Uber Careers: How to Make Money and Be Debt Free

I have a dream. Well, I have a few, but one of them is to get out of- and stay out of- debt. The problem is that most of my debt is student loans, and I do not make anywhere near the amount I owe. If I am to be truthful, I feel like I need to be on Warren Buffett’s financial level to pay these insane loans off. I am also quite sure I am not alone there. So what does one do when they do not make enough to pay off debt? A common need is to know how to make money that can do more than just pay your bills. I have a few ideas to share and one of them is about how to make money with Uber.

How to Make Money to Pay Off Debt

If you are like me and you are searching for how to make money to pay off debt, there are a few different avenues to try:

- A “Clock In” Job – There is always applying for a second job where you work for someone else. There is nothing at all wrong with this, but it is not always possible for everyone- especially if you have kids or an already sporadic schedule.

- Overtime – If your job allows you to work overtime, you might can pad your checks with overtime pay. Again, this will not work for everyone. It is also not going to be very fruitful for everyone because time and a half of minimum wage still does not add up to much, unfortunately.

- “One and Done” Jobs – These are things like cleaning out your grandpa’s garage, babysitting the neighborhood kids, having a car wash or yard sale- any job that is over when the day or weekend is done. These can bring in some pretty good cash, but it is not consistent.

- Side Hustles – Side hustles are completely separate from a job you clock in to. They are literally side jobs that you do in a fairly consistent manner, even if it’s only once a month.

Some might even consider taking out a loan to payoff debt.

How to Make Money with Uber & Lyft

With any job that does not have an hourly wage, you need to know the ins and outs of how to make money through them. If you go in blindly with no plan and no insight, you will more than likely not make the type of money you are looking for.

Before we go any further, though, you have to understand that there is no guarantee in the amount of money you will make. With Uber, Lyft or any other side hustle, you might make $1,000 a week and $10 the next. The following tips can help you maximize your earnings, but there are still no guarantees.

If you are here reading this, you may have been looking for info on how to make money with Uber, which we are getting to. Making money through companies like Uber or Lyft is very lucrative for some people. If you have a reliable car and enjoy driving, Uber might be right up your alley.

1. Ignore the “Hot Spots”

Quite possibly one of the biggest and most helpful tips on how to make money with Uber is to ignore hot spots and surge pricing. This is due to the very basic law of supply and demand. The fewer drivers that are available in an area, the higher the fare. If every driver knows that the bars on Main Street shut down at 2 a.m. and they are all sitting there waiting, supply is high so the price goes down. Find yourself a good, safe area where there are few or no other drivers.

2. Find a Spot and Park It

Do not just drive around waiting on a fare. You will use more gas that way and put more wear and tear on your car. Remember, your goal is to make a profit here. Find yourself a well-lit and safe zone (safety first, please) in your area to park and wait. Have a book, audio book, podcast, or something else to keep you busy in the meantime.

3. Use the Uber Passenger App as Well as the Driver App

If you are not sure where the hot spots are or where the highest supply of drivers are, it’s okay. Log in to the Uber passenger app. It will show you where other drivers are so you can pick a good spot.

4. Keep Food and Drink for Yourself

You do not want to eat into your profits, literally, by having to stop for snacks, food, and drinks. Keep yourself a cooler with something to drink and keep a couple of snacks.

5. Provide Things Like Bottled Water

This is definitely optional, but you want to get good ratings. Keep some bottled water and things like that for your passengers. It does not have to be expensive. You can get a cheap 24 pack from WalMart. It still shows thoughtfulness.

6. Open the Door for Passengers

This is also optional but might also up your ratings. Consider helping them unload their belongings, too, if they have something like a suitcase with them.

7. Drive a Good Car

I am sure that you know you need to drive a car that gets good gas mileage, but also consider the size. Uber also has UberX and UberXL, both of which open you up to being able to pick up more people at once. If you have a van or SUV large enough to qualify for UberXL, you can pick up some really large fares- and still pick up the smaller ones.

8. Utilize the Back to Back Rides

Do not wait until you drop off one fare to claim another. Use Uber’s Back to Back feature to claim fares before ending your current one. This can keep you going a little more consistently at times.

9. Do More Than Just Uber

Do not limit yourself to Uber. Apply for Lyft, as well. Then, you can be picking up fares from both during your on duty hours. Here is the trick though: Lyft will run as a background app while Uber will not. Sign into both apps but keep the Uber app open on your main screen and let Lyft be in the background. Another thing- if you are not really comfortable with driving people around, or you just want to earn some extra, apply for Uber Eats, too.

How to Use Uber or Other Side Jobs to Pay Off Debt

You also need to have some sort of plan to pay off your debt with your money. It can be tempting to blow that extra cash you work hard for, but if you are doing it for a goal- such as paying off debt- you need a set plan to do so. The first step to this is most definitely to figure out what debts you owe, list them in the order in which you plan to pay them, and keep that list somewhere that you can easily mark off your progress.

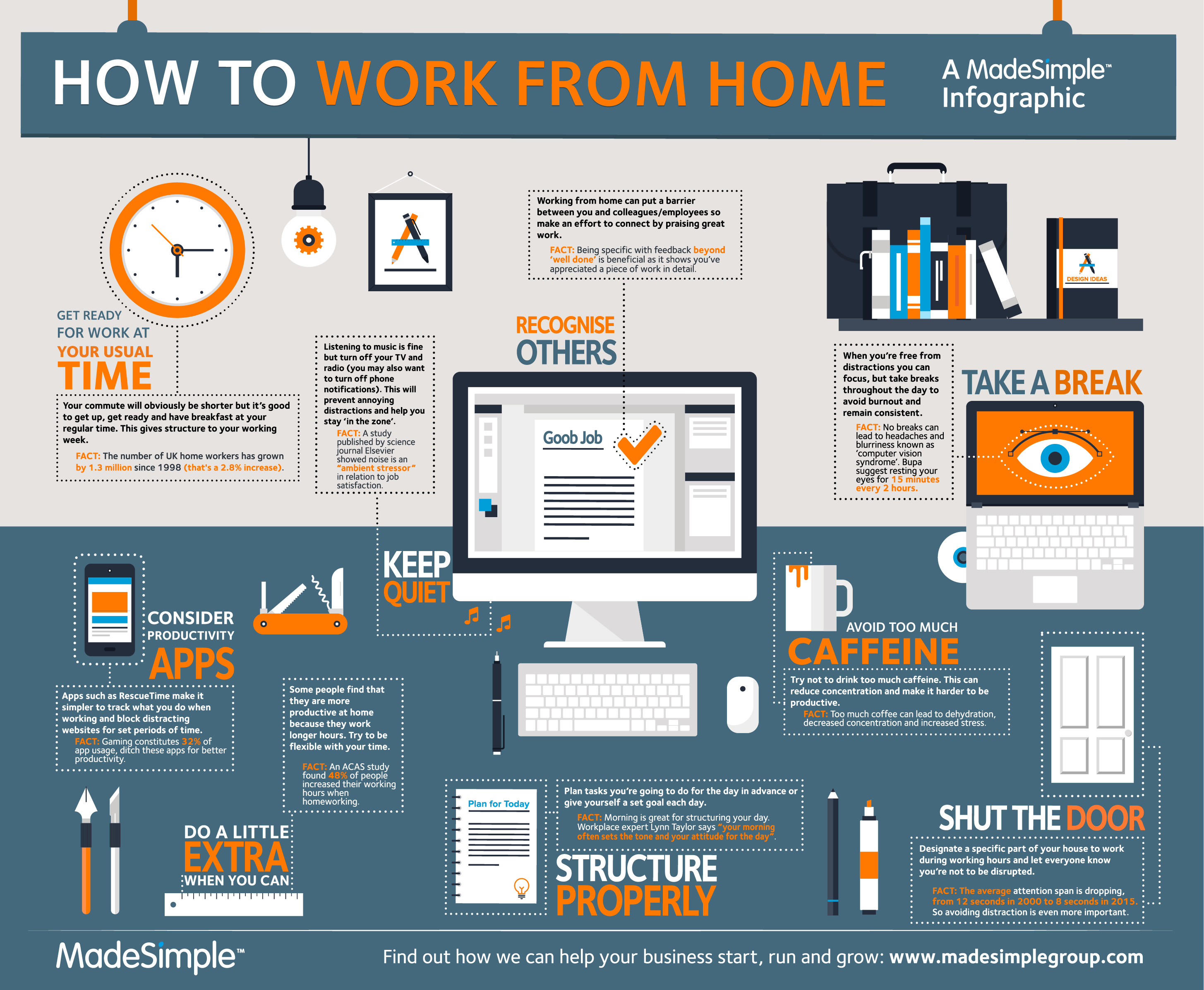

Side Hustles and Working from Home

I happen to be a bit partial to side hustles, as you will see in a moment. As much as I want to tell you to start one right now, though, it is important to understand what you are getting into. Here are the pros and cons I have experienced so far.

Pros

1. You are your own boss and make your own hours

This is quite often the most important reason people choose for having side hustles and working from home. You literally set your rules and your hours. This is one of the greatest things, in my personal experience. I have four kids and I homeschool them all. They range in age from six to fifteen. I have worked out of the home a lot.

I have never been nor will I ever be the type to sit around doing nothing. In fact, friends and acquaintances love to comment on how I am “always doing something”, and they are right. I am driven to help provide for my family and try to give my kids a great life.

The point of all of this is that I am in much more control at home than I could ever be at a job I have to clock in to. If you, too, are looking for a how to make money without having to stay away from your family or a job that allows you to work around other things, side hustles are definitely the way to go.

2. You make some extra dough

Obviously, making extra money is a definite positive for side hustles. The key is that you have to know how to make money with them. Don’t worry- we will get into this in a minute.

3. It provides an additional stream of income

This is not merely a repeat of making extra dough. This is literally about having another income stream. When I was around 12 or 13, I was told about the book “Rich Dad, Poor Dad” by Robert Kiyosaki. I am not going to go into detail about the book, but I will say you should read it. You can also check out the blog.

I bring up the book, though, because I specifically remember being told that it referred to having multiple streams of income (this principle did not originate with this book), meaning that you do not rely on only one income. Another way to say it is the ever-famous “Don’t put all your eggs in one basket.” If you were to lose that one income, then what? Instead, have income coming from various “streams”. A side hustle is a good stream to gain some income from. Once you get it started, you have a second income just in case something happens to your first one.

4. You might discover a whole new life path

Do not be surprised if you find much more happiness with your side hustle than you have in any other field. I have heard of people who started a side hustle, such as direct sales or marketing, that found that they were so good at it and loved it so much they ended up making it their only job.

This might happen to you, too. You might discover a whole new career or a different path to take in life. If you do, wonderful! Good for you! Please do, though, keep in mind that you still should aim to have multiple streams of income, so if you let your previous job go, replace that income with another stream.

5. You will gain more experience and skills

Side hustles are excellent ways to gain skills and experience that you might not gain anywhere else. Think about this: Have you ever wanted to apply for a job that you cannot get because you have no experience? I often find this frustrating because it happens so often with what are termed “entry level” jobs. This, of course, makes me want to scream that it is not truly “entry level” if you require that I have five years of experience. And, anyway, how am I supposed to get experience if no one will give me any?

I am willing to bet that you- or at least someone you know- has gone through the same thing, asking the same question. That’s okay, there is a solution. You will gain a ton of different skills and experience with side hustles. If there is a job you want that requires particular experience, find a side hustle that will give you that experience.

Cons

1. You are your own boss and make your own hours

I am guessing you noticed that I listed this as a pro, too. Yep, I did. That is because this is definitely something that can be both a pro and a con. We have already talked about the pro side- let’s hit on the cons.

If you do not have self discipline or time management skills, being in charge of your own hours might have the opposite effect. I will be honest, there are plenty of days that I am tired, worn out, physically sick, and more that makes me want to play hooky for the day- or week- to rest and recuperate.

I have the ability do just that, too, since I am my boss. I could easily turn off my phone, my computer, and everything else and just take the time I want and need. If it were not for my children being right here with me reminding me of why I push myself so hard, I just might give in. If you do not have the willpower or the motivation to push yourself, you probably will not be very successful.

2. Balance

Yes, one word- balance. I speak from very personal experience here. Think about it: I homeschool, I work from home, I am finishing my degree online. I work, teach, and learn in the same place I cook, clean, cuddle my babies, throw birthday parties, and love on my husband and kids. There is a huge lack of physical separation in my life. My desk and homeschool manuals sit in my bedroom about two feet from my bed. I also have my gym at home (No, I am not anti-social, I promise. I love people. I just happen to love home and I am a DIYer big time.)

Most people do not have as much going on in their homes as I do, but that really does not matter. When you start to mix business and home, the strive for balance becomes a daily fight. While I love having my children with me, sometimes I have to kick them out of my room and have them hang out with daddy while I hang my “Do Not Disturb” sign, plug my earbuds in, and turn my “Work Day” playlist on. There are nights I have to let go of my love of cooking for my family and let my husband do it- or even have a junk food night with Bagel Bites or pizza.

Even working full time from home, I still have lesson to prepare, a teenager to teach to drive, a house full of pets to care for, grocery shopping to do, a house to keep clean, a separate business I run, a body to try to keep healthy, menus to prepare, and- oh my goodness, it does not end. Balance does not just happen- you have to make it work. It takes a conscious effort every single day.

3. It can add stress to your life

I am sure I do not need to elaborate here. Just know that if you already have too much stress to handle in your life, a side hustle might need more consideration.

4. It might cost you more than you would like

Not all side hustles cost you. In fact, many of them do not. Sometimes, though, they require an investment. It might be for equipment, merchandise, some type of certificate, or something else. Before you take that plunge, do some math. Make sure that the investment will be worth the amount you should make.

5. There is no insurance or benefits provided

Since you are your own boss, you have to provide your own benefits. This may not be a problem if you have these from your other job, but it is something to consider.

Types of Side Jobs to Choose From

There are absolutely way too many types of side hustles, or side jobs if you prefer, to name them all. Literally, the sky is the limit. If you can think it up, you can turn it into money. Sometimes, though, we need a little help getting our brain juices flowing, so here are some types of side hustles you might consider:

Delivery Jobs

I am not talking UPS or FedEx here. I am referring to this recent wave of delivering fast food and groceries to people. Places like InstaCart, DoorDash, Postmates and more that literally deliver whatever people order. I live in a small, country area, so these have not overtaken my town yet. Not every business has gotten on board. However, if I decide I want a bucket of chicken from KFC, or if I prefer to let someone else shop for my groceries, I can place the orders and wait for it to be brought to my door. Check out your area and see what types of delivery services are available.

Clerical Jobs

If you have bookkeeping experience, you are in the money. This is a great job to do from home and, even in my small town, I am always hearing of someone looking for a bookkeeper. If you are good at PowerPoint presentations or something similar, you might advertise your services on Fiverr.

There are also people who need someone to make appointments for them and more. Sometimes, they are looking for a full fledged virtual assistant, and sometimes they simply need someone to take care of a few tasks. Websites such as Upwork, Zirtual, and PeoplePerHour are just a few places you might get hired through.

Selling Stuff

This can cover a large array of things. You might sign up with something like Avon or ItWorks! to sell their items. You could purchase lots of items wholesale and sell them on Amazon. You might also look for items at your local thrift stores and resell them. Some people go to thrift stores, purchase name brand clothing that is in good shape, then sells those items at tons of places online.

You might even consider organizing a garage sale to sell all the stuffs you and your family no longer use. That is an easy way to make some extra cash and have some free space at home at the same time!

Others buy old but sturdy furniture, fix it up, then sell it. And then some buy other items, including books, household appliances, and antiques, that they purchase from the thrift stores and sell them online for a profit. Another option if you are crafty is to sell items on Etsy. If any of these sound like your cup of tea, Google “how to make money (fill in the blank)”. The internet has a plethora of information on how to make money doing just about anything.

Teach Others

You might also consider teaching. You could tutor kids in your neighborhood, or you might apply for websites like Qkids to teach through. In addition to that, many people teach courses on Teachable or Udemy for a profit. If you are currently thinking, “I don’t know anything enough to teach,” let me set your mind at ease. There are always people who know less about something than you do, I promise, unless you know absolutely nothing.

There are courses sold on everything from making homemade bread to running a Fortune 500 company. If you have knowledge of something, you can teach it. To make it even clearer, check this out: this free financial advice that you are reading right here, right now- it could be sold as a course. You do not have to provide “expert” advice. You do not have to package it like a college course. Teach it as though you were teaching your best friend how to do whatever it is you are teaching.

I will stop here with this because there are also plenty of free and paid courses that teach you how to make and sell a course, as well as how to make money doing everyday tasks, so you can look it up if you are interested.

Write

Hey, hey! You can always be a freelance writer like me. You can write for websites, through content platforms, on your own blog, or write an Amazon book. I have done all of these and have enjoyed them all. I love writing for my own blog and writing my books, but I have found it very rewarding to write for others, as well. I have learned a lot of things I would have probably never researched on my own.

If I am to be truthful, I learned more writing for a business website in just three months than I did through an entire five years of getting an Associate’s, Bachelor’s AND Master’s in Business. Sad, isn’t it? Also, I have got to work with a lot of great people, and help others work towards their goals. If writing is something that you are passionate about, freelance writing is definitely a side hustle to consider.

Be a Photographer

Do you love taking pictures? I do. I love capturing the beauty of nature on both my cell phone and my Canon camera. I used to just keep all of these pictures, wondering what on earth I would do with them all. Then, I discovered I can sell them as stock photos through websites like Shutterstock. It is not an income stream I rely heavily on because I do not upload very often, but I have heard of people making full time incomes. If photography is your thing, this is a fun side hustle for you. Just look up “how to make money with stock photos”, and you will be met with a lot of options.

Tips for a Successful Side Hustle

Regardless of if it is Uber or something completely different, there are some things you should do to be successful:

Be Selective

When I first started as a freelance writer, I completely messed myself up. I had no idea about how any of it worked, so I thought that the only way I could make money is if I took every scrap of a job available. What this amounted to is me making less than minimum wage while working seventy hours or more per week. I was killing myself to make a few hundred a week. I almost gave up because I could not figure out how to make money from it without working way too much.

It is only recently- after reading about the experience of another freelance writer- that this started to change. As much as it hurt me, I had to convince myself that I could not help everyone (this is totally against my nature) and that I had to set some boundaries. I determined the amount I need to make each month, the amount of hours I can and am willing to work, and figured out how much I need to make per hour to reach this goal. I now aim to only accept work with which I can make that hourly amount.

I am still transitioning into this slowly, so I cannot give you the full result yet. However, I can tell you this: Since figuring this all out, I have been much more selective of the work I choose, my stress is decreasing, and I have more time for other important things. I no longer work 80 hours a week to barely get by, though I have only cut it down to 70 so far. Once I have fully transitioned, I will have it down to 40 to 50 hours a week.

Take it from me:

If you are going to be an Uber driver or do any other side hustle, it is imperative that you figure out an hourly, or weekly, amount to meet. Have an actual goal, a stopping point. Then, figure out how much you are actually willing to work. Do not just take every little thing that comes your way. Like with the Uber hot spots, when you ignore the barely beneficial jobs, you can maximize your earnings.

Have a Schedule

This does not have to be a stringent Monday through Friday 9 – 5 schedule, but you should have some type of routine to follow so that you know what to do when you need to do it- especially if you have other responsibilities. I am not stringent in mine, but I will give you an idea of what I mean:

Most of my work orders come in near the end of the week, so I tend to work the most from Wednesday to Sunday- usually 10 or more hours a day. Knowing that, I use Monday and Tuesday to do the most hands-on homeschooling lessons that we have. I introduce new concepts and practice with the kids. I teach science and history lessons, talk about their new writing projects, go over spellings lists, and so on. Because I have this heavy stuff done, I can let Daddy take over more Wednesday and Thursday to do activities and worksheets that drive the lessons home. Friday we save for makeup work, projects, art class, nature walks, and so on. Sundays, I go over the next week’s lessons, make the weekly menu, and delegate any tasks.

This schedule has to be tweaked at times according to my workload, school lessons, sick days, and so on, but we have this basic structure to follow. Try to have one for yourself- it will make a world of difference.

Do What You Love

It is best to choose a side hustle that involves something you love- or at least like. I mentioned this a little above with the types of side jobs.

Be Organized

You may or may not need a ton of equipment for your side hustle, but what you do need should be as organized as possible. There is nothing worse than sitting down to work and not having what you need. I know this feeling way too much, courtesy of my daughters who love to use and lose my pens, notebooks, and so on to “work like mommy”. As much as possible, keep what you need in one spot- even if it is all in a backpack.

Listing it is actually the easy part

Making sure it gets there might be a little more difficult, especially if you need money to pay bills or just want to splurge. The best thing you can do is keep your side income separate. If you put it into your regular accounts, it will likely go elsewhere. This is fine if you really need the money to keep your lights on, but your side income should still be kept separately.

The best piece of advice I can give you here is to get a prepaid card that is deemed for nothing but paying debt. You can get these from all over, but I like the Now card from Regions bank. You can go to their ATM and load cash directly onto your card. This was especially helpful to me when I was a server living off of tips. You can use them for direct deposit, too.

Set up all of your side income to go to your separate card. If you really need the money for a bill, you still have access to it, but it is not pooled with your other resources. Only take this card out when you are paying on a debt. The rest of the time, keep it put away in a drawer or a closet- not in your wallet.

If you do this, you should be able to systematically pay down or off your debt. You might even reach that goal long before you expect to.

In Conclusion

Whatever you do, think through your options and decisions. Side hustles are great, but not if you cannot keep it up because it does not fit in with your life. Do not wait until everything is “perfect” to start- because it will never be. If your side hustle requires an investment that you do not have the cash for, such as a new computer or a car that gets good gas mileage, consider a small personal installment loan. That may seem counterproductive to getting out of debt, but it might be better for you than waiting for another three to five years until you have the cash.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.