What Federal Loan Forgiveness Programs Are Available?

No matter how hard you work or how careful you are, you can end up over your head in debt through no fault of your own. Many people become overwhelmed by debt, unable to imagine a future where they are not financially struggling. Relationships suffer and marriages end because the stress is simply too much.

Debt relief programs provide a way for people to get out from under even seemingly hopeless financial situations. Some plans will provide more immediate relief while others require you to enter into a program that could take years. Before making your final decision, you need to consider factors such as how a particular solution will affect you down the road. Bankruptcy has long-term financial repercussions, but other solutions might not be the best for your particular situation.

Federal Loan Forgiveness Programs

If your debt stems from student loans, then you should look into federal loan forgiveness programs. One of the advantages of federal loan forgiveness programs is in the word “forgiveness”. As you will see, not all federal loan forgiveness programs offer 100% of your student loans. However federal loan forgiveness programs can still save you a lot of money in the end. It is also important to note that federal loan forgiveness programs don’t just save you money overnight; you need to make some payments in order to reap the reward.

The two types of federal loan forgiveness programs are the Public Service Loan Forgiveness (PSLF) Program and the Teacher Loan Forgiveness Program.

PSLF Program

If you make 120 payments while working full-time for a qualifying employer, then you may be qualified for the PSLF Program. Government organizations and not-for-profit organizations count as qualifying employers for this federal loan forgiveness program. You could also qualify by serving as a full-time AmeriCorps or PeaceCorps volunteer. After the 120 qualified payments are made, the remainder of your loans (100%) will be forgiven. The 120 qualified payments are generally made over a 10-year period, though for the PSLF Program, it is not required for the qualified work to be done consecutively.

You must be patient and fill out the appropriate forms and submit them on time in order to qualify for federal loan forgiveness programs. In the past, there have been issues with this, resulting in many people being rejected for the program. Make sure you check the eligibility requirements in advance, and speak to your servicer if you are not sure if you qualify or not. If some or all of your payments were not made on a qualifying repayment plan for the PSLF Program, you may not be at a complete loss. It could be possible for you to still receive loan forgiveness under the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) opportunity.

Teacher Loan Forgiveness Program

In order to qualify for the Teacher Loan Forgiveness Program, you also must work full-time for a qualifying employer for five consecutive years. For the Teacher Loan Forgiveness Program, low-income elementary schools, secondary schools, and educational service agencies all count as qualifying employers. Though you will receive forgiveness faster than with the PSLF Program, you will generally not receive 100% forgiveness. You may receive a maximum of either $5,000 or $17,500 in forgiveness, depending on what and where you taught.

For instance, if you were a highly-qualified full-time mathematics or science teacher who taught students at the secondary school level or a highly-qualified special education teacher at either the elementary or secondary level, then you may be eligible for the $17,500 in forgiveness. If you were a highly-qualified, full-time elementary or secondary education teacher but did not teach mathematics, science, or special education, then you may be eligible for up to $5,000 in forgiveness.

To find more information about federal loan forgiveness programs, check the Federal Student Aid website. To see if you are eligible for one of the federal loan forgiveness programs, you can check online for the eligibility requirements for the Public Service Loan Forgiveness (PSLF) Program and the eligibility requirements for the Teacher Loan Forgiveness Program. If you are a teacher or are interested in working for a government organization or not-for-profit organization and have a lot of student loan debt, then federal loan forgiveness programs could help you.

Debt Relief and Debt Counseling

When you are choosing between debt relief programs, you can speak with representatives and ask more questions before making a final decision. These representatives can assist you during debt counseling by giving you advice about your debt. They will typically help you make a plan that works for you based off of your budget and income. Debt counseling can be very helpful if you are struggling to handle your finances and debt. Some of the debt relief programs out there are similar, but with the assistance of a debt counselor, you should be able to find one that works for you.

Debt relief can take many forms. Five potential debt relief options are :

- Debt settlement,

- Debt consolidation,

- Credit counseling,

- Debt management, and

- Bankruptcy.

All of these debt relief options have pros and cons, so you should know the basics of each type of debt relief before making your decision.

1. Debt Settlement

Debt settlement, just like it sounds, is when you settle a debt. When you have a debt, you can go through debt settlement with either your creditor or a third-party company in order to negotiate your debt down to a lower payment. By agreeing on and settling for a lower payment, you and your creditor both win. You win because you will save money by agreeing on paying a lower amount, and the creditor will win because they can guarantee a certain amount of repayment and do not have to wait for their money over a long period of time. (If you use a third-party company to settle your debt with your creditor, then they also win, through whatever fees they may charge you).

Debt settlement can be a great option to get rid of your debt quickly, but it is not the best option if you do not have enough money up front to pay the settlement or do not have good enough credit to get a debt settlement loan.

Pros of Debt Settlement

According to Huffpost, debt settlement is helpful when your credit is already poor and your financial situation is causing you unreasonable amounts of stress. It may help just knowing that there is someone who is helping you through the process of negotiating down your debts. Debt settlement is also helpful for people whose first language isn’t English or who simply have trouble expressing themselves when under stress.

Cons of Debt Settlement

The disadvantages of using debt settlement include the fact that you may have to pay a fee upfront. This just in order to get the process started. Then you may owe a monthly fee and a percentage of the amount the company saved you. Debt settlement also has the potential to cause damage to your credit score. That’s why you may not want to use it if you still have good credit. The Internal Revenue Service considers any debt that is forgiven as earned income. What does it mean? It means that you could end up paying taxes on a debt you are finally free from.

2. Debt Consolidation

Debt consolidation is a great option if you have more than one kind of debt. It allows you to consolidate your debt. That way, instead of making multiple payments to multiple creditors every month, you can make just one payment to one creditor. This simplifies your debt repayment. It allows you to decrease your debt stress. This could also be helpful if during consolidation you get a lower interest rate than you had on your previous loans. Do not worry if you have credit; you can still get a debt consolidation loan with bad credit.

3. Credit Counseling

Credit counseling, or debt counseling, is a good option for someone who needs help handling their debt. Getting a debt counseling expert can help you if you don’t have the time or background knowledge to figure it all out on your own. A debt counseling expert can review your debt and explain what your options are, as well as help you figure out what the best decision is for your specific situation. You do not have to do this all on your own. A debt counseling expert can help and support you.

4. Debt Management

If a creditor is not willing to go through debt settlement with you, they might be willing to go through debt management with you. Debt management, rather than settling for a lower overall repayment, allows you to negotiate a repayment plan that works best for your current situation. This means that you may be able to agree on a lower payment per month, but in the end you will still have to pay off the original principal. You may want to consider debt management if you are going through a rough patch and need a break.

5. Bankruptcy

If you have no means to or are just not able to pay your debt, even with the assistance of the other debt relief programs above, then it may be time to consider bankruptcy. Bankruptcy is a legal procedure that will discharge your debt. At least if you can prove that you truly do not have the means to pay them.

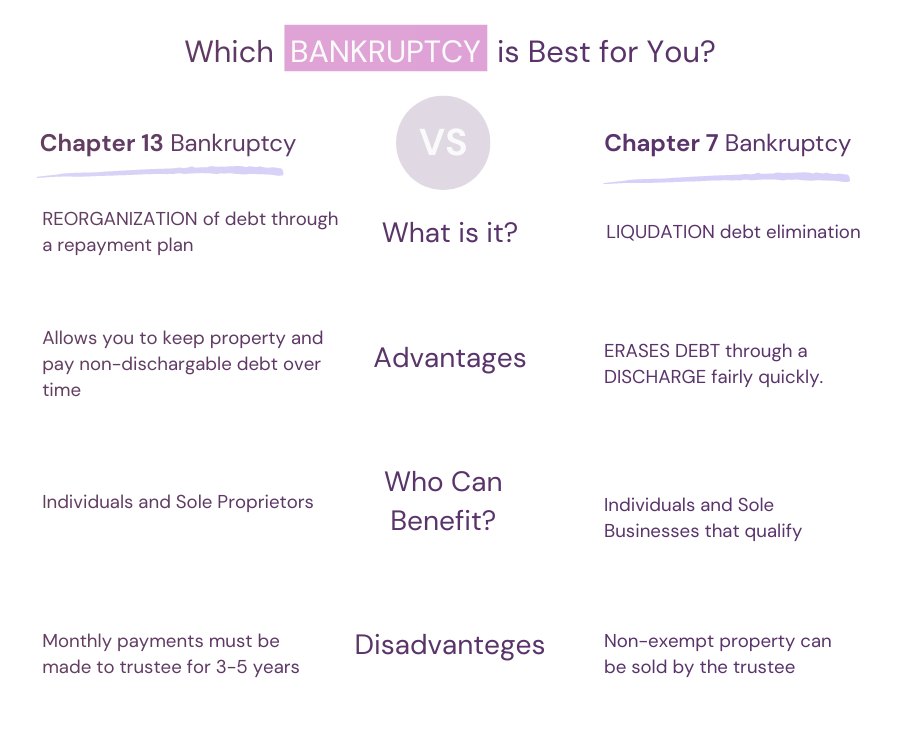

If you have a mountain of debt and need to wipe the slate clean, then you should consider bankruptcy as a last resort. Before applying for bankruptcy, you need to decide which type of bankruptcy is better for your situation.

Is it Chapter 7 bankruptcy or Chapter 13 bankruptcy?

Recovering from a Bankruptcy

Filing for bankruptcy can be a tough decision to make. If you must file for bankruptcy though, it is not the end of the world. There are some helpful steps you can follow to recover from a bankruptcy:

Create a Budget

Life happens. But if you have already had so much debt in the past that you could not afford to pay off, then it might be a sign that you could use a little more guidance in your everyday spending. It is important that you do not spend more than you earn. Otherwise, you may get into the same predicament that you were in before. Creating a budget will help you keep track of and prioritize your spending, as well as allow you to take back control of your finances.

Contact a Debt Counseling Company

If you are still feeling overwhelmed with your debt and getting back on track, then you may benefit from contacting a debt counseling company. Getting your own personal debt counseling expert can make dealing with your debt and finances easier and less stressful. They can help you decide your next steps and give you some peace of mind. Never be afraid to ask for help.

Educate Yourself on Personal Finance

While there is plenty of outside help it is also a good idea to educate yourself on personal finance. This way you will not be entirely dependent on someone else. Plus, you can be in control of your own personal finances. You can start by reading the 7 best personal finance books for beginners. Then you should be ready for the 7 best personal finance books for experts. If you are interested into those 2 lists, they are available on Loanry.com! You could also benefit from using one of the many available personal finance apps or personal finance sites.

Getting Payday Loan Debt Relief

If you are struggling with debt and regular expenses but do not have the credit to get a traditional loan, then you could consider getting a payday loan instead. You would not get a payday loan in place of a mortgage loan, student loan, or personal loan for vacation. Rather, a payday loan is what you might get if you are in dire need of money for a necessary expense before you reach payday. For instance, if you cannot afford groceries or gas, then you might get a payday loan. If you are so low on cash that you cannot afford to make the payment on your car this month, then you might consider getting a payday loan to make your car payment to prevent repossession of your vehicle.

A payday loan is a very easy type of loan to get.

To be eligible you need to:

- Be 18 years of age or older

- Hold a valid ID

- Have a regular income (from a job, disability, or even another regular and verifiable source)

- Have an open and active checking account.

You do not need credit or any collateral, besides your check, for this kind of loan. Your check counts as collateral, since if you do not pay, then they can just cash your check. Since they do require a check as collateral, it is important to make sure that you will be able to afford the payments. So that you do not have to deal with them overdrawing on your account with your collateral check.

Payday loans may be convenient, since they are so easy to get, but they can also cause you debt issues. If you got payday loans in a time of need but are now looking for a way to get payday loan debt relief, you could contact a debt counseling expert to discuss your debt relief options. Also remember: Never consider taking a payday loan if you are not 100% sure you will be able to pay it on time!

Conclusion

There are many reasons you might be in debt, but there are just as many ways to get debt relief. A great option for student loan debt relief are federal loan forgiveness programs. If you do not qualify for a federal loan forgiveness program, or do not get the entire remainder on your student loan forgiven, then you could consider one of the many other options for debt relief.

Debt settlement and debt consolidation could both save you money in the long-run. Firstly, debt settlement because you are settling for a lower overall payment. Then, debt consolidation if you get a better interest rate when you consolidate your debt.

Debt management, while not decreasing the overall amount you will end up paying on your debt, will make your debt more manageable. It can help you find an appropriate repayment plan for your income. If you cannot afford the payments on your debt, do not just not pay. Talk with your creditor to see if you can work something out. If you just don’t pay, it will have a bad effect on your credit. It is always better to communicate when you need help.

If these options are not right for you or you are still not sure which option is better for you, then a debt counseling expert can help you. He shall help you determine what the best option for your personal situation is. They can help you determine if one of the above debt relief programs is right for you or if you should instead consider bankruptcy. Remember, you’re not alone.

Whether you can benefit from a Federal Loan Forgiveness Program or not, you should definitely consider creating an emergency fund for your future! One easy way to do it, is to launch a savings account. To help you considering this opportunity, we developed this widget:

Grace Douglas is a master candidate in international security management by day and a personal finance writer by night! With powers in finance, writing, and languages that she received by being exposed to high dosages of university courses and being bitten by booklice while working in a rare books library, Grace loves to use her powers for good rather than evil. If you need help with budgets or personal loan questions, then just call Grace, your friendly neighborhood FinanceWoman!