The 7 Best Online Payday Loans: Read with Caution

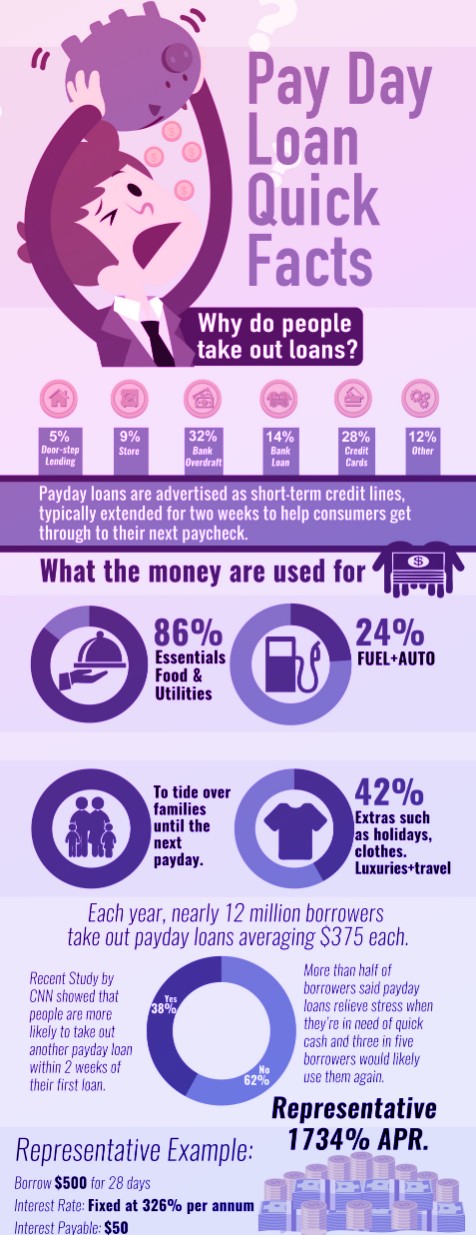

Having a source of funds you can turn to in a pinch is important. Most people can qualify for some type of loan even with a low credit score. One major type of loan that’s widely available is online payday loans. You can qualify for these loans on the basis of your employment.

The lender considers the applicant’s income when determining loan worthiness. This means that payday loan applicants must be employed to be approved. The lender knows the borrower will pay off the loan because he or she has a paycheck coming regularly.

You now have many options for online payday loans. Numerous financial companies offer this type of loan product. Payday loans were once categorized as alternative loan products. However, these days even mainstream financial institutions are starting to offer similar products.

You should do your research and learn as much as you can about payday loans before applying.

Advantages that payday loans offer

One thing in particular that you should be aware of is what makes these loans advantageous. Payday loans offer certain advantages that conventional or standard loans don’t offer. Understanding what these advantages are helps you to use this resource properly.

Here are some major advantages of online payday loans. These are just a few examples of advantages of this helpful financial product.

1. Availability

Payday loans are widely available and easy to come by. A simple Internet search reveals all the different products out there. Thanks to the online aspect, consumers can shop many loan products at once.

You won’t need to visit financial institutions to apply or learn about loan products. The process for applying for a conventional loan can be long and cumbersome. The payday loan process maximizes convenience for the consumer thanks to widespread availability.

2. Speed

If you need extra funds, you may not have any time to wait. That’s why it’s a huge advantage that the payday loan process is so fast. Those who take out these loans get the funds they borrow right away. What’s more, the application is quick to fill out as well. In fact, the application for many payday loans only takes a few minutes to complete.

If you apply for payday loans, you don’t have to wait for a response. You can even get payday loans tomorrow if you need them. In many cases, you’ll instantly know whether you’re approved.

3. Credit requirements

Online payday loans are ideal products for consumers who might not have the best credit history. They are easier to get approved for than conventional loans.

Conventional loans often require good or excellent credit. They also often involve income requirements and background checks. Many consumers are unable to get approved for conventional loans. On the other hand, payday loans are available to those with fair or even poor credit.

4. Flexibility

Another advantage of online payday loans is that their terms are flexible. With payday loans, the lender is often willing to work with the borrower. Borrowers can take advantage of flexibility when it comes to the amount they borrow.

As a borrower, you can also enjoy flexibility regarding repayment. You can choose from among various loan terms and monthly payment amounts to suit your needs and budget.

5. Simplicity

Overall, taking out a payday loan is a lot more simple than taking out a conventional loan. There is much less information required of the applicant. The lender does not analyze as many aspects of the prospective borrower’s life. Although the applicant’s credit history may be checked, the lender is probably not going to contact the applicant’s employer or run a background check.

Applying for a conventional loan sometimes requires a personal interview. This means that the borrower needs to go to the financial institution. He or she may need to sit down with a representative. Loan applications sometimes include answering embarrassing questions about one’s financial past. Fortunately, applying for a payday loan typically requires no interview. In fact, much of the application process is completely anonymous.

Good reasons to take out a payday loan

Establishing healthy finances is about making good decisions. You need to decide when to borrow. You shouldn’t borrow indiscriminately. Rather, you should only borrow when necessary.

There are numerous scenarios that make taking out a payday loan a good idea. The following are three of the most common scenarios where it’s a good idea to take out online payday loans.

1. Emergency expenses come up.

Emergency expenses can come up for a variety of different reasons. You could experience emergency expenses because of a vehicle malfunction. You could also experience emergency expenses because of storm damage to your home.

You can’t know when emergencies will happen. However, you can have a fund source in mind to deal with them when they occur. Online payday loans could be a solution for you when it comes to emergency expenses.

2. You want to invest in a business opportunity.

When you have opportunities to make money, you want to be able to take them. You may not be able to start up your own business without the capital. Payday loans might be a source of capital for business ventures.

Regardless of what type of business you’re interested in starting, payday loans might help. You can find a payday loan product that you can fit into your fledgling company’s budget. It’s important to be resourceful and proactive as an entrepreneur. Therefore, you always want to have payday loan funds as an option when business opportunities present themselves.

3. You’re temporarily short on funds.

Unfortunately, it’s not always a simple matter to manage one’s budget. Things can always come up that leave you short and unable to cover all your bills. For situations like these, payday loans are a good solution. You can take out a payday loan to cover expenses. Then, you can pay it off as time goes on.

Payday loans are good for making it so that you don’t have to miss payments. Missed payments on credit accounts and other account types can damage your credit score. With a payday loan, you can pay bills right away rather than waiting and having to pay a late fee as a result. However be sure you can repay it before applying. A late payday loan payment would have a huge negative impact on your credit score and would require to pay lots of additional fees.

Protecting your credit score is important. Never let yourself miss a payment if you have a source of money available.

Best online payday loans to consider

Payday Loan Basics Spelled Out: Loans 101https://t.co/GrqauFbn3K

— Loanry.com | Loan Shop ? (@LoanryStore) September 23, 2019

You’ll find lots of online payday loans out there. However, all of them are not the same. Payday loan offers from some providers are better than others. Some loan providers are predatory lenders and will charge unfair amounts of interest.

If you’ve never taken out such a loan before, you might not know what to look for. Your financial health is on the line when you borrow. This means you need to be careful and protect yourself.

We’re here to help you make the right decisions for your financial future. At Cashry.com, we provide information to consumers to help them choose online payday loans, when they plan to.

Below, we’ve compiled some helpful information about seven payday loan options out there. Considering all the different payday loan products out there can be overwhelming. You need to do enough payday loan shopping to thoroughly explore your options. If you feel like payday loans might be a good option and you know you can assume to repay it, then the following seven options might be interesting online payday loans:

1. US Bank

US Bank offers a loan product that is much like a payday loan. This is a trustworthy financial institution. Their payday loan product is among one of the most affordable on the market. Interest rates are kept quite low on payday loan products from US Bank.

Another huge advantage of a loan from US Bank is that the loan will contribute to the consumer’s credit score. If you take out a US Bank loan, your credit score will improve if you pay it off on time. That’s because US Bank will report your performance to the credit bureaus.

There are a couple stipulations to this loan product. For one thing, borrowers need to have a checking account. They also need to have direct deposit set up on their paycheck. This means that payments will go right into their bank accounts. If you take out this loan, you can have your loan repayments automatically debited from your checking account.

2. OneMain Financial

OneMain Financial provides a variety of different loan types. Among their loan options is a payday loan product. OneMain Financial is a highly reputable lender. The company has an A+ rating with the Better Business Bureau.

There are advantages to borrowing a payday loan from this lender. One great advantage is how convenient the application is. The application can be filled out online. It only takes a few minutes to complete the application and get a response. Also, there is no minimum credit score to apply. Loans from OneMain Financial are available to many consumers even without strong credit histories.

Another advantage is that this loan does not require any application fee. Consumers can apply for a loan without having to worry about losing the application fee amount.

3. LendUp

If you need a loan but your credit is poor, LendUp might be a good option. LendUp has a good reputation as a lender. The company has an A+ Better Business Bureau Rating. However, LendUp loans are not available everywhere in the country. LendUp loans are offered in only seven states.

LendUp endeavors to be more than just a lender. The company does what it can to improve the financial strength of customers. LendUp offers free financial education courses to borrowers. Another thing LendUp does is offer better loan terms to repeat customers.

The interest rates on LendUp loans are quite competitive. The borrower has the opportunity to choose from among numerous installment options regarding repayment. LendUp loans are entirely online, and the company has no physical locations.

As a company, LendUp is devoted to ethical practices. This company is definitely not a predatory lender. While those who borrow payday loans are often subjected to predatory lending, they will not be if they do business with LendUp.

4. Check Into Cash

Check Into Cash is a good option for consumers looking to borrow a payday loan. There is a lot of flexibility that goes along with these loan products. If you decide to borrow from Check Into Cash, you can borrow any amount between $50 and $1,000.

Among the advantages of Check Into Cash are the fact that loan funds are deposited within two business days. Another advantage many consumers like is that there are physical stores to go to. If you feel more comfortable talking to a representative in person, Check Into Cash might be the best provider for you.

One possible drawback with Check Into Cash is that the APR is high. There is an APR on loans that can reach 390%. Always make sure you can assume to repay your loan before applying! Don’t forget that you are looking for a way to make your life easier, not harder!

5. Viva

Viva is a provider of online payday loans. Those looking for a process that is entirely online will enjoy this loan provider. The payday loans offered by Viva are available in every state. Consumers who have borrowed from Viva appreciate how easy it is to use the website.

Loan amounts can vary significantly. Individuals can borrow as little as $100 and as much as $5,000. There is also a significant range in the available repayment timeframes. Loans can be paid back in 90 days or in up to six months.

Some borrowers may qualify for relatively low interest rates with Viva Payday Loans. The APR can be as low as 5.99%. However, it can also be as high as 35.99%.

6. CashNetUSA

CashNetUSA is another highly popular payday loan provider. This site features a very quick application. The application only takes about five minutes. Once the application is filled out and submitted, applicants quickly get a response. This makes CashNetUSA a great option if you need your loan funds quickly.

The loan amount range is relatively limited with CashNetUSA. Consumers can borrow between $255 and $500. However, the loan funds can hit the borrower’s bank account in as little as one day. There are next day deposits available with CashNetUSA.

Some consumers might prefer to avoid CashNetUSA loans because of the high APRs. The APR on these loans can reach 800%. Once again, make sure you can assume this high APR before even considering applying!

7. Speedy Cash

Speedy Cash is an option if you want to borrow from a lender with physical locations. There are 200 physical Speedy Cash locations. These locations are found in 14 different states. Those who apply at a physical location often get their loan funds faster than those who apply online. In addition to applying in person, the borrower can also apply over the phone. Of course, there is also the option to apply online. Speedy Cash loans are available in 28 states total.

The loan amounts on Speedy Cash loans are on the low side. A consumer can borrow as little as $100 and as much as $500. Fortunately, the interest rates on Speedy Cash loans are fairly low.

If you’re worried that your credit score is too low, Speedy Cash is a good option. Speedy Cash regularly approves applicants with low credit scores. The company has been in business since back in 1997. Speedy Cash is reputable and widely trusted.

Final Thoughts

You’ve always got online payday loans in your corner when you need help. When you know the payday loan product to turn to, you enjoy greater peace of mind. You don’t have to worry about budgeting mistakes or emergency expenses. You can always acquire funds quickly and conveniently.

Learn as much as you can about the above mentioned products. Then, analyze your own financial situation. Figure out which safe payday loans you’re eligible for. Always remember however that payday loans should not be your first option. It is kind of an emergency solution that you should only consider when times are really hard and only if you can assume paying it back.

And never forget that building strong finances takes time and effort.

Cashry is always here to support you in all your financial quests and to help you fulfill your financial needs.

Katherine Davis is a freelance writer specializing in the subjects of finance, banking, and investment. Based in New York City, Katherine’s experiences combating the Big Apple’s outrageous real estate costs and living expenses have provided her with some great budgeting insights on stretching a dollar. A graduate of Penn State University, Katherine advises millennials to be disciplined when it comes to their finances and to start investing as soon as possible.