The Top 7 Life Habits that Will Change Your Life

Are you like most people and feel like you are drowning in debt? Maybe you are not drowning in it, but you feel like you cannot get ahead financially. I would be willing to bet that you could make some changes to your life habits to get yourself in a better position. They may feel a little uncomfortable at first, but once you get used to them and you see the results, you will most likely feel inspired to keep going. We live in a world where we want everything right now. It does not matter if we cannot afford to pay for it.

Society tells us that we need to live a certain lifestyle, drive a specific car, and wear expensive clothes so we can feel good about ourselves. It is really hard not to get caught up in that mentality. I encourage you to consider saving more and spending less in the short term so you can have more flexibility over the long term. Continue reading to find out more.

Where Do I Start?

You know you need to change some life habits to put yourself in a better place financially, but you just are not sure where to start. Starting is often the hardest, but once you make those first few steps, you are on your way to financial freedom. This article will give you some saving money tips to help you make the most of your money. In order to get anywhere, you have to understand where you are starting. You need to really think about your goals. What is it that you want to achieve? Do you want to be completely debt free? Do you want to have a certain amount of money that you want to save within a certain amount of time? Maybe you want to do it all.

It is important to understand your own financial goals. Once you understand them, then you can prioritize them. This is helpful because it gives you goals to work towards. Also when things become challenging for you, and believe me, they will, you have a set of goals that you are working towards. These are your goals. They were not established for you by someone else. It is easier to focus on your goals when you establish them for yourself.

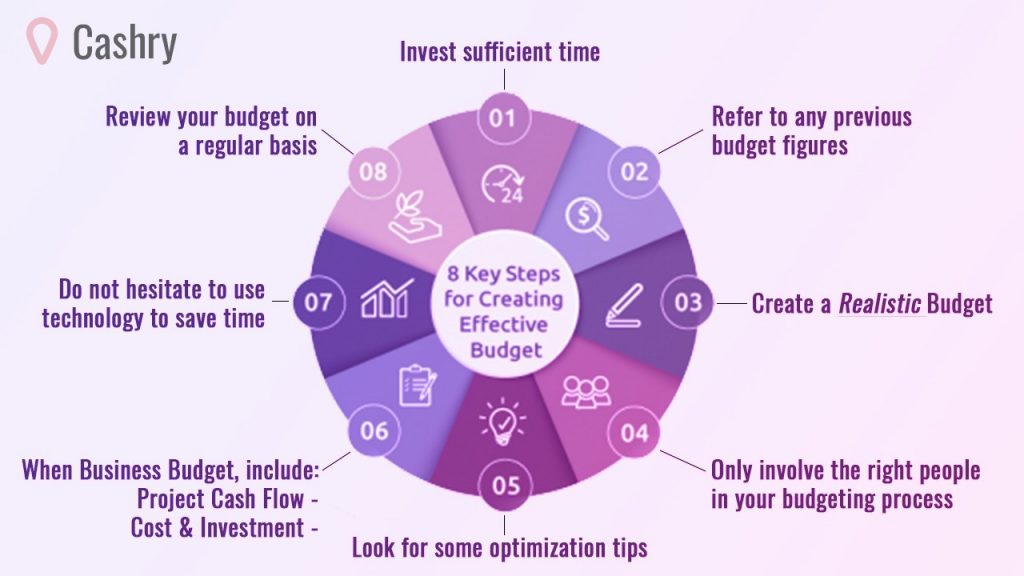

Habit #1 – Create A Budget

I know most people do not like to hear the word budget. They immediately begin to think that they are going to be put in financial jail and not be able to purchase the items they want. That is not quite true. You should look at a budget as a tool to help you meet your financial goals. Having a budget gives you control over your money. It helps you understand your income and your expenses. It also gives you a deeper understanding of how much money you are spending. I am willing to be that if you do not currently have a budget, then you have no idea how much money you are spending and where. It can also give you an idea of what life habits you may want to change.

To create an accurate budget, you need to have access to about three months of bank statements, or something that indicates how you have spent your money. You must capture all of your income that you have coming in every month. You need to have a clear understanding of your income, such as when you receive it, how much and is a regular stream of income. That is probably the easy part of your budgeting. Now, the more difficult part is figuring out all of your expenses. This is when you want to refer to your bank statements. It is important that you capture all of your expenses. Now is not the time to hide anything or ‘forget’. This is a key step to creating a budget.

You must capture all of those expenses in another column and add them all together. Once you add them and get a total amount, you can see how it compares to the amount of money you are bringing in each month. You must also be aware of expenses you may have on a semi regular basis such as medical bills and miscellaneous expenses. You may want to create a budget of expenses for those items each month to ensure you have that budgeted.

Habit #2 – Emergency Fund

No matter what your financial goals are, many experts suggest that you have an emergency fund available at all times. Many say that you should build this cushion first before you focus on any other financial goals. This most likely is going to require you to change your life habits to ensure you can get money into an emergency fund. Some say you should have $1,000 in an emergency fund and then you can shift your focus to reducing debt, or whatever your goals may be. Others say you should have 3 months of expenses saved in an emergency fund. While I do not know your personal situation, I would think that $1,000 is not enough to cover three months of expenses. Keep in mind, that once you have $1,000 in an emergency fund, that does not mean you stop putting money there. It just means that you do not have to put all of your spare money there.

If you are not convinced that you should first focus on an emergency fund, let me share a few other reasons with you. Having this fund can help reduce your stress. Just knowing that you have some money sitting in an account that is available to you, if you happen to need it. When there is an emergency expense, you can easily pull from your emergency account instead of worrying about where will you find the money. Having some money in an account can prevent you from going further into debt with another expense. If you did not have this money in an emergency account, you might have to use credit cards or take out personal loans to cover the expense. Borrowing money from yourself is definitely cheaper than borrowing money from another source.

Habit #3 – Save for Retirement

I can understand that planning for retirement may not seem to make a lot of sense to you right now while you are looking at your current financial outlook and you want to get out of debt. However, that is the perfect reason why you should begin planning for retirement now. If you think you are struggling to pay your bills and afford your lifestyle, it will only get harder in retirement. You may need to change your life habits in order to save a little more money for your future. You are responsible for making sure you have enough money in your retirement. There is not someone that is going to do that for you. You must take control of it.

You want to make sure you have a retirement account in which you are putting money. It may be some type of 401k through your employer, or even an IRA that you put money into for yourself. No matter what it is, you want to make sure you are putting enough money into that account so that you can effectively save for retirement. You should put as much money as possible into your retirement account(s). If you have a 401k through an employer and they match, you want to make sure you are putting in the maximum amount they match so you can ensure you are getting the maximum return. There are many tools available online that can help you plan for your retirement and give you a good indication of how much money you should save.

Habit #4 – Do Not Spend More Than You Earn

This may seem like one of those life habits that I should not have to say. However, this is much harder than most people realize. The cost of living is high and it continues to get higher. It is important that you have an understanding of how much things cost and how that compares to your earnings. It is also important to spend only the money you have. This may be a huge shift for you, so it might be difficult to switch to a frugal living. One of the key points here is to only purchase items that you need. You should pause before you decide to purchase an item and determine if you really need it. Is this item something you want?

Simply asking yourself that question may help you to limit your spending. If it is something that you want, you should create a list of those items and their costs and work towards saving for those items instead of just buying them right now.

You should remove the items for which you are paying that you do not use. One of the biggest culprits here is gym membership or subscription services. If you are not using these items, you should stop paying for them. If you eat out often, you can work to limiting the amount of times you eat out per week. This includes all types of eating out, even breakfast and coffee. Those items add up quickly. You could start small and cut the number of times you eat out per week in half. If you currently eat out during the weekdays and weekends, save your eating out until the weekends. Watch how this cuts down your spending. You probably spend more money on eating out than you realize.

Habit #5 – Pay Bills On Time

This is definitely one of the life habits that you want to focus on doing. It is important that you pay all of your bills on time. There are some major reasons why you should do this. First, when you do not pay your bills on time, it negatively impacts your credit score. This always costs you more money in the long term. When you have a low credit score, you may not be approved for loans, insurance, and even jobs.

If you are approved for loans with a low credit score, you will have higher interest rates which costs you more money over the long term. When you have a higher interest rate, you will end up paying a higher monthly amount. If you are approved for insurance, you may have to pay more for that insurance.

In addition to impacting your credit score, when you make your payments late, you often are hit with fees and penalties for the late payment. While some fees are small amounts, like $20, often times they are higher. Or they get higher the more times your payments are late. Even if it is a small amount, you are paying that amount when you really do not have to.

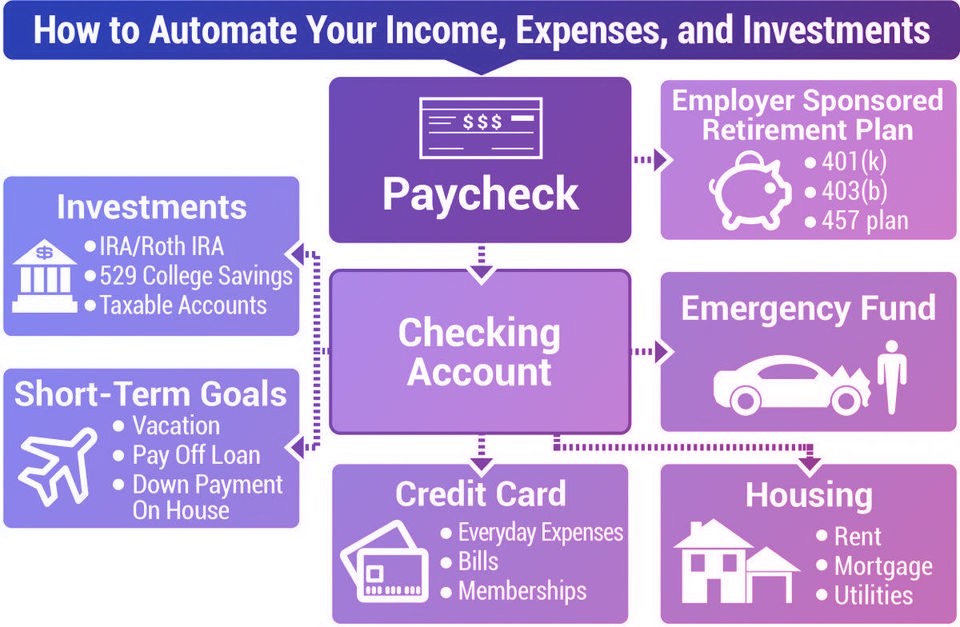

Habit #6 – Automate Savings

We have already talked about how saving money is important. Once you have some padding in your emergency account and you can begin to shift your focus to other items, your savings plan should not stop there. One of the best life habits you can create for yourself is to automate your savings. You should also get into the habit of paying yourself first. I know that may seem challenging when you have debt, but it is an important one of those life habits. The best way to do this is to set it up so that your money is automatically sent to your savings account. That way, you do not even have to think about it. It just happens for you.

You can have money sent directly from your paycheck to your savings account before you even see it deposited into your account. This is helpful because your brain does not process that is money that you have. You never see it, so you never think about it. You do not have to take the steps to move the money yourself. This also prevents you from needing the money before you are able to move it into your savings account.

Habit 7 – Reduce Debt

When you want to reduce your debt, it is important that you have an understanding of how much money you owe and to whom. How can you pay it off if you do not know what you have to pay? Another one of the great life habits you should take on is working hard to pay off your debt as opposed to going further into debt. While there are many techniques you can use to pay off your debt, one good one is the snowball method.

With this approach, you list out all of your debt starting with the lowest amount first going to the highest amount. You pay the minimum payment on all of your debts EXCEPT the top one, which should be the lowest amount. You pay as much money as possible towards that debt each month. The purpose of this is to quickly pay off one debt. This gives you a quick win, which you can feel good about.

After you pay off that top debt, you move down to the next one. You pay the minimum amount all of your debt except the top one. Then you pay as much money as possible towards the top debt, which should be a little more now because previously you were paying the minimum and now you are adding to it. You continue this process until all of your debt is paid. It does take consistent work.

Negotiate Bills

I want to talk about one other item that may be a one of the good life habits for you. This is to negotiate your bills to see if you can get a lower amount. Many people consider doing this when they are unable to pay their bills, or if they want to find some ways to save money. I encourage you to consider this on a more regular basis. Utilities and other household bills are expensive.

There is usually always some type of program or special available from your utilities or television / internet provider. You will not now what might be available unless you call and ask. It does not hurt you to make a phone call and see if you can negotiate a lower amount. You may want to consider doing this once a year.

Conclusion

This article gives you many life habits to help you save money and work on paying off your debt. There is probably at least one area where you can make a change to save money. Consider looking at them critically and understanding where you can make positive changes in your life!

Julia Peoples is a long-time business manager focused on providing decision making assistance to the public. She works with people at key points of their lives who are making important retirement and financial decisions. She has had many articles published that educate the public on sound financial decision making.

Julia writes for those who are working towards financial freedom or a better understanding of how finances work. She has shared her financial insights with individuals on a one on one basis for years.