle to get you over a hump. You need some money until you get the next chunk of money. If you know you have money coming in and you can pay off this loan, it may work for you. However, the vast majority do not know how they are going to pay back the money. This is when short term loans become dangerous. You are putting yourself in a terrible position. When it comes to short term loans, you must really make sure it is the right solution for you.

What Are PayDay Loans?

Another options for low credit score loans is a payday loan. There is a good side and a bad side to payday loans. It mostly depends on how responsible you are with them. First, what are payday loans? The title of it basically tells you everything you need to know. It is a loan intended to get you from one payday to the next. They are intended to be short term. You can get up to the amount you get in your paycheck. You have to have proof of the income you receive. They have high interest rates and short turnaround time. I know I just said that, but it is important and you need to remember it. You have to pay back the loan in one or two pay periods, usually within two weeks.

The application process is fast, minutes fast. Many of these lenders have store fronts that look like an old fast food place. Maybe that is the point, they are the fast food of lending. Just like with fast food, these should be used in moderation. A payday lender verifies your proof of income and proof of a checking account. They deposit the money directly into your bank account. They also require you to write them a post dated check for the date the payment is due. This way they do not have to come looking for you, they already have your payment. Payday lenders do not check your credit. If you really want to consider this type of loan, you should do some payday loan shopping.

Online Loans – Good Or Bad?

The question should not be is this type of loan good or bad. It really should be do you intend to use it properly? Do you have the money to pay back the loan on time and in full? If yes, then you can consider low credit score loans. If no, you should stop here and not proceed with any type of loan. Any type of loan that helps your current position, is considered a good debt. Any type of loan that hurts your current position is considered a bad debt. Online loans are no different.

In the past, online loans were considered only for those with bad credit. That is not the case as much any more. Online loans are convenient. You can apply on your computer from the comfort of your home at any time you want. The application is fast and streamlined. You can upload all documents directly into the same application. It is so simple. You can get an answer in less than 24 hours. If you are approved, your money is in the bank in about 24 hours after that. It is no wonder more and more people are applying for loans online.

Now, let me balance all that with some information of which you need to be mindful. Online loans tend to have a higher interest rate, which makes your monthly payment higher. There are scammers lurking in every corner of the internet. They are looking to prey on people in vulnerable positions. People in those positions tend to make fast and emotional decisions. That is exactly where scammers want you. Be aware of any online lender you use. Make sure they are a legitimate lender.

Should I Really Get A Loan With Bad Credit?

You are the only person that can determine if you should get a loan. Remember, just because you can get a loan does not always mean that you should. The first question you should answer is why do you want this loan? Do you really need the money? Perhaps this is for some type of emergency, like your car needs repairs, or for medical bills. Then, your answer may be yes, you should get a loan despite having bad credit. However, if this loan is for a vacation or new furniture, or something else that you really do not need, you may want to reconsider getting low credit score loans.

If you are wondering if you are really able to get a loan with bad credit, the answer is yes. Loans are available for those with fair or poor credit. When you fall into the credit range of 560 to 650, you are in a dangerous area. You do not have good credit, but it is not the worst it can be. If you already have bad credit, you probably should not take on any more debt. You should focus on taking care of the debt you currently have and lowering that. You should make timely payments and work on improving your payment history before considering more debt.

I Have Really Low Income, What Can I Do?

You have low income and you want to improve your financial picture. How do you go about it? If you have low income, you could possibly have a lower credit score. This could be because you do not have much credit. It could also be that you have too much debt in comparison to your income. You may be able to secure low credit score loans, but they may not be the right answer for you. What goals are you trying to achieve? Do you not have enough money to pay your bills and you are looking for assistance? Do you need to find a way to bring in more income?

There are a few options available to you. You could consider section 8 housing which can help decrease your housing costs. There are many federal and state programs that can help you pay your utility bills. These may be better avenues for you instead of obtaining a loan. If you already do not have the money to pay your bills, taking on more debt is not going to help. There are many church organizations that are willing to help you. You may be eligible for food stamps to help pay for food. Before considering a loan, you should look into the help available to you at the state and federal levels.

Should I Find A Local Lender?

Local lenders can offer you some things that other lenders cannot. They are local and accessible. Most of us, including me, do not want to talk someone face to face, but it is nice to have the option. Local lenders have a building where you can go and talk to people if you have a problem. When you visit a local lender, you get an answer quickly. You can have the cash in your hand without having to visit a bank. Many local lenders offer low credit score loans. Keep in mind, these lenders often have high interest rates. They also really hit you hard with fees, if you do not pay back your loan on time.

If you are going to visit a local lender, you must do so responsibly. You must keep in mind that you have to pay back the loan. This money is not extra money you are getting. It is money that would be coming in your next paycheck. You are just getting it early. When payday does arrive, basically your check will be decreased by however much you have to pay back. Local lenders are a great source of fast cash to get you through a tough spot before you get paid. This is helpful only when you have the money to pay back the loan on time.

Do I Really Need A Budget?

Yes, my friend, yes, you need a budget. If you have to ask, most likely you do not have one. That also means that you have no clue where your money is going. You probably do not even know how much you spend on expenses per month. In our technology driven world, there is no reason why you have not created a budget. There are so many free resources available to you. You should take advantage of them. Visit Loanry’s budget site to get all the help you need creating a budget. You cannot possibly know if you can afford low credit score loans without a budget.

Not only does your budget help you track your spending, but it also helps you reach your financial goals. When creating a budget, you take a hard look at your expenses. You can see where your money is going. This also gives you the opportunity to see where you are wasting money. This allows you to make corrections. It is never too late to create a budget. The great thing about a budget is it can change based on your needs, income and debts. You are in complete control. Without a budget, you feel like you are out of control with your spending.

How Can I Save Money?

Now that you have created a budget, you see how much money you are spending on bills. You know that you are not bringing in enough money per month to pay all the bills. You are considering low credit score loans, but you cannot be sure that is the right move to make. It probably is not the best move for you. If you currently cannot afford to pay your bills, adding another debt is not going to make that any better. You should begin saving money and paying off your debts. I imagine right now, you are throwing up your hands saying, I have no money, how can I save?

It may be time to take a look at your budget and start making cuts. It does not have to be forever, just until you have more wiggle room. Anything that is not necessary to live and work can be cut. These are hard cuts to make, but they can help you save a lot of money. You could consider getting a part time job to help pay off all your debts. You could also sell some items in your home. Look around, you may have a gold mine sitting in front of you. This can achieve two goals: save money and clean up the clutter in your house.

Conclusion

If you know that your credit score sits somewhere between 560 and 650, that mean you are looking for low credit score loans. It may be a surprise to you, but there are quite a few options available to you. Having less than stellar credit it not financial suicide. It does mean you have a long road ahead of you. However, your goals are still possible.

One thing that I hope you take away from this post is that just because you can get a loan, that does not mean that you should. You should first determine if this is a loan that you really need. Then, decide if this is a loan you can really afford. If you cannot afford to pay back the loan, you should stop there and maybe consider a loan for another moment. You should focus your financial efforts on rebuilding your credit by reducing your debt and creating a positive payment history. You should take control of your budget and your expenses and not let them control you.

Julia Peoples is a long-time business manager focused on providing decision making assistance to the public. She works with people at key points of their lives who are making important retirement and financial decisions. She has had many articles published that educate the public on sound financial decision making.

Julia writes for those who are working towards financial freedom or a better understanding of how finances work. She has shared her financial insights with individuals on a one on one basis for years.