The 7 Best Financial Literacy Charities: Money Deeds

By 2018, the average American had approximately $38,000 in personal debt, excluding home mortgages. Over the years, there has been a steady increase in the amount of personal debt that Americans owe. These range from small cash loans to loans for low-income earners. While taking out loans can help borrowers to meet their immediate needs and achieve their financial goals, it is important to do due diligence before taking on debt. Similarly, borrowers have to ensure prudent use of the financial resources in order to avoid sinking further into debt and going through unnecessary frustrations. Today, financial education and literacy have become invaluable when it comes to making sound financial decisions and handling tough economic times.

The good news is that there are a number of financial literacy charities that help consumers to understand money and debt. This not only equips them with the necessary knowledge on the various financial options available. It also puts them in a better position to make informed decisions. In a world where there are numerous organizations that offer loans for anyone, borrowers should understand what they are getting themselves into before they commit.

Here are a few things that every consumer should be aware of.

Financial Literacy

Simply put, financial literacy is the possession of the skills and knowledge necessary to understand how money works in both personal and business life. This means a clear understanding of how money is made, spent, invested, and saved. Financial education and literacy also entail the ability to use financial resources to make decisions. Individuals who are financially literate should be in a position to understand income taxes, the concept of budgeting, and how to meet their daily expenses so that they can make wise decisions with money.

Financial literacy can be beneficial to individuals and organizations in many ways. Today, a good number of people are investing time and resources to learn skills related to creating a budget, tracking spending, paying off debt, and planning for the future. The good news is that there are financial literacy charities through which consumers can acquire these skills. However, borrowers have to identify the best and most reliable charities.

The Importance of Financial Education

Taking into account the dynamic financial landscape, the consumer in today’s world has to make more financial decisions than ever before. The situation is made even more complex by the numerous options provided. Whether a consumer is planning to take out small cash loans or invest their money, financial education will help them identify the possible obstacles and opportunities.

With financial literacy, individuals are able to enhance their money management skills. They can then manage debt more effectively. Such consumers will also develop their knowledge and behavior in relation to money. For organizations, financial literacy can help to add value to the lives of employees. Plus it might influence productivity levels by eliminating financial stresses. By acquiring great money management habits, consumers can aspire to a good level of financial security. In order to become financially literate, individuals must not only learn financial concepts. They must also practice them. While many people receive informal education from their role models or loved ones, formal instruction from trusted organizations will provide a reliable and comprehensive education. Working with some of the best financial literacy charities will see both individuals and organizations enjoying the benefits of financial education.

Our Choice for Top 7 Financial Literacy Organizations

In a world where consumers have a wide range of options when it comes to financial services and loans for anyone, financial education can come in handy. The good news is that there are several organizations that work with communities to provide vital knowledge and resources.

Here are the top financial literacy organizations consumers should know about.

1. Operation Hope

Operation Hope focuses on empowering underserved communities, especially those that comprise of low-income earners, by providing education. The organization appreciates the need for equal access to resources in a capitalistic society and offers education and credit counseling to communities, families, and individuals. Operation Hope gives students the opportunity to pitch their business ideas, receive funding, and access mentorship. This instills healthy economic values and promotes dignity and opportunity.

2. MoneyThink

This is another organization that structures its activities around mentorship. MoneyThink believes that dealing with financial illiteracy has a lot to do with talking to kids. With the belief that children are the future, the organization sends trained college students to provide mentorship to urban high school students. The aim of the program is to help young people develop financial and entrepreneurial values by understanding the basics of personal finance and business development.

3. Springboard

This nonprofit organization has a team of credit counselors that offers assistance to those looking to improve their financial situation. The credit counselors provide unbiased, informed, and free advice relating to debt and bankruptcy. Free personal finance education helps individuals to make informed decisions and handle their finances better so they can lead a life of dignity and take advantage of the available opportunities.

4. National Foundation for Credit Counseling

The main aim of the organization is to ensure that credit counselors in the country conform to certain set standards. NFCC has Agency Members in all 50 states as well as Puerto Rico. What this means is that consumers can trust an agency with NFCC accreditation. Most of these members offer free services on different topics, ranging from budgeting to debt management.

5. Clearpoint

Consumers looking for quality financial education and advice can turn to Clearpoint. This nonprofit credit counselor has an office in 12 states, making it possible to offer services to many consumers. The organization also provides free education and advice in person, online as well as over the phone. They also recognize the importance of having strong, friendly, and locally-based financial institutions, a factor that has seen the organization maintain a good working relationship with credit unions nationwide.

6. Consolidated Credit Counseling Services

This organization is committed to community and education, providing solid and proven programs that are designed to promote financial literacy across the country. Anyone who needs financial help can head over to CCCS for reliable advice on how to handle their situation.

7. Advantage Credit Counseling

With over 40 years of nonprofit work and 400,000 consumers cleared of debt, Advantage Credit Counseling Service provides debt and credit counseling for free. The organization provides personalized advice through its online credit counseling program. One of the advantages of working with the organization is that consumers are able to access advice from any screen through which they can access the website. They also have a database of great and useful articles on finance.

There are many more financial literacy charities that consumers can benefit from. Some of the organizations that offer debt and credit counseling include InCharge, Financial Finesse, and CESI Debt Solutions. Advice and guidance from experts in these organizations will not only help borrowers to choose the most appropriate small cash loans but also manage their debt in a better way.

An Overview of Debt

Debt plays a critical role in determining the financial situation of any individual or organization. This is why it is important for consumers to understand debt. Today, debt comes in a wide range of forms, making it important to take on only those that are relevant to your situation. While debt-free living is a great concept and offers consumers some advantages, it is not common. On the other hand, too much debt can present certain dangers, making it necessary to use debt as a tool to achieve some set goals. Taking out the different loans for anyone can derail your plans and leave you in huge debt.

Regardless of the type of debt that a consumer wishes to take on, it is important to ensure that they work to increase their chances of qualifying and getting approved. Most financial literacy charities will also agree that consumers have to ensure proper management and use of the money. This means having a good reason to take out a loan. Creating a plan and sticking to it. Then using the money for the intended purpose and repaying back the loan in good time. All borrowers have to make informed and reasoned decisions. The aim is to control their debt. In the end, whether a debt is positive or negative will largely depend on the borrower.

Contacting a Debt Counseling Expert

For some borrowers, making the right financial decisions can be confusing. This is why people turn to debt counseling experts for advice and guidance. It is important to know the right time to contact the professionals, since delays may see you making costly mistakes.

A debt counseling expert can help when one is in financial trouble. This includes when you are living paycheck to paycheck, have so many creditors, find it impossible to save for a rainy day, are receiving calls from your creditors, or are struggling to pay your bills. A qualified counselor will help to identify how you got into the financial crisis and suggest ways of getting out of debt.

For those struggling with or working on getting out of debt, it is important to contact an affordable, licensed debt counseling expert. While most people will always have debt in life, borrowers should understand that there is good debt and bad debt. Consumers can reduce debt by controlling spending. Not to mention controlling non-essential bills, and more generally understanding debt. While it is unusual to live debt-free, this will go a long way in helping such an individual to start saving.

Financial circumstances vary from person to person. Whenever a consumer feels the need to contact a debt counseling expert, they should do so. However, acquiring skills and knowledge through financial literacy charities will still be a crucial step.

Smart and Effective Ways of Reducing Debt

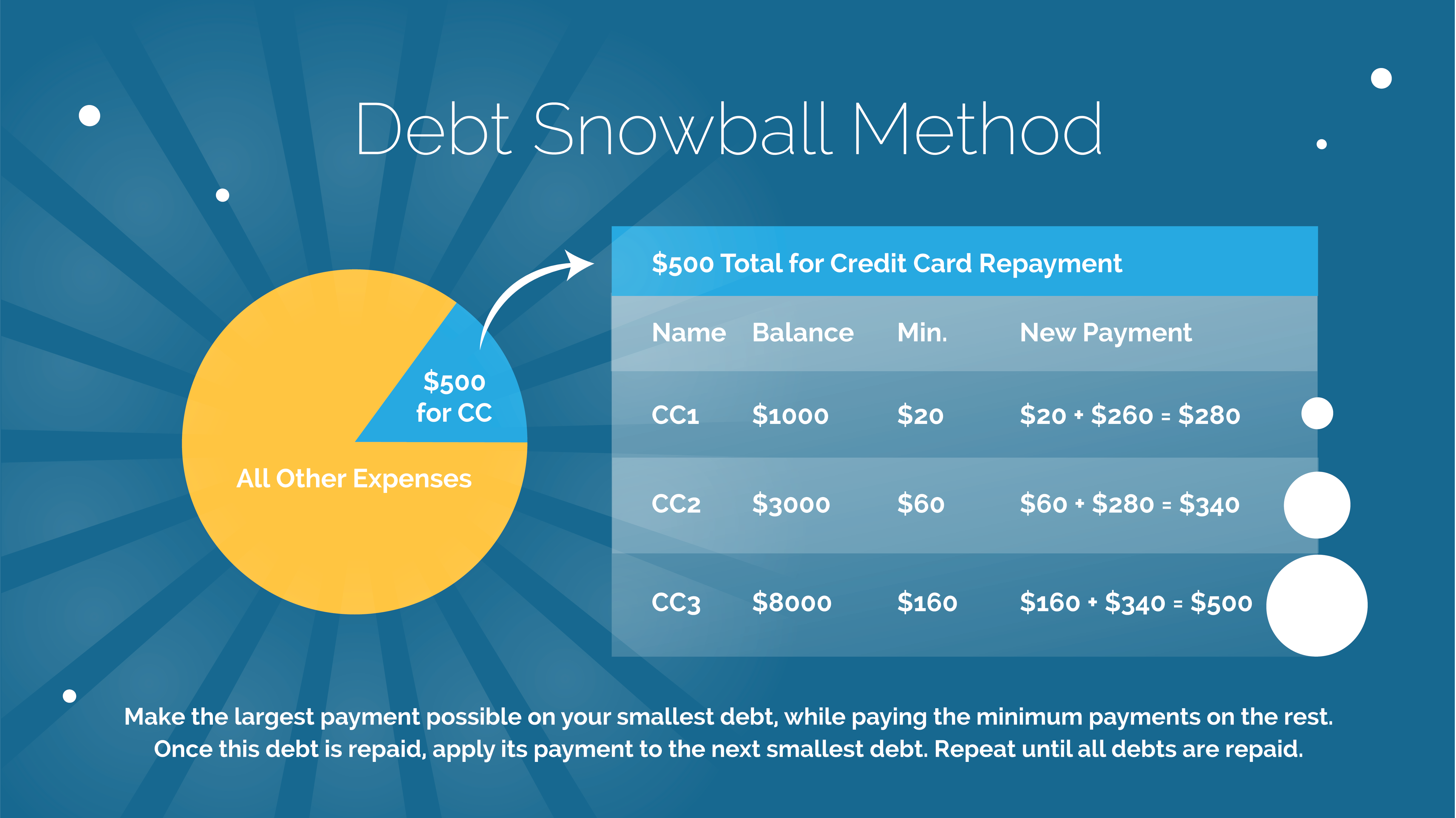

The debt snowball method is a debt reduction strategy that involves paying off debt from the smallest to the largest. Borrowers start by paying off small debt and gain momentum as they reduce each balance and progress to the next small balance. This entails listing all debts besides the mortgage from the smallest to the largest. The borrower then makes minimum payments on all debts except the smallest one, while paying as much as they can on the smallest debt. This process is repeated until all debts are paid in full.

Financial literacy charities can help consumers master the technique so that they benefit from the psychological boost, reduce their stress, and handle their finances better. However, it is important to remember that this method may lead to paying more in interest in the long run as a result of using another repayment option. Borrowers can pause the snowball in the event that they have an unexpected job loss, they are in the middle of a health crisis, are going through a major life event or have an outstanding IRS bill.

Saving for a Rainy Day

One of the reasons why a good number of Americans owe so much in personal debt is because they have not embraced and developed a savings culture. Rather than going for small cash loans, saving for a rainy day will ensure consumers have the money they need to meet their financial needs.

In order to handle emergencies and unexpected expenses without taking on debt, consumers should consider increasing their monthly income. For those who are employed, asking for a raise at the existing job, getting a second job, or starting a freelance business are great ways to boost income. Financial experts also recommend taking advantage of some of the deals available. Similarly, it would be important to restructure your budget, getting rid of unnecessary expenditures so that you are in a better position to save money.

You could start by having a look at how much you can make thanks to a savings account.

Once consumers are able to set aside some money, they should identify ways to make money work hard for them. Placing the funds in an interest-bearing account or investing it will help add up more savings faster and with little effort. The good news is that financial literacy charities help people to understand how money works. This allows them to identify the opportunities available and make sound financial decisions as they seek to explore the opportunities.

How to Manage Your Bills

Another area that consumers have to consider carefully when seeking to manage their finances is bills. Anyone who wishes to lower their debt should think about lowering their monthly spending as a way of improving their financial health. This would be particularly helpful for those repaying loans for low income.

- Negotiating bills: most consumers do not know that they can negotiate their bills in case they are beyond what they can afford. Keeping track of usage and monthly fees makes it possible to decide whether the consumer should downscale or downsize.

- Bundling several services: instead of paying for both cable and internet, consumers should consider rolling up the two services into one. In most cases, this will come at a discount, helping them to save money.

- Special promotions: every so often, there are promotions that offer consumers a chance to save money on bills. Taking note about these promotions will ensure they renegotiate before prices go up.

- Cutting extras: a close look at various bills will reveal that there are certain extras that one can cut. Since these will help to save you money in the long run, you should consider doing away with those that you do not need.

Skills and knowledge acquired from financial literacy charities can help consumers to calculate the interest charged on their credit card debt. This will allow them to search for credit cards with better rates. In the end, it will be easier to manage the bills and get out of debt.

Dealing With Debt Collectors

Once a borrower has fallen back on their loan repayments, there is the possibility that they will receive collection calls. While borrowers have a duty to pay back the loans they take out, it is possible to stop unwanted calls from creditors. However, just like being knowledgeable about loans for anyone, consumers should be aware of what creditors can and cannot do legally.

Generally, debt collectors can only call between 8 AM and 9 PM. This means that consumers have the right to tell the collectors that they do not wish to be contacted via phone or hang up the call. In the event that the collector keeps calling, a consumer can ask them to get in touch by writing. Borrowers should avoid admitting anything regarding any debt. Instead, they can consider talking to a debt counseling expert to help them in handling the entire process.

Financial literacy charities advise against giving any sensitive information to anyone via phone. This is because scammers can use this method to collect and misuse sensitive information. In order to avoid dealing with harassing debt collectors, borrowers should strive to pay their debts in good time. It would also help to know your rights as well as those of the collector. Consumers should avoid obtaining emergency cash loans to pay for debt as this may push them further into debt.

The Debt Snow Ball Method

Good Reasons to Incur Debt

Knowing the reasons for requesting a loan is just as important as understanding the amount and type of debt that will suit your needs. As such, every borrower should identify their reasons for wanting to take out loans for low income. This before making any financial commitment.

Here Are a Few Good Reasons to Incur Debt:

To increase working capital

People running their own business can take out loans to increase their working capital. Such funds can go into buying more inventory to take advantage of the business opportunities available.

To improve cash flow

When used in a responsible way, debt can help to improve cash flow. This applies to both individuals and businesses. One of the best ways of achieving this is by paying old debts with new loans, a process known as refinancing.

To build a credit history

Taking on debt can present an opportunity to build a credit history. If paid back in good time, the borrower will be able to access more financing options. He will enjoy better terms on future loans.

Financial emergencies

Loans can also help consumers to take care of financial emergency such as medical expenses. It could also cover the costs of home repairs occasioned by storms, floods, or other natural phenomena.

Debt consolidation

Borrowers with several loans can take out a new loan to pay off the existing ones. This makes it easy to repay the new loan and allows them to focus on servicing a single debt.

Home loans

People looking to acquire property and enjoy the peace of mind that comes with homeownership can consider home loans to finance the purchase.

Education

It is common for a number of people to borrow in order to pay for college tuition. This is seen as an investment in personal growth and future earning potential.

There are many more reasons for taking on debt. Pursuing the educational programs offered by financial literacy charities will help borrowers make the right choices.

Debt Settlement

While debt consolidation can help to manage debt better, borrowers should be aware that there are scams. At the same time, debt consolidation is not the only option, and consumers can explore other options such as debt settlement. Debt settlement is an approach in which there is a mutual agreement between the creditor and debtor on a reduced balance that is regarded as payment in full. While in some cases the creditor will offer a deal, borrowers can also ask them if they would be willing to negotiate a deal. One of the advantages of debt settlement is that the creditor will recoup part of the debt, and the debtor will clear off the debt and boost their credit score.

Some creditors and debtors hire a third-party to negotiate the deal on their behalf. Generally, debt settlement companies charge a fee for their services, commonly as a monthly charge from the structured payment or at the end of the repayment. Financial literacy charities advise consumers to be prepared to enter repayment before using a debt settlement company. Those who do not have the ability to pay each month will not benefit from this arrangement.

It is important to understand who should use debt settlement before going for this kind of arrangement. Debt settlement works best for people who are behind on their payments, with creditors accepting a settlement offer from such borrowers. This means that those making their payments will not be approved for restructuring. As such, those making their payments can consider going for a consolidation loan when looking to reduce their monthly payments.

How Debt Settlement Can Help You

While debt settlement is associated with a number of benefits, it is rarely recommended as a viable solution for dealing with debts due to lack of education among consumers and debt settlement scams. How debt settlement can help an individual depends on their debt types, the amount owed, and the creditors who will settle.

Here are some of the ways that a borrower can benefit from a debt settlement program.

One of the most outstanding benefits of debt settlement is that the debtor gets relief from overwhelming debts. By paying only a portion of the debt accumulated, the debtor will be in a position to clear off their debt without straining. In the same way, a debtor will be able to get creditors and collectors off their back, giving them the peace of mind they need to focus on repaying the debt. Another common reason why people choose debt settlement is to avoid bankruptcy. Since bankruptcy will remain on an individual’s credit report for ten years, it is considered a debt solution that will follow a consumer for the rest of their life. When done right, settling debts with creditors can help to avoid filing bankruptcy, and dealing with the associated consequences.

With a good debt settlement program, a debtor will be able to repay their debts in less time. Compared to paying debts normally, debt settlement allows a debtor to repay in a period of between two and four years. It is critical to ensure that borrowers make the most of the opportunities presented by debt settlement. This is why they should think about taking structured courses from financial literacy charities to gain a deeper understanding of debt and how one can go about reducing their debt.

The Risks Associated With Debt Settlement

While debt settlement has its advantages, it is not without some downsides. Through financial literacy charities, consumers will be able to understand these risks and know the necessary steps to take when choosing this as their preferred debt reduction strategy. Borrowers need to understand that creditors are not guaranteed to agree to settlement offers. Depending on your creditor, this option may not be available to you. This is why it is important to contact the creditor immediately you think about debt settlement. There is also the risk that the debtor’s credit score will suffer in the meantime.

Apart from the fee, you will owe the debt settlement company for negotiating on your behalf and managing the payments, some creditors may not be willing to reduce the interest rate. This means that interest on the debt will continue to accrue. When using debt settlement, consumers may be required to pay taxes on the amount of debt that has been canceled. It is necessary to be mindful of these expenses when considering debt settlement as a method to reduce debt. If the debtor stops making payments on the debt, they could incur late fees or interest. This means that they may end up with more debt, making it harder for them to clear off what they owe.

Making a decision on whether to use debt settlement to reduce debt will require a consumer to weigh the benefits of the strategy against the associated risks. This will also mean that the individual takes into account their unique financial circumstances to determine whether they will benefit from the program. Financial education will play essential role in helping to make a decision. Such knowledge will also make borrowers aware of the different alternatives to debt settlement and how to explore the various options.

Final Thoughts

In summary, the benefits of financial education and literacy cannot be denied. However, it is important to note that such education can be invaluable regardless of whether one is struggling with financial problems or not. This is because the skills and knowledge acquired through the education programs go a long way in helping with budgeting, financial management as well as debt reduction. In addition to financial literacy charities, there are many other organizations that can offer personal finance education and credit counseling services. This helps not only those who wish to take out loans for low-income earners but also businesses that are keen on acquiring large loans for expansion purposes.

Cole is a personal finance research analyst and writer with extensive experience in building and maintaining a corporate brand utilizing both qualitative and quantitative methods. Cole has written on a diverse range of topics including financial planning, cryptocurrency, commercial real estate, and tax strategy. A graduate from Drexel University, Cole seeks to demystify financial borrowing and help individuals achieve financial freedom.