Shark Bite: What is Considered a Predatory Loan?

In 2010 alone, 12 million American families took out emergency loans from payday lenders. This is a clear indication that these loans are not only gaining in acceptance and popularity. A good number of them helping consumers meet their immediate financial needs.

Loans can come in handy when there is a need for extra cash. However they can also adversely affect the financial position of the borrower if not used responsibly. Today, there are numerous lending companies that offer different types of loans in the market. Although this gives consumers a wide range of options to choose from, it also makes it difficult to choose the right product for their needs. One of the challenges that borrowers have to deal with is predatory loans.

Generally, people with low credit scores tend to look for bad credit loans when they require money. The need for fast loans may see such people going for loans whose terms and interest rates are exploitative. In the long run, this may not only affect their credit score but also result in financial stress and frustrations. Borrower might plan to take out small cash loans for their short term needs or large loans for bigger projects. Whatever the reason, it is important to make the right decisions and choices. Here are a few things borrowers should know to avoid taking out a predatory loan.

What is Predatory Lending?

Whether you need to buy a car, a house or go to college, you may need to borrow money to finance the activity. Don’t worry, most of the companies in the loan business are legitimate. However, there are those that look for consumers whose credit is not in good shape. The lenders can then take advantage of the consumers by charging high-interest rates and fees as well as creating unrealistic payoff terms. These lenders are known as predatory lenders.

In most cases, predatory lending practices target low-income earners who have a hard time making ends meet and need financial help. A good majority of the loans are payday loans that have to be paid back on the next payday. While they are usually small amounts of money for paying important bills or meeting emergency expenses, they carry a huge interest rate. It is critical that borrowers understand what a predatory loan is in order to avoid being taken advantage of.

What to Know About Loans

A majority of borrowers who fall victim to predatory lending practices are low-income earners looking for small cash loans. However, it is possible to avoid payday loans even with low income. Here are a few things every borrower needs to understand about loans.

One of the most important things to keep in mind is the following. “Simply because one is eligible for a loan does not mean they should take it out“. Loans come with a great deal of financial commitment and can affect the borrower’s credit score. As such, borrowers should apply for loans only when they need to.

It is critical that borrowers ensure the loan they choose is right for them. There are different types of lenders and loan options available today. This means that borrowers can get overwhelmed and end up making the wrong decisions. Financial experts recommend asking the preferred lender the right questions to ensure that the loan will serve the intended purpose.

There are basically two types of loans:

- Secured Loans

- Unsecured Loans

While secured loans require borrowers to put up some form of asset as collateral, unsecured ones do not have collateral attached to them. Regardless of the type of loan, consumers should remember that loans have a fee. Not to mention that they also have interest or rate associated with them. This information can play a big part in helping to avoid a predatory loan.

What is Considered a Predatory Loan?

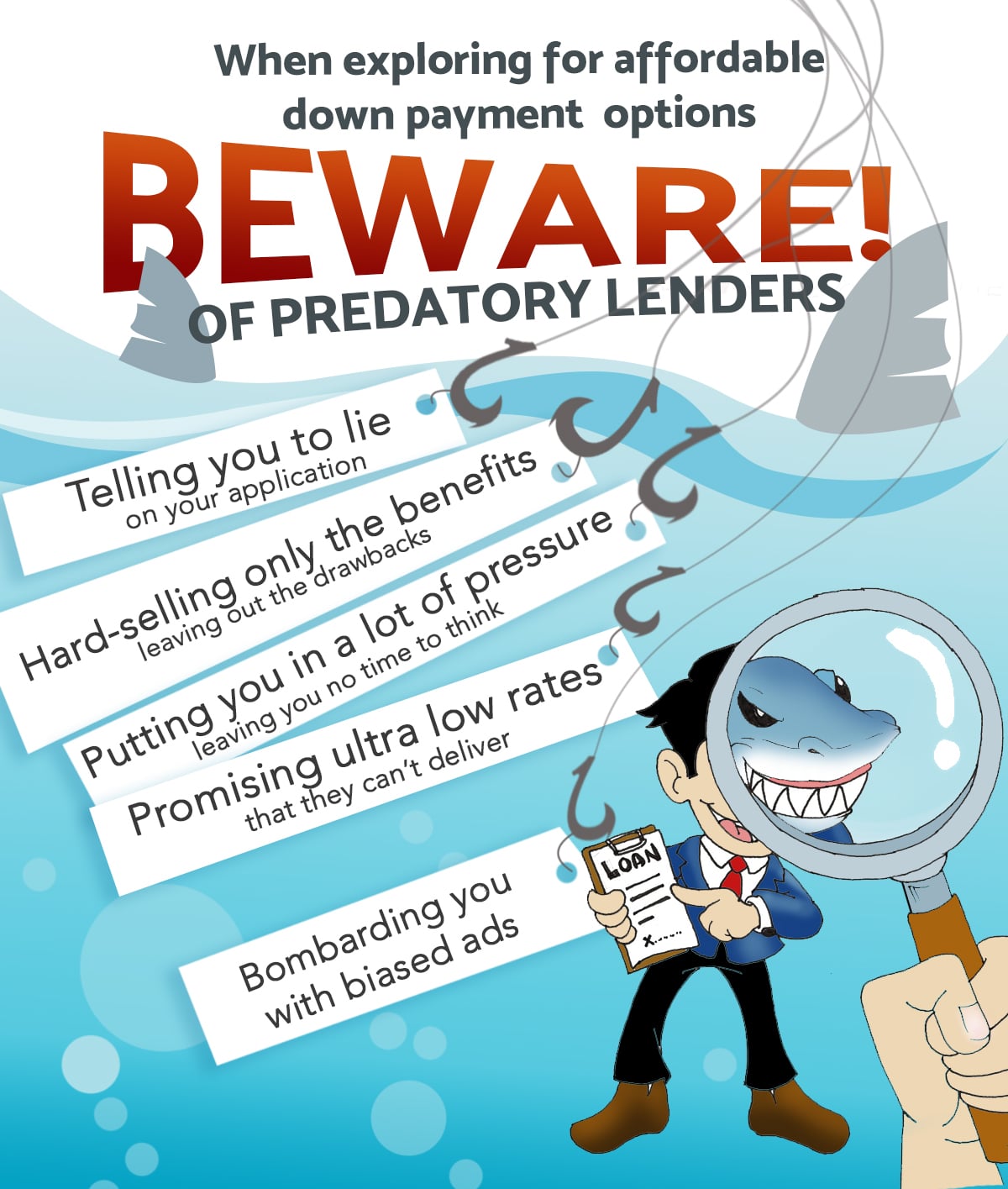

Simply put, a predatory loan is one that features unfair or abusive terms for the borrower. The practice through which these loans are issued forces borrowers to accept the terms. This, even in cases when they do not want, need, or cannot afford the loan. Understanding the common characteristics of this type of loans will help consumers know how to deal with them. Not to mention that they will also know how to avoid them whenever they can. Here are some of those characteristics:

Limited Documentation

Most unscrupulous lenders will not provide borrowers with sufficient documentation to allow them to understand the loan. This is considered a predatory practice. Indeed, the borrower will be getting into a financial commitment that they do not understand well. The documentation supplied when a borrower applies for a loan should have details. Among which: the loan terms, interest rates, fees, and other charges. Lenders are required by law to ensure that they provide borrowers with the documentation necessary to help them make a good decision. In case a borrower notices that the lender they intend to work with has difficulties in providing the specific documentation required, they should simply walk away and find another lender.

False Information

With the many lenders that consumers can approach today, there is a chance that one will meet a dishonest one. Generally, a reliable lender will provide the borrower with factual information. He will also answer any questions that the borrower may have. On the other hand, lenders who are looking to issue a predatory loan will provide false information. The aim for him is to get the consumer to believe something about the loan that is not true. Just like documentation, factual information will make it easy for the consumer to make the right decisions and know the next steps to take. For this reason, one should be very careful in case they suspect that the lender they are about to work with is providing false or inconsistent information regarding the loan.

Excessive Points and Fees

There is no doubt that companies involved in the loan business are always keen on making profits. However, there are those that may charge excessive fees in order to bring in more profit. Lenders who ask for more points than normal are considered to be using predatory practices. This is why consumers should avoid companies that charge extra closing costs. Even when taking out small cash loans, borrowers should ensure that they are provided with a good-faith estimate. When this is provided in a good time, it allows the borrower to determine whether the fees are honest or not. Any exorbitant fees will push up the cost of borrowing and make it harder for the borrower to pay back the loan.

Prepayment Penalties

Prepayment penalties make for one of the most important things that borrowers should inquire about when they seek to take out a personal loan. This is because the facility should not affect their future financial mobility and allow them to adapt to life changes. With predatory loans, lenders will restrict the flexibility of the borrower. The company will only be keen to make a higher commission without taking into account the interest of the borrower. It is crucial that consumers know the policy of the lender regarding prepayment penalties so that they not only decide whether to take the loan but also know how to handle different situations that may arise over the term of the loan.

Loan Flipping and Churning

Unscrupulous lenders are constantly coming up with practices that are considered to be unfair to consumers. This makes it even more important for consumers to acquire financial education so as to identify these schemes and protect themselves and their interests. Flipping and churning are practices that are designed to coerce borrowers to refinance their home loans. What follows is that the borrower loses equity on their home while the lender makes profits arising from the related fees. This is a predatory loan because such lenders use it to advance their interests at the expense of the borrower. It also presents serious problems to investors who buy the said loans on the secondary market.

Balloon Loans

Although balloon loans are extremely rare today, there are lenders who offer them as a way of taking advantage of borrowers. These loans are structured in such a way that borrowers make small monthly payments for a good part of the term of the loan. In actual sense, these payments only cover the monthly interest. Since the principal is not addressed during this period, borrowers are required to make one large balloon payment as the last payment in order to retire the principal amount. In most cases, borrowers are never prepared for the payment, a factor that results in the foreclosure of their home. Some lenders encourage these loans in order to get the refinance business and earn more interest and fees on the same loan.

Packing

Another common characteristic of predatory loans is packing. This is a lending practice where lenders pack extra things in with the loan. This without the knowledge of the borrower. What this means is that the consumer will end up paying more for the loan without any direct or added benefit to them. There are ways to avoid being a victim of this practice. Borrowers should carefully look at the details contained in the loan documents. As a precautionary measure, borrowers should do due diligence when shopping around for loans. Apart from asking for recommendations from trusted friends and family, borrowers should consider going through online reviews. While this is not a guarantee that the process will be above board, it will help to minimize the chances of such practices.

Emphasizing the Payment

There is more to any loan than just what the borrower is going to pay back every month. One of the ways to identify a predatory loan is when the lender focuses so much on the payment as opposed to other factors of the loan. Such lenders can use different ways to manipulate the monthly payment to fit your budget but could devastate you financially in the long run. Since such practices can involve the use of complex procedures, borrowers should acquire quality financial education. It would also help if one talked to a financial expert to help them through the process. In any case, loans are meant to make it easy for borrowers to achieve their financial goals.

There are many more factors that can make a loan be considered a predatory loan. If there is no credit check. Or if the lender seems to be rushing through the process. Not to mention if the company presents the borrower with blank documents. Also, if the deal is just too good to be true, borrowers should definitely exercise caution. Take care choosing your lender!

Good Reasons to Incur Debt

Before making any financial commitment, borrowers should not only understand the amount and type of debt that will help meet their needs. They should also understand the reasons for requesting the loan. Here are some good reasons to incur debt:

- To increase working capital: Loans can help those in business to buy more inventory so they can take advantage of the business opportunities available.

- Financial emergencies: Consumers can take on debt in order to handle financial emergencies such as medical expenses or repairing their homes after floods or storms.

- To build a credit history: If used responsibly and paid back in good time, loans can help those with a low credit score to build their credit history. This will ensure increased loan opportunities in the future.

- To improve cash flow: Both individuals and businesses can rely on loans to improve cash flow. One of the best ways of doing this is taking out new loans to pay old debts.

- Debt consolidation: Borrowers can take out a new loan to pay existing ones. It allows them to focus on a single debt and manage their finances better. However, borrowers should be careful not to take out a predatory loan. This would make it even harder to reduce debt.

Other reasons for taking on debt include to buy a home and to finance college education. Today, there are bad credit loans for borrowers whose low credit scores limit the loan opportunities available to them.

Advantages of Payday Loans

When consumers work with reliable payday loan lenders, they are likely to enjoy numerous advantages. Below are some of the advantages of good payday loans.

- They are not secured: Unlike other types of personal loans, payday loans rely on the borrower’s promise to repay the lender. This means that borrowers will not be required to put up any collateral as a promise to pay. This is a factor that offers flexibility.

- Fast cash: Compared to conventional loans from traditional lenders, payday loans offer fast cash. The money is usually deposited into the borrower’s account immediately after approval of the application. This makes them a great option when looking to handle financial emergencies.

- Easy approval: Generally, proof of employment is a more important factor than the credit score when it comes to payday loans. Although the loans are associated with easy approval, borrowers should be sure that they are not taking out a predatory loan.

- Online applications: Today, there are numerous companies that offer payday loans online. This offers convenience and ensures a faster process. Once a borrower has answered a few questions in the privacy of their home, they get the funds by direct deposit when approved.

All these advantages offer the convenience that many consumers look for. However, it requires financial literacy to distinguish between bad credit loans and predatory loans.

Reasons to Avoid Payday Loans

For all the advantages that payday loans offer, they have a number of disadvantages. Those are the ones borrowers should know about. This will help them to make the right decisions and take only the loans that are suited for their needs.

- They are expensive: Compared to other types of loans, payday loans are expensive. These loans have a high interest as well as fees. What pushes up the cost of borrowing. Because of the costs associated with payday, many low-income earners find it difficult to get out of them.

- Your credit score might suffer from it: While most lenders will not look at the borrower’s credit history when approving the loan, the borrower’s credit will suffer in the event that they fail to meet their obligations.

- It might be harder to repay: Considering that the high costs associated with the loans may make it hard to repay, consumers should ensure they can afford the loans before taking them.

- You might have to give access to your bank account: Some lenders will require that borrowers give them access to their bank accounts. This is usually done in order to ensure that the loan is repaid by automatic withdrawals. In case a borrower fails to roll over the loan, the money will be deducted from their account balance without additional notice.

To be sure that the product they are taking is not a predatory loan, they should look at the details. This will go a long way in helping them avoid some of the downsides associated with payday loans.

How to Avoid Payday Loans

Payday loans can help consumers to meet their financial needs. Especially low-income earners. However, it is important to note that one can, without these loans, effectively avoiding the risks associated with a predatory loan.

Any borrower looking to avoid payday loans should consider alternatives, among which applying for a loan with their bank as opposed to these loans. Banks are more likely to help out with small loans if borrowers have enough income and decent credit. This way, borrowers will be able to negotiate terms and enjoy lower interest rates.

Instead of taking out a conventional loan, consumers can think about asking their employer for an advance. However, such employees need to have been in the job for a reasonable period of time and have a track record of reliability. Consumers may also consider getting a second job to boost their income so they can meet their needs.

Another way to handle an unexpected expense would be to get a cash advance on a credit card. However, there are times when this is not the best option for those avoiding payday loans. Credit card loans tend to have high-interest rates and come with withdrawal fees.

In case you have personal stuff that you are no longer using or do not need, you can sell them to raise the money you need. Consumers can also explore the interest-free alternative of borrowing from friends and family.

Ways to Get Cash With Bad Credit

Having bad credit can contribute to a frustrating experience when looking to take out loans. This is why it is important for borrowers to take the necessary steps to improve their credit. However, if a borrower wants to meet some financial emergencies, they can take out bad credit loans.

One of the options that borrowers can explore when they have bad credit is credit unions. These organizations offer loans at affordable interest rates, provided the individual is a member. Consumers can also borrow from family and friends. This is an interest-free alternative for which consumers will qualify easily. However, the borrower must pay back the money to avoid straining the relationship.

Other options available for people with bad credit include finding a co-signer. By getting someone with better credit to co-sign the loan, the borrower will be giving a guarantee that they will pay back the loan. Individuals can tap home equity or turn to online lenders to raise the amount of money they need.

While it is possible to find a good loan with bad credit, it may take some time for such borrowers to get their applications approved. At the same time, the loans are likely to come with high-interest rates. Borrowers should ensure they are aware of the characteristics of a predatory loan if they are to achieve their financial goals.

Effective Ways of Reducing Debt

Employing effective ways of reducing debt or creating emergency fund give not only consumers peace of mind but also minimizes the chances of taking out a predatory loan. Here are some ways to ensure proper debt management and reduction.

- Build an emergency fund: One of the most common reasons why people take out small cash loans is to handle financial emergencies. By building an emergency fund, consumers can use the money in such situations instead of turning to debt.

- Save for a rainy day: The importance of saving for a rainy day cannot be denied. Putting aside some money to use in the event of unforeseen and unexpected expenses will help consumers to avoid and reduce debt. The money can be invested in order to multiply.

- Debt snowball method: This is a debt reduction strategy that entails listing all the debts owed except the mortgage. The debtor then proceeds to make large payments towards the smallest bill until it is paid in full. At the same time, they make minimum payments on other bills until the smallest bill on the list is paid in full.

- Managing bills: Excessively high bills will push one into debt and make it hard for them to reduce what they owe. Proper management of bills through negotiating bills, bundling several services, taking advantage of special promotions and cutting extras will go a long way in helping to reduce debt.

Talking to a debt counseling expert can help consumers to learn more about reducing debt. Consumers will also access guidance and advice on how to identify and avoid a predatory loan. In the end, reducing debt will require sustained healthy financial habits over a period of time.

The Importance of Financial Education

The dynamic financial landscape and numerous options available make it important for consumers to acquire financial education. Whether one is planning to take out small cash loans or invest their money, quality financial knowledge and skills will help them identify obstacles and opportunities. This includes bad credit loans that will push them closer to their financial goals.

Another benefit of financial literacy is that it equips learners with money management skills. This means that consumers will be in a better position to manage their debt effectively and make sound financial decisions. In the end, individuals can work towards financial stability and security.

Financial education and literacy make it easier for consumers to identify fraud, prepare for retirement, seek out help when they are in need, and learn how to cope with major life changes. This ultimately allows them to keep track of their financial payments and ensure their finances are in order.

Today, there are a number of financial literacy charities that offer structured financial education to both individuals and communities. The programs mainly target low-income earners who are more likely to tale out small cash loans. Since individuals in this category are more prone to be taken advantage of through a predatory loan, the credit counselors at these organizations help to ensure that this group of consumers acquires the knowledge they need to protect themselves.

Conclusion

In summary, it is clear that a borrower is more likely to be a victim of a predatory loan if they take out small cash loans. The good news is that consumers can protect themselves from unscrupulous lenders by acquiring financial education in order to identify opportunities better and detect dishonest practices. Another great way to avoid taking a predatory loan would be to work with a third-party that is not in the loan business to make the process of looking for a lender easy and fast. We make it possible for consumers to find reliable lenders who provide products that will meet their needs. The next time you are looking to take out a loan, kindly consider working through us for a seamless borrowing experience.

Jennifer is a seasoned finance writer with a special focus on wealth creation and retention. Her pieces have appeared in several leading finance websites and blogs. A creative writing graduate from Southern New Hampshire University, Jennifer believes that proper finance management is a habit, a habit that can be learned through practice and dedication.